Rocket Fuel

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 62

Bitcoin always has a passionately felt narrative, but never before as deafening as this one. I have been following Bitcoin closely for eight years, and it is rare that the story screams to this degree.

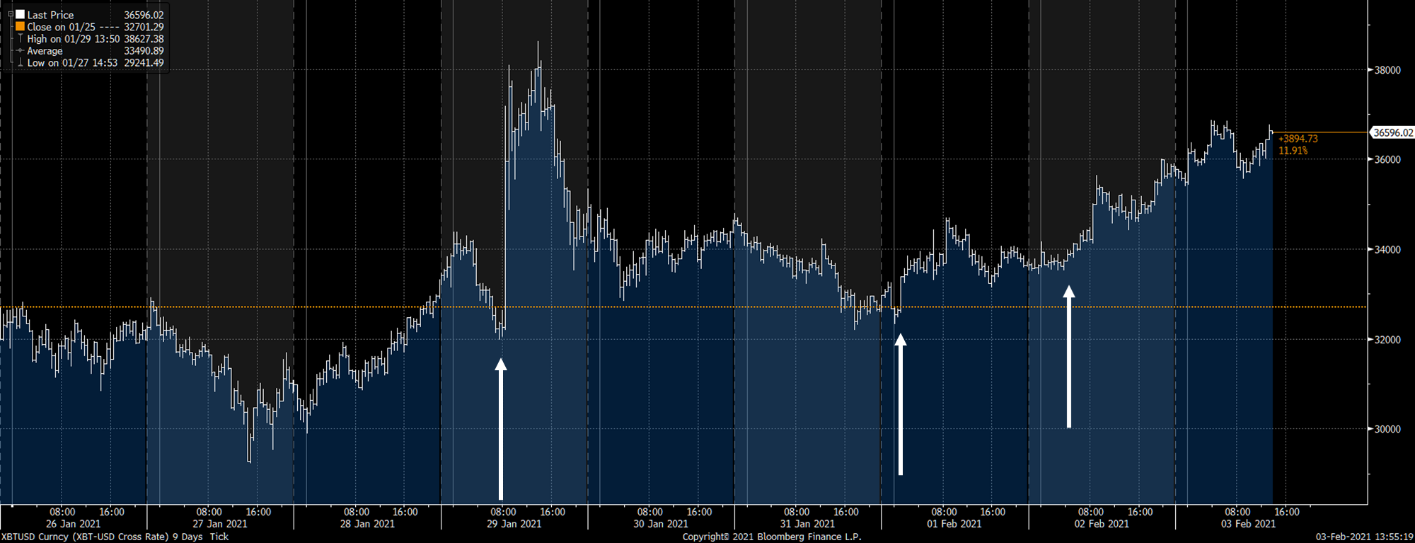

This past week, the price was heavily influenced by Elon Musk. All he had to do was change his profile on Twitter to “Bitcoin”, and the crowd roared. He also logged “it was inevitable” onto the blockchain which will be there forever. Quite cool.

Even cooler is how he has turned the trend. Last week, I was looking at a volatile, overbought and overvalued Bitcoin, with an exhausted narrative. Musk has refreshed it with just a few tweets - with a little help from his millions of fans on social media.

Watch Musk

Over the past two days, Musk pledged to take a break from Twitter. A call from high up perhaps, but Michael Saylor has picked up the baton. He is trying to persuade thousands of CEOs to buy Bitcoin with their company treasury. I’ll come back to that.

Leaving aside halving last May, the price of Bitcoin has behaved as you might expect it to, given the circumstances. It crashed in March 2020, because there was a major market liquidation event. It recovered quickly because there was a massive monetary and fiscal bailout. It then took off in the autumn because the logical reasons to own it over the long-term were carefully explained while people listened. Price rocketed to a new all-time high on 16th December, only to double within 23 days. A fabulous outcome.

