ByteTree's Bitcoin Valuation Model

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 60

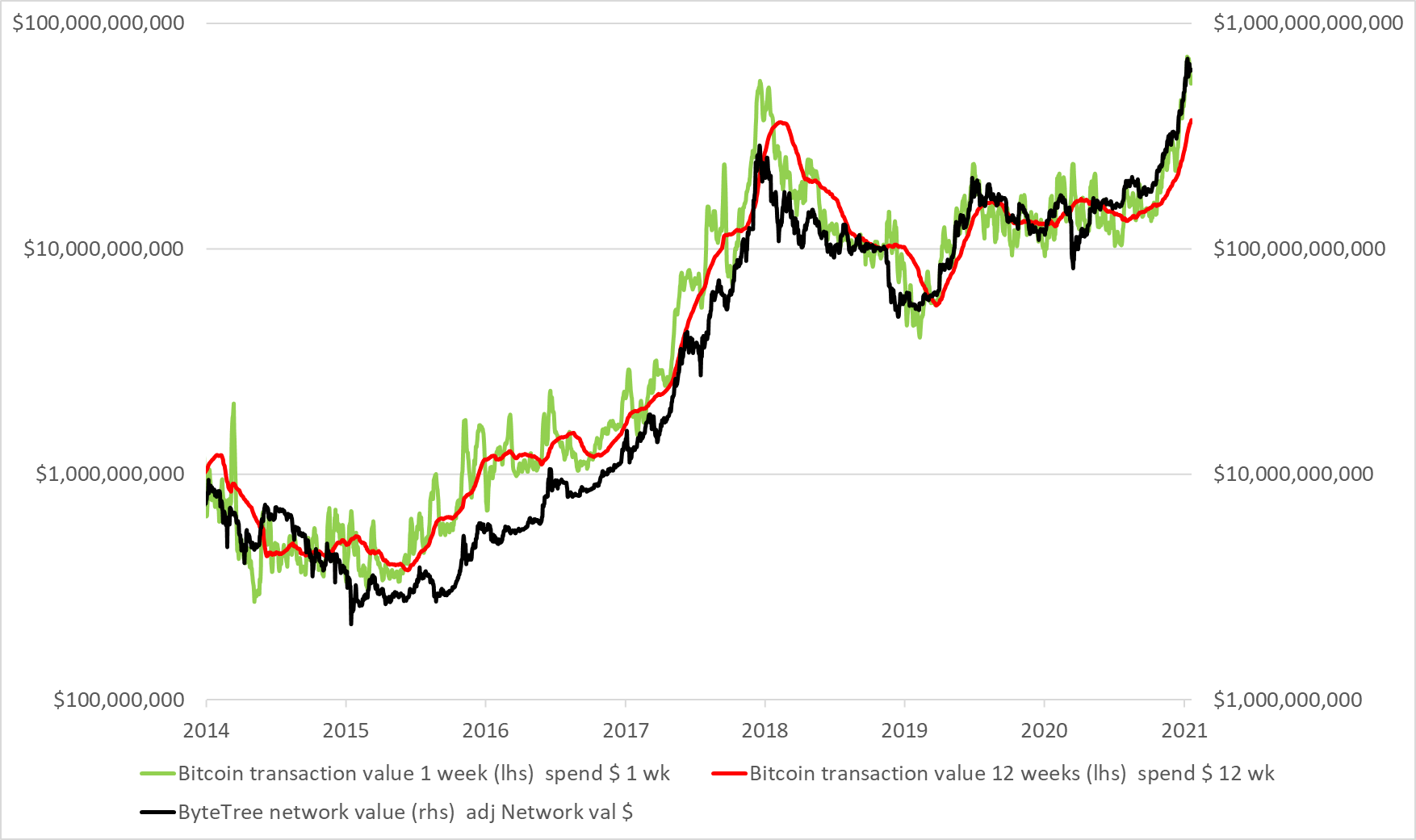

Every time someone initiates a Bitcoin transaction, they contribute to the network. According to ByteTree data, last week there were 2.2 million transactions that saw $55bn change hands. At that rate, expect to see over $2 trillion change hands over the Bitcoin Network this year, another record high. Given Bitcoin’s main purpose is to transfer value over the internet, it stands to reason that the amount of value transferred (transaction value TV) is closely linked to the total value of the network (network value NV).

