The Bitcoin Squeeze

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 64

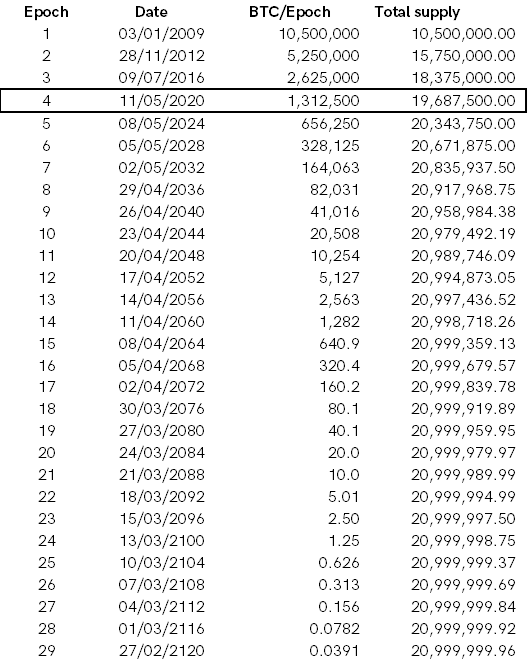

Bitcoin’s creator, Satoshi Nakamoto, designed the Bitcoin Network to become ever more attractive over time. He defined time by epoch, the period between halving events, which are 210,000 blocks apart. With an average block interval of 600 seconds (10 minutes), the time between epochs is expected to be 1,458.3 days.

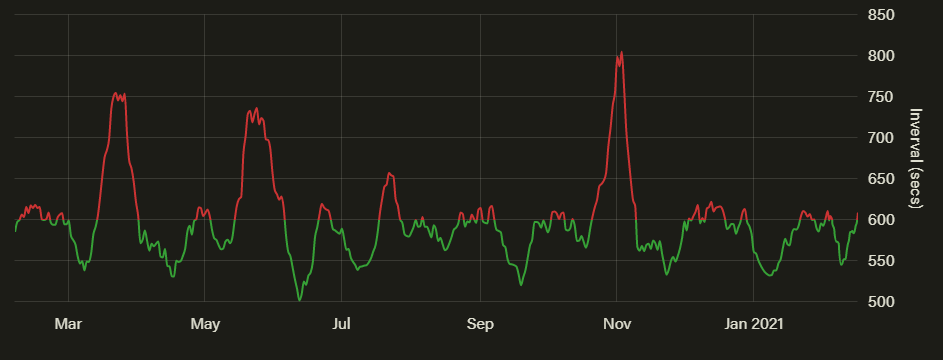

Average Block interval

The average block interval has reverted around 600 seconds. Yet blocks are created more quickly when the miners work harder and speed things up, and slow down when they take a break. Unsurprisingly, they put in the overtime when prices are high, and each time they do, their job gets harder.

Bitcoin has gained so much attention since its creation, that the miners have consistently delivered epochs ahead of schedule. The second epoch arrived 33 days ahead in 2012, the third 139 days in 2016, and the current fourth epoch, 56 days. Such has been the demand for Bitcoin, that the miners have been revving their rigs at full speed.

This fourth epoch will see 1,312,500 BTC mined (exactly) bringing the total BTC supply to 19,687,500 by 8th May 2024 (estimate). No doubt they will be ahead of schedule as they have been in the past.

The maths is elegant to say the least. As each epoch passes by, fewer Bitcoins come to market. At $50k per Bitcoin, the current epoch will see approximately $65.5 bn paid to the miners ($16.4 bn per year) excluding transaction fees.

To have achieved a $50k BTC price in the first epoch, the miners would have required $525 bn ($131 bn per year), and so unsurprisingly, it never happened. Yet to sustain a $50k price in the 5th epoch drops to $8.2 bn per year and $4.1 bn in the 6th. Wait a couple of decades, and it becomes chump change. High prices become easy to sustain, the longer you are prepared to wait.