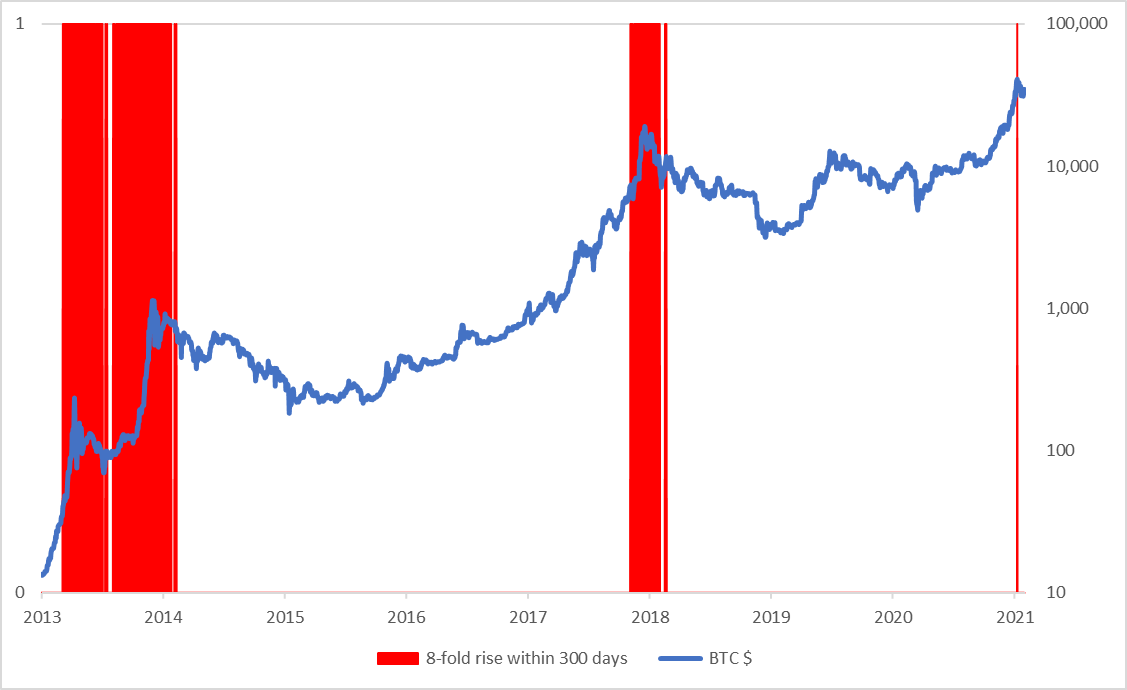

But there is more to it, and I believe many are underestimating the scale of the recent advance. Between the 16 March 2020 low at $4,904 and recent 9 January 2021 high at $40,859, Bitcoin rose eight-fold in just 300 days. That got me thinking. How big of a deal is that and how often has that happened before?