In the chart, the NV (black) is the number of Bitcoins (in existence) times the BTC price; also known as the market cap. The green line shows the TV over one week, while the red line shows a smoothed version over 12 weeks (Nerds note: for the coin count, I have deducted inventory of 1,530,029 BTC, which are still held by miners).

Network value is closely linked to transaction value

Different characteristics closely link these three lines. A few observations:

- The y-axis right and left scales are 10:1 apart. NV tends to be around 10 times TV.

- The 12-week TV lags the 1 week TV. When they cross, they agree.

- From 2015 to June 2017, the NV appeared to trade below TV.

- Post 2018, NV is more in line with TV.

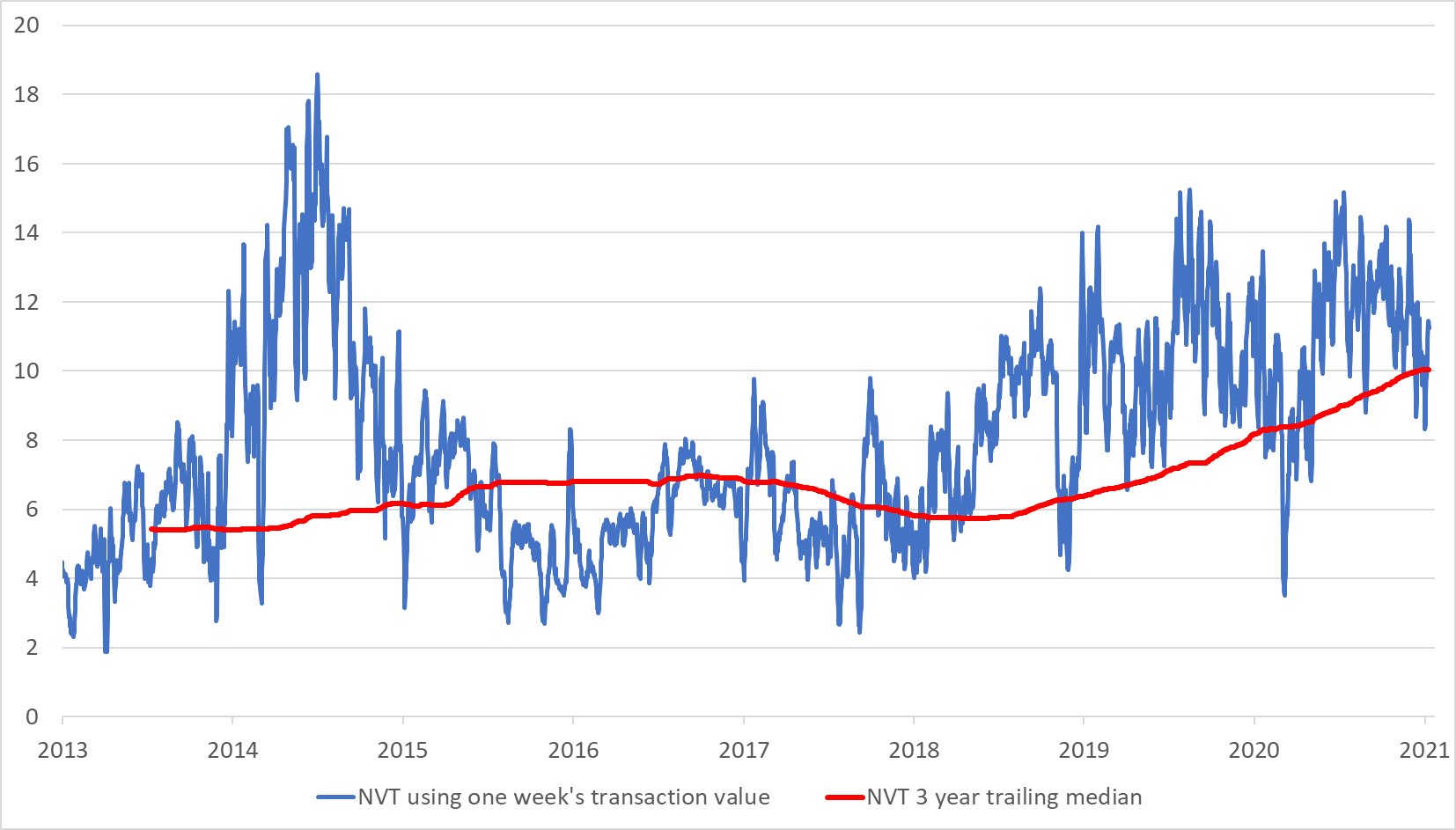

The y-axes are 10x apart, which looks neat and simplifies the point. However, this relationship moves over time. By dividing the NV by the TV, you get the network value to transaction value ratio (NVT). That is shown by the blue line below. It used to average around 7, but post-2019 has been closer to 10.