Then comes the institutional investor

Knowing this inevitability, the big money has arrived. I look at $16.4 bn per year and think it’s a lot of money. Michael Saylor, honorary Bitcoin head of sales, takes a different view and sees these numbers as peanuts. If the BTC price is going to $1m one day, then just buy it now. After all, these flows will get you there around 2036. It is hard to argue with that logic, especially as a Bitcoin holder, someone else picks up the tab, while you face minimal dilution, as the majority of BTC has already been mined.

That is why the institutional investor is a gamechanger. Just as the miners have fought to bring forward each epoch, institutional investors can mop up supply like a giant squid. Bitcoin funds have purchased 329,583 BTC in the 4th epoch when only 256,612 BTC have been mined. High prices have encouraged the miners to drawdown their inventory. In so doing, they have managed to sell 284,828 BTC; the excess having been mined in previous epochs.

Institutional inflows into the Bitcoin network have run down the miners’ inventories, so much so, that all BTC mined since the dawn of the 2nd epoch have already been distributed into the network, and most likely, sold.

The only inventory left was mined in the 1st epoch, before 2012, and presumably belongs to Satoshi and his friends. Will we ever see it? I have no idea, but that inventory of 1,523,386 BTC inventory (ByteTree.com) is now worth $77 bn.

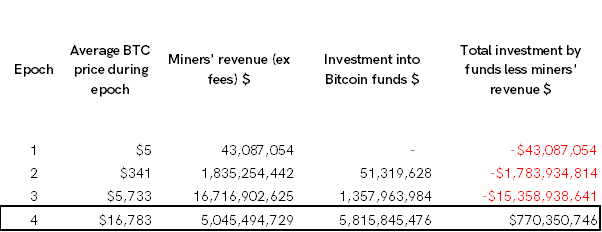

There were no known funds in the 1st epoch. Grayscale (GBTC) was launched in the 2nd epoch on 25th September 2013, and XBT Provider (CoinShares) in early 2015. They remained small for some time, only to collectively break $100m on 17th November 2015. Interestingly, XBT Provider was larger at the time. It wasn’t until the 3rd epoch that funds became a meaningful source of external demand for BTC. But even then, they absorbed less than 10% of the new BTC supply.

Bitcoin fund inflows versus miners’ revenues by epoch

Then comes the 4th epoch. Bitcoin fund inflows have mopped up all of the miners’ supply, and then some. They bought 333,370 BTC at an average price of $16,783, which are now worth $17 bn. I am only discussing fund inflows into BTC here. Add to that, retail investor flows into countless apps, Tesla, MicroStrategy, Square and so on. It’s big.

Assuming Satoshi’s stash doesn’t come to market, the only new supply the market sees going forward are the coins that are yet to be mined, and sales from the secondary market (BTC investors sell). Fund inflows have caused the market to tighten, and the price behaviour in recent weeks resembles a squeeze.

This has been super bullish but doesn’t change the fact that the world is not (yet) running out of newly minted BTC. The 4th epoch doesn’t end until another 1,055,888 BTC have been mined. At $50k, that needs $52.7 bn of inflows in the 4th epoch to pay the miners. And if you’re holding out for a $100k BTC price, then we need $105.5 bn of inflows. This is Bitcoin, so anything is possible.