An eight-fold surge in 300 days is rare

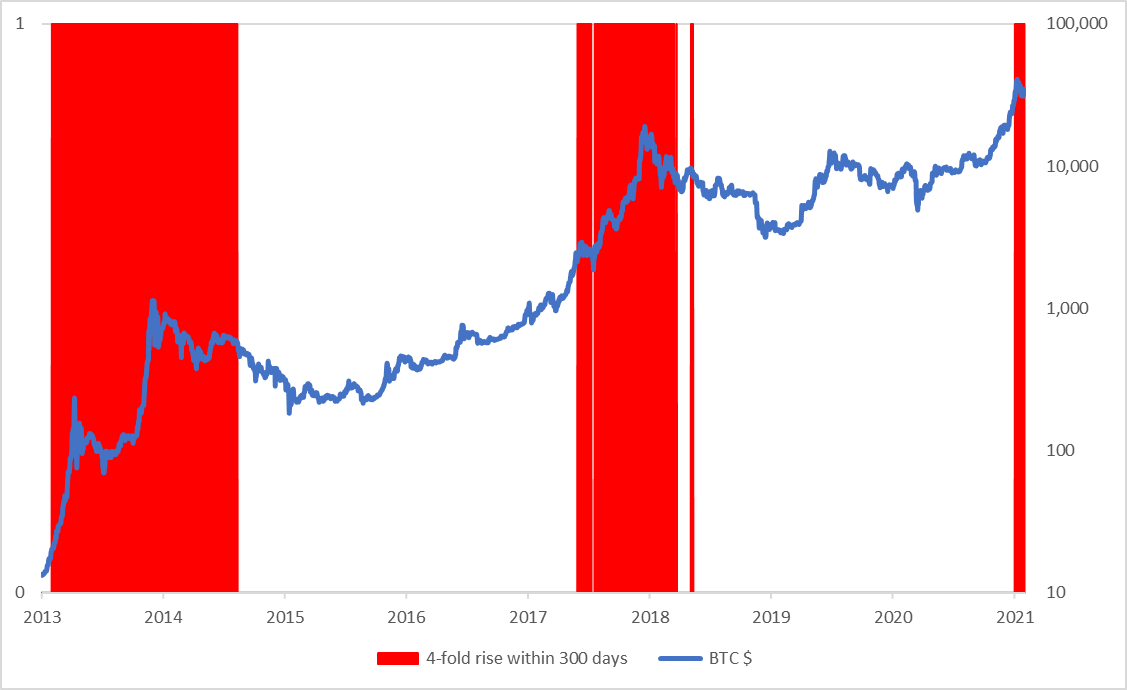

This event was not uncommon in the pre-2013 era, but in modern times, it hasn’t been seen outside the 2017 peak, until now. In case you are wondering, it achieved this 4 November 2017 at $7,229. The bull market ran for another 44 days to reach a final peak on 15 December 2017 at $19,345 (opinions vary). Data mining and unfair perhaps. I agree. What about a more modest 4-fold increase over 300 days?

A four-fold surge over 300 days is also rare

Again, outside the pre-2013 era, even four-fold moves within a year are a major event. In this case, the first occasion in 2017 occurred on 29 May at $2,307. Very early. In any event, the four and eight-fold moves within a year have signalled a changing environment and brought in a new crowd. The Bitcoin conversation has generally been more rational and thoughtful outside these periods than within.

Following the recent surge, many see their reference point as the 2017 all-time high. Bitcoin has doubled since. High time and so what? It is good at doing that. Perhaps “twice-the-old-high” understates what has recently happened. This recent rally is up there with the greats, and the behavioural changes have more in common with an eight bagger than a two bagger.

The trend is your friend

What is remarkable is how this trendline has stood the test of time. I first spotted it in 2016 and highlighted the 118% annualised rate of return. In 2017 it sped away only to return by late 2018. It broke lower in March 2020, during the broad financial meltdown, and is once again trading back above. The trend currently sits around $19,100, which is 46% below the current price. Small beer in the big scheme of things perhaps; after all, the trend will be back to the current price by the end of 2021.

The long-term trend more than doubles your money every year

118% is a huge return that soon mounts up. This trend won’t last forever and will have to slow at some point. But I hope there are a few more doubles left to come before that happens. For reference, gold managed a 35% IRR in its heyday during the 1970s. But gold started the journey as a much larger asset class, which went on to match the value of the S&P 500 by 1980. That’s $82 Tn today, so on that basis, a 118% trend could last for a while yet. However, one obstacle before a further surge comes from feeding the miners.

Feeding the miners

Over the course of 2017, the value of the Bitcoin Network escalated from $14.5 bn to $291.8 bn. For that that huge amount of value creation, the miners were rewarded with $3.7 bn.

Since then, 1,875,850 BTC have been mined while miners have sold 2,006,064 BTC into the market for the tidy sum of $18.1 bn, as they have run down their inventory.

The rally since 15 March 2020 has seen $523 bn of network value created, while the miners have received $5.2 bn for their efforts.

At current prices, miners will be selling over $11 bn of Bitcoin in 2021, and someone has to buy it. That is where the institutional investors come in, which explains why Michael Saylor is so passionately carrying out God’s work.

