The Corporate Cash Mountain Eyes Up Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 57

You’ve heard about MicroStrategy and Square buying Bitcoin, so consider what would happen if Silicon Valley and their like-minded friends around the world followed suit?

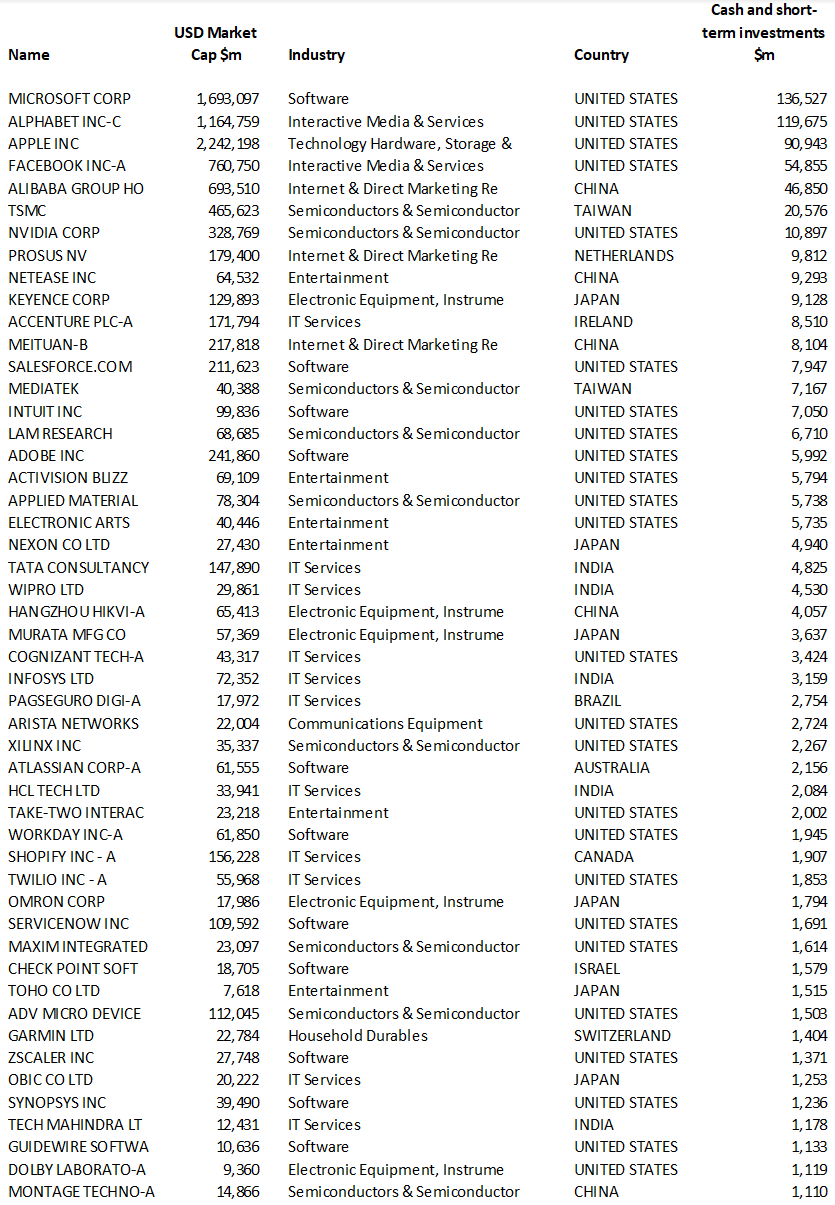

In the list below, I have identified 50 companies, typically in the tech space, with surplus cash. They are growth companies and aren’t naturally high dividend payers. Their capital-light businesses are so profitable that they don’t need the money to fund future growth. The result is a growing cash pile that receives no interest to compensate them against inflation.

Cash-rich companies

Between them, these companies are sitting on $500 billion, which is more than Bitcoin is worth, at least this week. What is so fascinating about corporates investing their treasury into Bitcoin, is that the regulator has allowed them to do so. You might have expected them to have resisted, but they didn’t.

Who’s next is the big question? My guess would be to start at the bottom of the list and work your way up, rather than the other way around. The giants may get there in time, but I imagine it will take longer for them to follow suit. The bigger the numbers, the harder it is to move quickly, but they’ll get there in the end.

We know the conversation is underway because Michael Saylor is driving it. This isn’t happening privately in the corridors of power, but publicly on Twitter.

Just as Ruffer’s purchase will force every investment committee to have a view, corporate treasury management will become a widespread boardroom discussion. Inflation expectations are rising, and in 2021, this will become apparent to all.

