Bitcoin Isn't Gold; It's All About the Network Effect

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 55

At ByteTree, we see Bitcoin as a network which is subject to the laws of the network effect. Busy networks are extremely valuable, while quiet networks are worthless. Just like gold, or indeed any other asset, investment inflows will drive the price higher in the short-term, but that alone will not sustain it over the longer-term. For Bitcoin to create long-term value, the network must grow. The recent rally has been spectacular, but the trouble with flows is that they eventually cool.

The Bitcoin price is still battling with the resistance at $20k, and there was a modest sell-off last night. But in the big scheme of things, we believe this is just noise. Corrections within a bull market are an opportunity to buy.

This price strength, followed by recent weakness, has broadly followed network transaction value. It spiked at $30bn per week, only to ease back to $22bn; in line with November levels. The good news is that it has started to rise again, which is clearer when you zoom in please visit the site.

The Bitcoin Network cools

The Bitcoin Network was designed to exchange value over the internet, and so transaction value is the key metric. The more people that exchange value, the higher the Bitcoin price will be. But when too many people flood the network at the same time, fees rise making it expensive to transact. The recent rally began in mid-October, and the scramble to buy caused a spike in network fees (paid to the miners for enabling transactions), taking the average fee (LHS) from $2 to $12 in just two weeks.

Fees turn down

The result of a fee spike? Fewer transactions. High fees in late October caused the number of transactions to fall. They have subsequently recovered.

Transactions reject high fees

Fee spikes have always choked off demand, and that is nothing new. Indeed, at the December 2017 price high, the spike in fees saw the number of transactions fall by a third over the following month. $12 to transact may be nothing for an institutional trader, but is a high price to pay for routine, non-speculative network activity.

The average Bitcoin transaction is around $140, which is why so many transactions are sensitive to fees. The swaggering institutions may laugh at the little guys, but it is they that do the hard work. Regardless of whether it is a bull or bear market, those workers have been the Bitcoin Network’s rock, while the investment flows have come and gone.

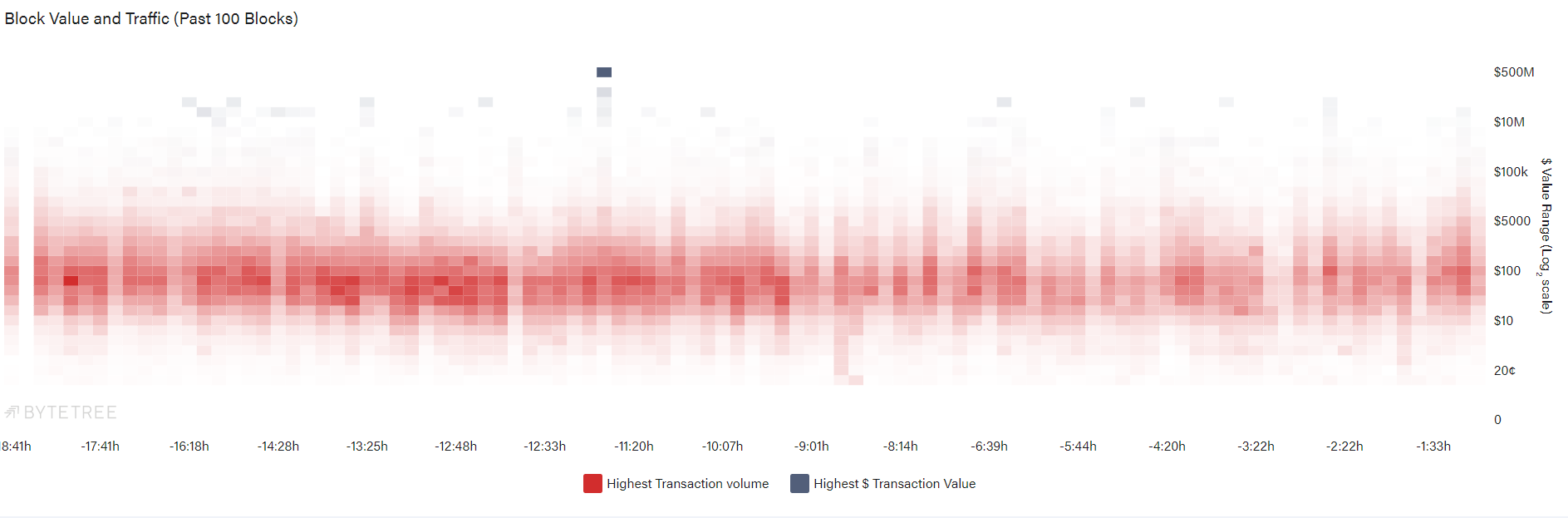

In a typical day on the blockchain, as seen block by block in our heatmaps, there are around 300,000 transactions. The thick red band shows a high number of transactions in the $10 to $5,000 area, with a few (grey) whales dealing in large sums. That prominent dark grey square was a single transaction worth £306m. These days, such transactions have become commonplace.