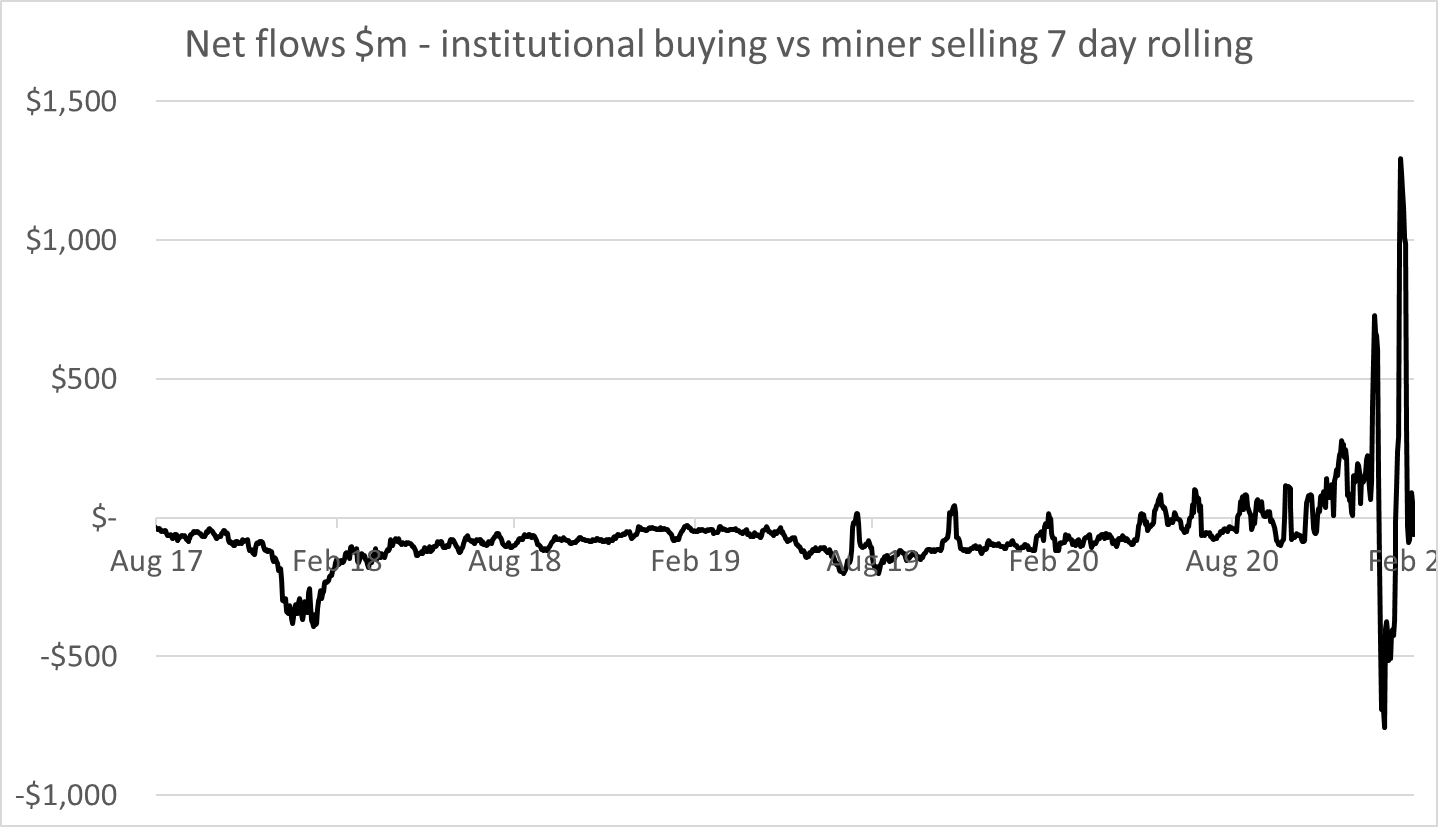

The importance of institutions

Pre-2020, institutional investment was helpful, but retail overwhelmed it. In future, this has to reverse because the sums required by the miners escalate rapidly.