Many don’t believe it because the post-2008 stimulus has failed to reflate the real economy. The money stayed within the financial systems and boosted asset prices. This time, the money has been injected into the real economy, and that will see consumer prices rise. The bond market already sees long-term inflation back at “normal” levels while the world remains in various stages of lockdown.

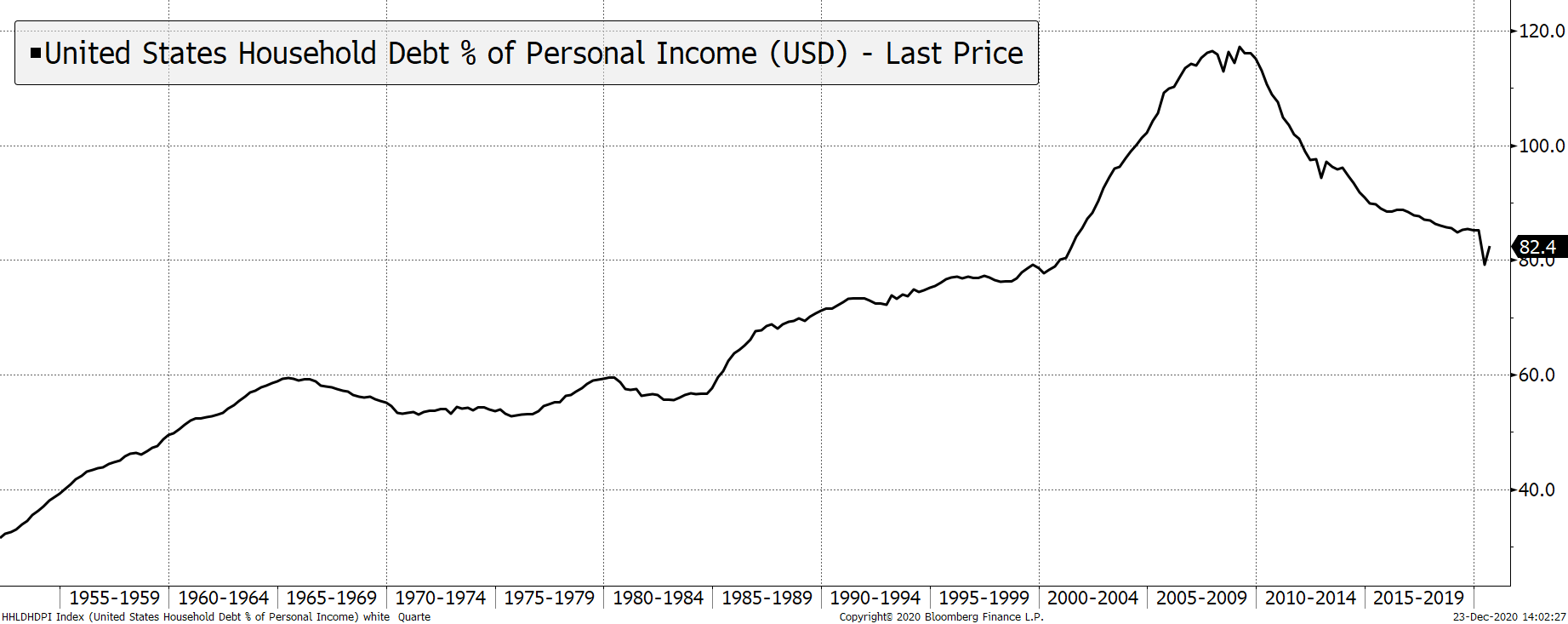

The oil price is rising while people are staying at home. Coal has nearly doubled since March when you’d think the solar panels and wind farms had given cause to leave it in the ground. Then there’s the consumer balance sheet. Some people have had a very tough time in 2020, but the majority have managed to save.

Consumers were stretched in 2008 as they were over-indebted, yet that has been recovering ever since. Lockdown has accelerated this trend, just as it has accelerated many trends. The consumer is in rude health and ready to spend like Japanese tourists in the 1980s.

The consumer is ready to rip

Sooner or later, we will be allowed to travel again, and that will see prices will soar; not just of oil and coal, but of everything. In 2021, this will come to light, and investment committees and boardrooms will be forced to take note. Gold is an effective and timeless inflation hedge, while Bitcoin does a similar job, just on steroids.

Which company will be next? One of Saylor’s mates, probably. Musk? He’d love to, but Tesla didn’t make the list. I suppose he could take on more leverage.