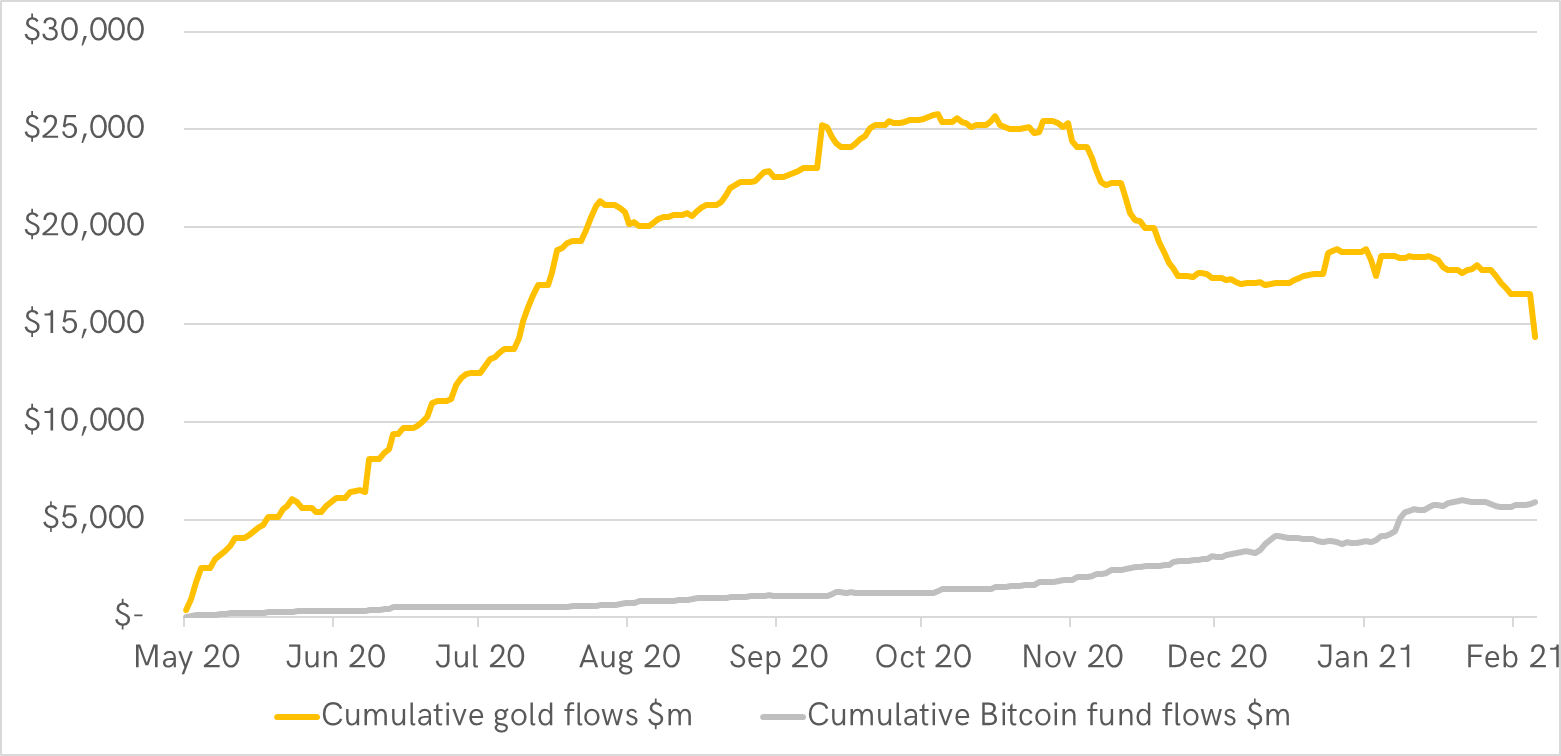

If you are wondering where this money has come from, then the gold funds are an obvious candidate. $10 bn has left the gold ETFs since October, half of which headed straight for Bitcoin.

Gold and Bitcoin fund flows in the 4th epoch

I suspect these lines might meet at some point, and that makes the contrarian investor smile. As Bitcoin surges and gold cools, the contrarian knows that his dollars will buy more ounces of gold than they did six months ago, yet much less Bitcoin. The contrarian in me believes that when Bitcoin finds its peak in epoch 4, gold will spring back to life and hold the fort until epoch number 5.

At ByteTree Asset Management, we believe Bitcoin and Gold are an optimal combination, and have a strategy called BOLD. If you are an institutional or expert investor, please do not hesitate to contact us at bold@bytetree.com.