A Typical Day on the Blockchain

In 2020, the average daily transaction value was $2.1bn until mid-October, ballooning to $3.4bn per day since. That 62% boost in transaction value coincided with a 72% jump in the average price over the same period. The ByteTree approach has focused on this link between transaction value and price since I started researching this space in 2013. In this case, a modest 10% dip puts them back in line.

Institutional Flows Wane

As I highlighted last week, institutional investment flows have been incredible. They have amassed over 600,000 BTC, which has contributed to the excitement. Yet it is not the 600k BTC leaving the grid that creates the long-term value; it is the associated sustained increase in network activity that goes with it. In other words, while the funds have been net buyers of BTC, it is the trading activity around them that creates network value.

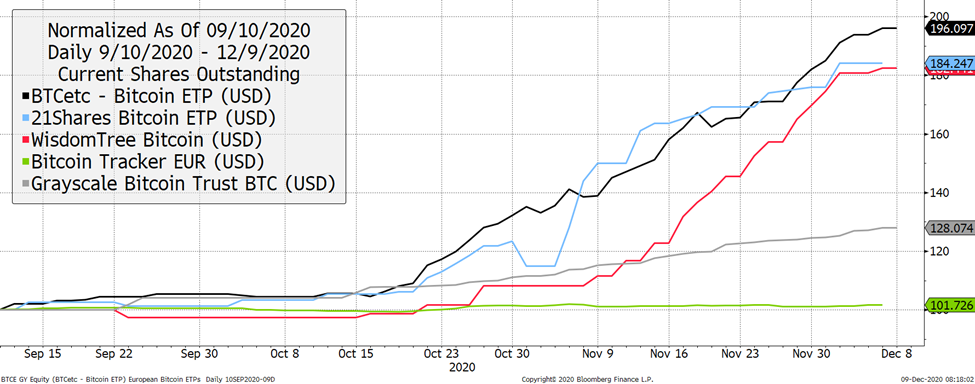

The chart shows the growth in share issuance by the leading institutional investors: the European exchange-traded products and Grayscale. Flows are still rising, but probably at a lesser rate than last week, which is little surprise as we move into the holiday season.

Institutional Buying

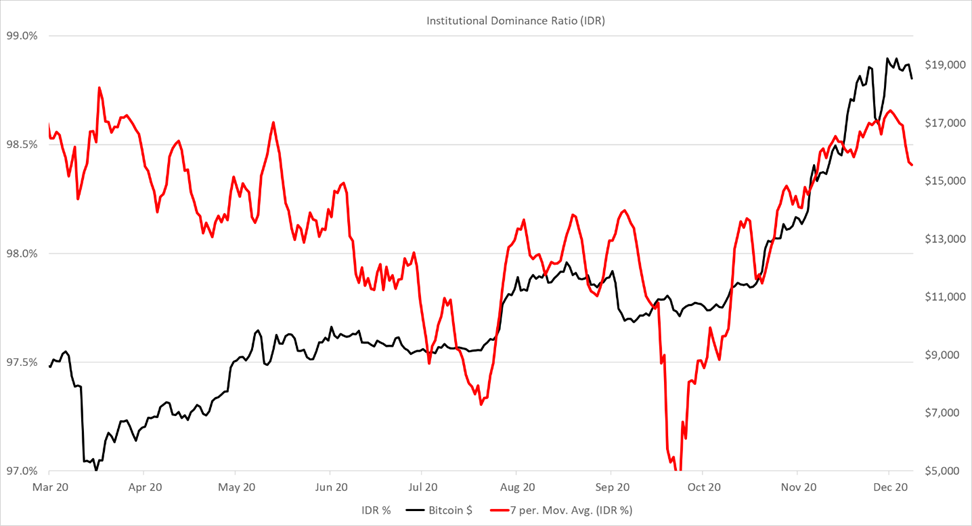

That sample of funds captures some known institutional flows, but not all. To catch all, the best data always comes from the blockchain itself. The high transaction value weight of all traffic, where there is an institutional bias, has started to turn down relative to all traffic. This indicator is a simple way to track speculative activity. At times, it can be a noisy series, but the big upturns have given powerful signals; the downturns less so. I suspect the next upturn will coincide with the long-awaited $20k breakout.

Speculative Activity May Start to Cool

The legendary value investor, Ben Graham, famously said,

“in the short-run, the stock market is a voting machine. Yet, in the long run, it is a weighing machine.”

It’s a quote every investor should repeat to themselves each day. I certainly do. Fund flows influence asset prices in the short term, but they do not change an asset’s value in the long-term.