The red line is a three-year trailing median of the blue line. As you will recall from school, a median gives less weight to the outliers, which is important as Bitcoin has plenty of outliers. The red line varies around 7 until 2018 and has been rising since. It is now 10, which is how ByteTree’s valuation models have been calibrated.

ByteTree’s NVT ratio

We know that TV and NV are closely linked and the difference between them is the NVT. A decade of observation confirms that NVT is a mean-reverting series, which makes it a useful measure of relative value. When the NVT is high, it suggests that NV (proxy for price) is ahead of the TV (proxy for utility or activity), and vice versa. A few observations from above:

- The NVT was consistently high in 2014, which was a bear year for Bitcoin. The TV was falling faster than the NV.

- This settled down in 2015 when the one-week NVT fell below the three-year median.

- Post-2018 the median has been rising.

- Today’s reading is 10.

The rise in the median NVT could be due to an increase in lost coins, which means fewer BTC are visibly circulating. Alternatively, the network is trading at a structurally higher valuation these days, which reflects a wider interest in Bitcoin as an asset class. It must surely be a combination of the two, but I believe that using a three-year rolling measure allows us to separate the long- and short-term relationships. Three years is long enough to capture the cycle, while providing effective calibration for measuring shorter term deviations.

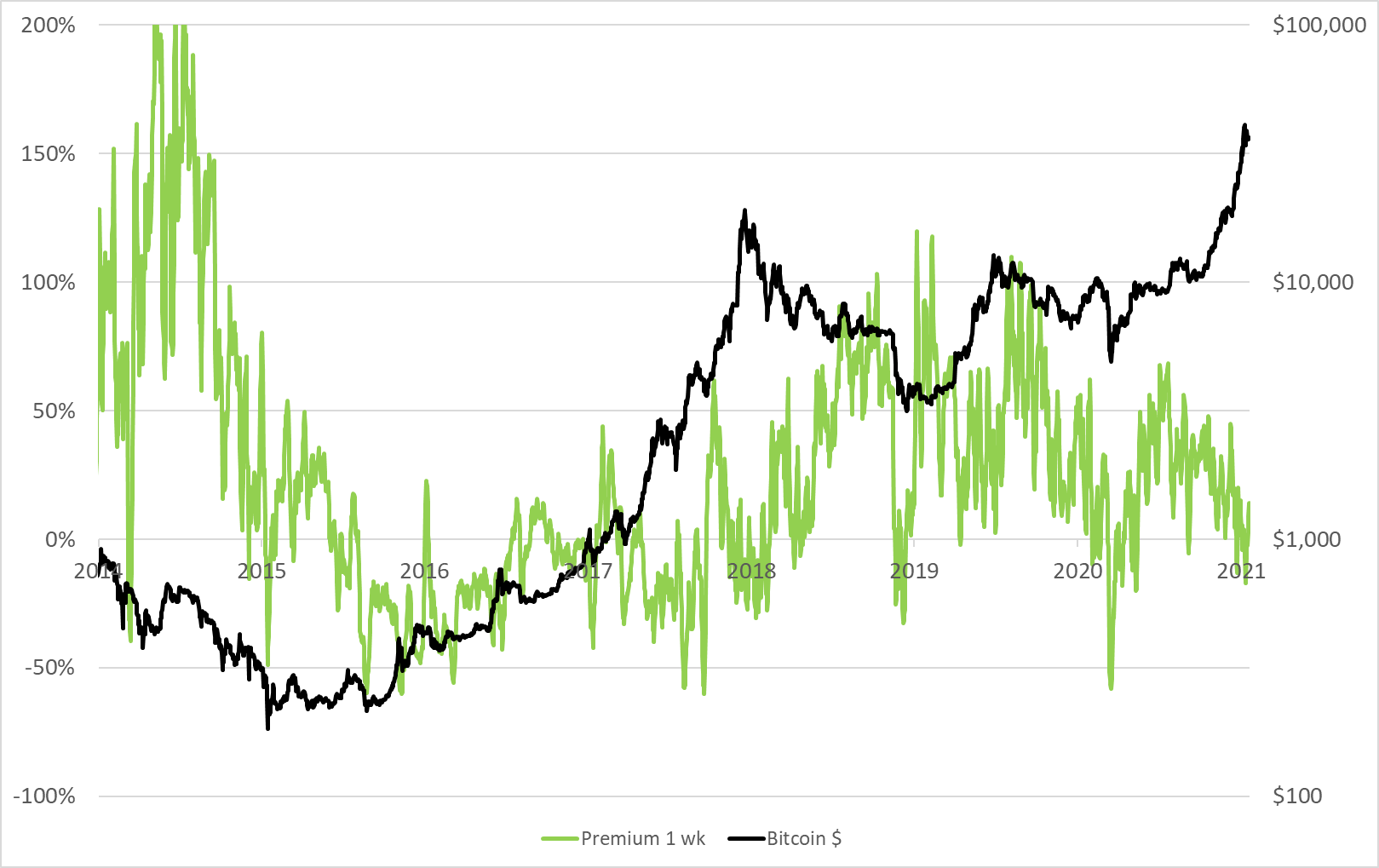

The final part is to divide the NV by the number of Bitcoins to get a per coin fair value and compare it to the BTC price. The one-week measure showed significant overvaluation in 2014 and 2018. It spiked ahead of the November 2018 and July 2019 peaks. These measures proved useful in my bearish analysis at the time.