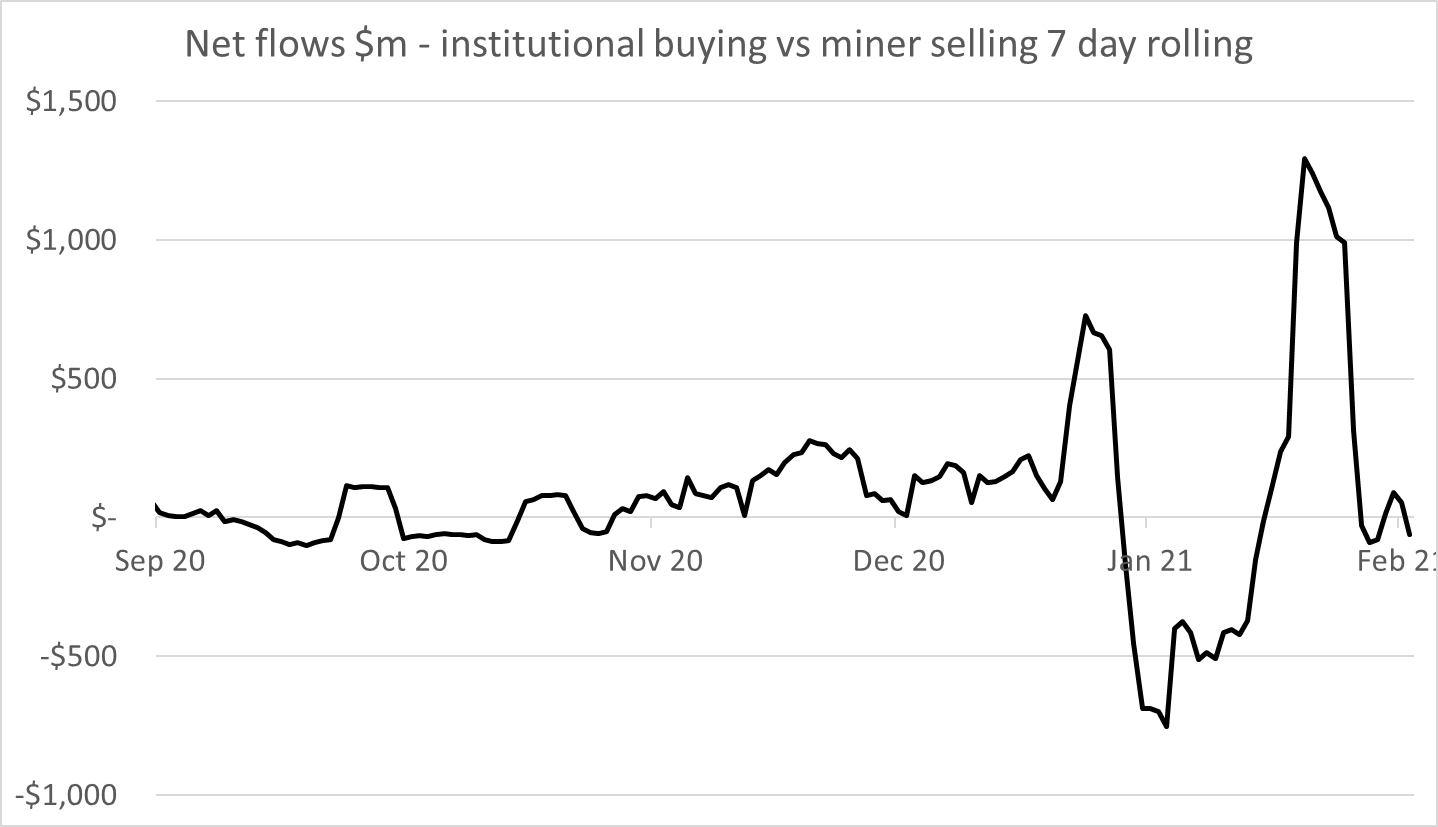

I have combined the daily fund flows for the Grayscale Bitcoin Trust (GBTC) and the European ETPs against the daily sales by miners as measured by ByteTree’s First Spend. There are other sources of institutional flow information which I hope to add, but this captures the lion’s share. The results are displayed over a rolling seven-day period.

The institutions bought less than the miners sold until recently, which reaffirms the importance of retail investors in the past.

Zooming in, the sustained net inflows began in mid-October. They ran until 28 December 2020 when a single miner sold $322m of BTC, which they had been accumulating since March. That briefly swung the net flows into negative territory, and a price peak soon followed on 9 January 2021. The second spike occurred as the miners backed off in the face of slowing institutional flows.

More flows please. I wish Michael Saylor well, because we all need to. But I believe it’s not the CEOs that matter nearly as much as the portfolio managers. Just as a small allocation to gold a decade ago, soon saw $200 bn in the gold ETFs. The same needs to happen with Bitcoin. A modest allocation, across many portfolios, would support a sustained advance.

In order to attract portfolio managers en masse, Bitcoin needs to be an attractive proposition for the “suits”. The real risk here is not just the price volatility and the noise, but the way in which they deter the institutions that the network so badly needs. Remember last October when the institutions couldn’t get enough?

A rising price means we have to feed the miners even more than we currently do. In that sense, I do not see the four-year halving of new supply as a force which drives the price higher, but more of a relief to reestablish market equilibrium. Bitcoin needs $11 bn of institutional flow this year and even more if you want a sustained bull market. Think about that while you curse those suits.

Comments ()