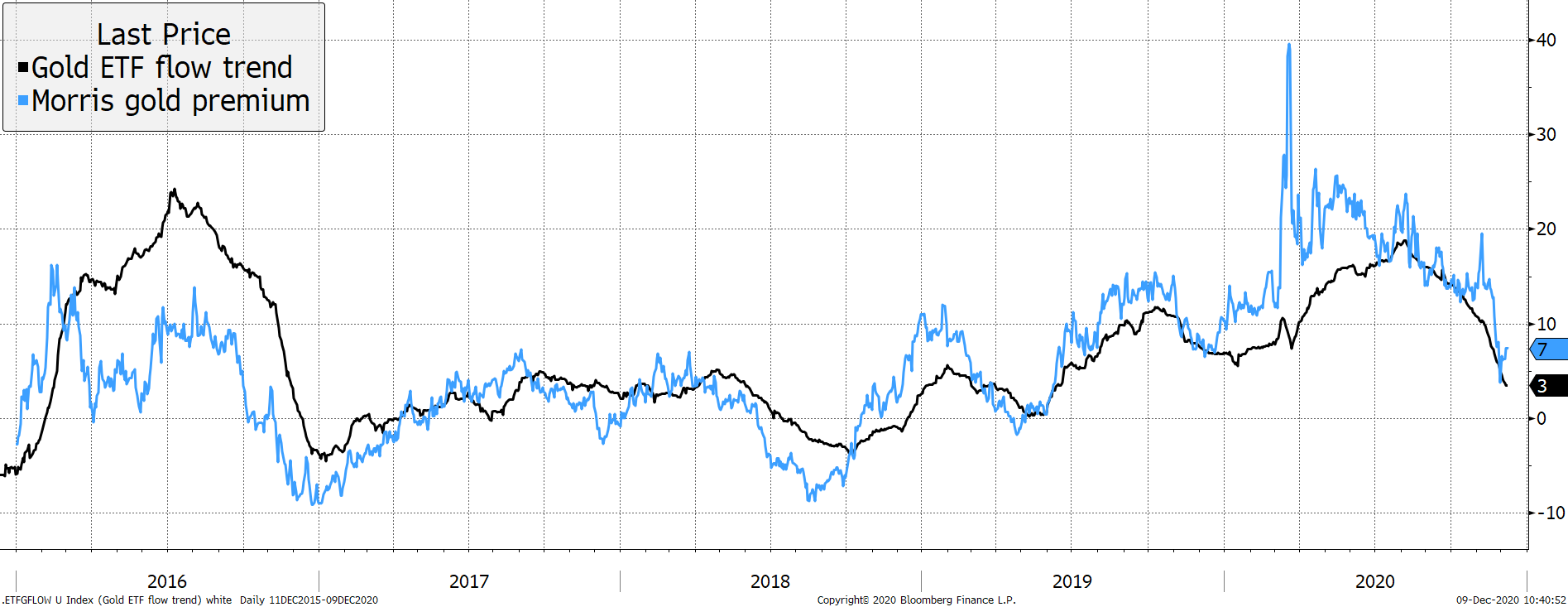

When speculative fund flows eventually slow, so does the premium they created in the first place. To demonstrate that, I’ll turn to gold where the market is more established, with hundreds of funds all around the world, worth $198bn. Incidentally, that approximates to the value of the Bitcoin Network when you take into account the lost coins; a subject for another day.

In gold, the premium or discount to fair value correlates with fund flows. In other words, the gold market attempts to trade at its fundamental fair value (weighing machine), whereas the investor or speculator pulls the price either higher or lower than fair value. The ETF flows lag the price fundamentals. Rather than buy low and sell high, the institutions are trend followers, that lag by a month or so.

The Voting and the Weighing Machine

The gold price is driven by past debasement, real interest rates and the outlook for future inflation expectations. For more on my methodology for gold’s fair value, please visit gold.org.

In contrast, Bitcoin is driven by the network effect. As the Bitcoin Network grows, so will its liquidity, distribution, and acceptance, while its volatility will fall. As a result, it could become a mainstream asset and start to resemble a monetary asset. But it can’t possibly work the other way around.

It is unrealistic to believe that a monetary asset can be created within a short space of time, while assuming there will be widespread faith, no matter how great the engineering is. The forward-thinking folk are excited by Bitcoin, but the historians know to trust gold. As always, the answer lies somewhere in between.

New Bitcoin fans

One of the world’s greatest financial historians, Niall Ferguson, gave an excellent interview on the Money Maze Podcast

The hedge fund manager, Ray Dalio, stated that Bitcoin:

“could serve as a diversifier to gold and other such stokeholds of wealth assets. The main thing is to have some of these type of assets (with limited supply, that are mobile, and that are store holds of wealth), including stocks, in one’s portfolio and to diversify among them. Not enough people do that.”

Ferguson and Dalio know what they are talking about. Ferguson is very much in the Bitcoin Network effect camp whereas Dalio accepts Bitcoin as part of the real asset gang. At ByteTree, we believe in both camps. They both like gold too, as do we.

Summary

Narratives can be fun, but they can also be dangerous, especially when they are wrong. Currently, the most deafening narrative revolves around limited supply. That’s great as we’d all rather have limited supply than endless supply. But the bottom line is that it is network activity that creates long-term value in Bitcoin. That means a new user is more likely to attract others, and so it goes on. In contrast, the investment flows come and go. For the price of Bitcoin to rise, the underlying network must grow. That means more active investors, liquidity, applications, acceptance and above all, users. Be sure, the internet is good at this.

If you want to get ahead, understand the weighing machine so that you have sufficient knowledge to trade the voting machine. The institution ship creates a bow wave, and it is a great place to go surfing. As for the short-term price dip, there is no evidence of an impending bear market, merely a pull-back from one hell of a rally. Buy the dip.