The Bitcoin premium using one week transaction value

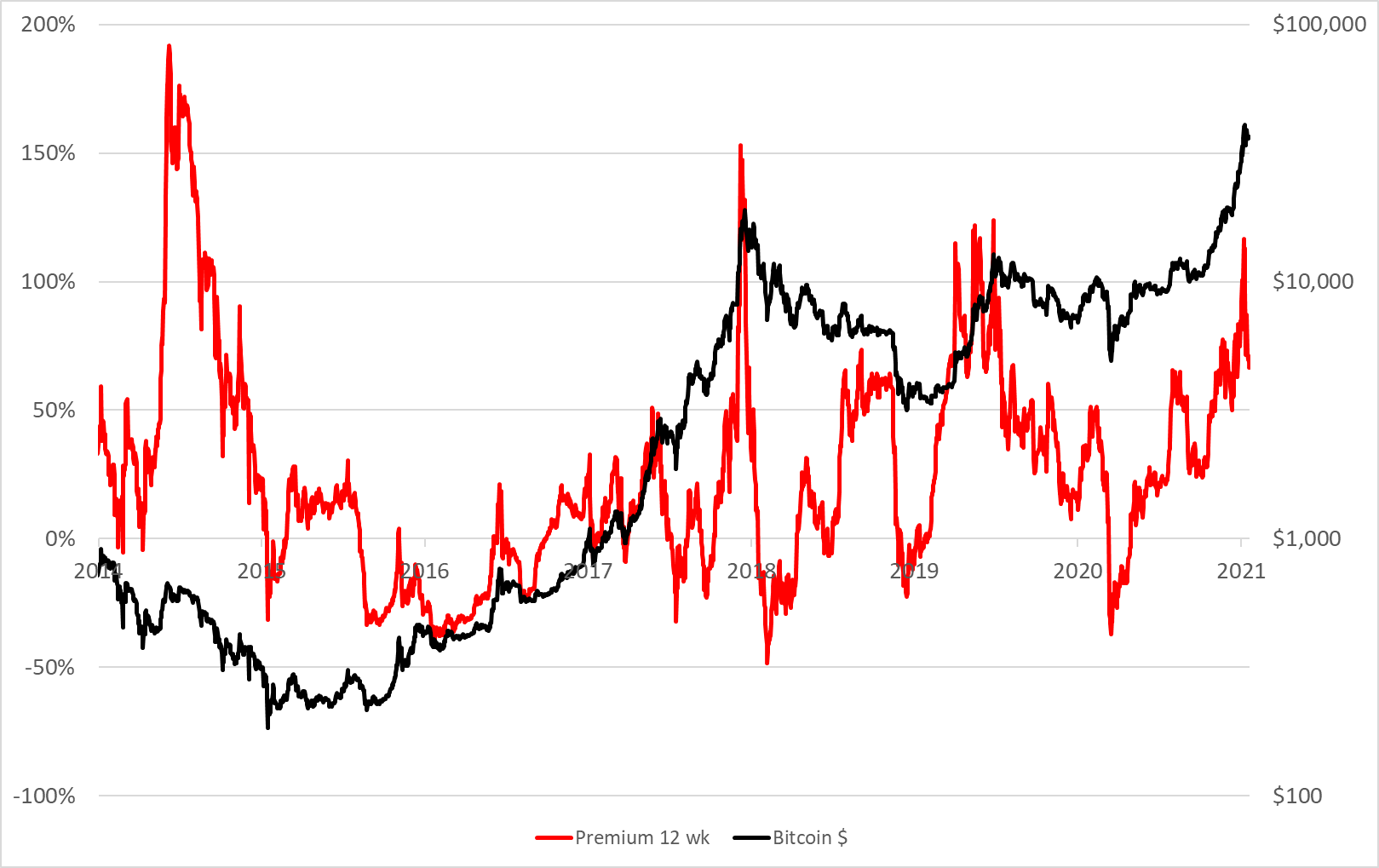

Although the one-week data appears to be volatile, it isn’t nearly as volatile as the 12-week data. It may change frequently but sits within a tighter range. The 12-week reading is less noisy, but it was abundantly clear in 2014 and late 2017. It called out the autumn 2018 crash, the July 2019 peak and a little of the pre-March 2020 hype (remember halving last year).

The Bitcoin premium using 12-week transaction value

The recent reading above 100% on the 12-week measure does appear bubbly. Fortunately, it wasn’t confirmed on the one-week numbers, but makes the point that rapid surges in on-chain activity are difficult to sustain.

Having seen $20bn average weekly TV in mid to late 2020, it quickly tripled by January to the highest levels in history - $70bn. Over the past week, this has eased back to $54bn and is a key metric that helps to keep things in check.

Bitcoin transaction value – past quarter

I first wrote about this in Atlas Pulse in 2014. What is truly remarkable is how this concept has stood the test of time. I used to call it the Network to spend ratio (NSR), but alas, the world moved on and it morphed into the NVT ratio.

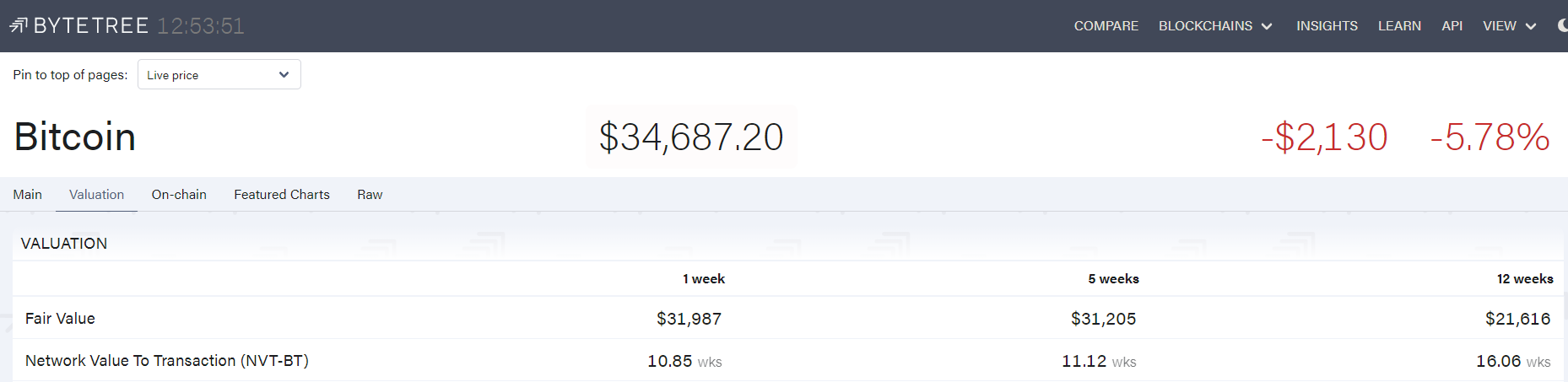

It is worth pointing out that like all the best ratios (price to earnings, price to sales etc.), it’s not actually a ratio as it has units. An NVT of 10 means the NV is ten weeks’ TV. Next time you look at valuation on Bytetree.com, you will see Bitcoin trading at fair value when the NVT = 10.

Having previously followed the 12-week number, the gauge now follows the one-week number. At least that keeps things interesting. The one-week number is quick to respond, whereas the 12-week number is slower. As things stand, don’t be entirely surprised if Bitcoin revisits sub-$30k territory before the next advance.