Bitcoin is Four Ounces Short of Its All-Time High

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 53

For Bitcoin, making a new all-time high in Turkish Lira or Argentinian Pesos came easily. A new high in dollars is underway, but it is boring as people deliberate whether it came at $19,602.80 or intraday at $20,001.20 on some far away exchange. Quite obviously, Bitcoin has reached its all-time high in dollar terms, and in much ruder health than at the 2017 peak.

Last time, the price was 350% above its 200-day moving average. This time it sits at a more sustainable 90%. The Bitcoin ecosystem has vastly improved, as the 2017 high attracted the grownups. They have been hard at work preparing Bitcoin for institutional investment, just as they did for the gold market 20 years ago.

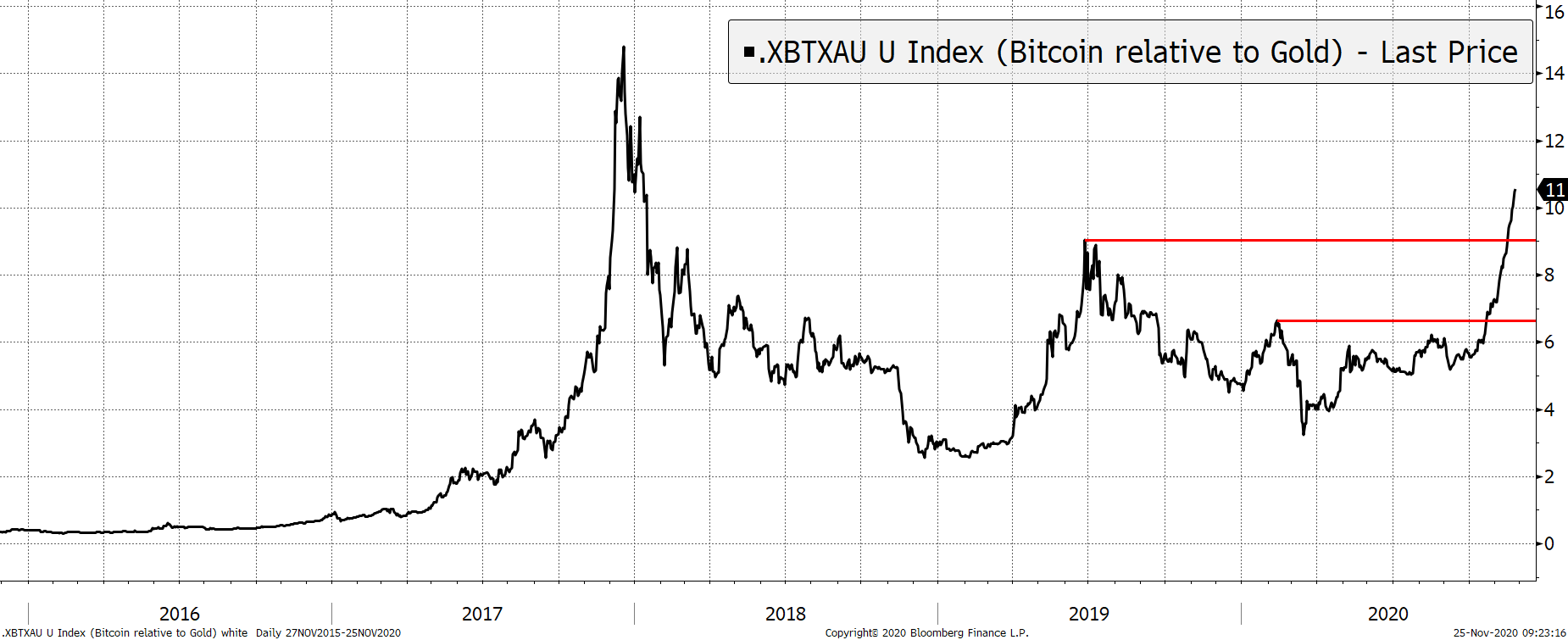

On that note, Bitcoin is still four ounces short of its all-time high when measured in ounces of gold. A Bitcoin currently buys you nearly 11 ounces of the yellow metal. The old high in 2017 bought you 15, but you had to be quick. Bitcoin’s last major hurdle before it reaches true fresh air will be a new high measured in gold. At least for the Austrian School.

A Bitcoin buys you 11 ounces of gold

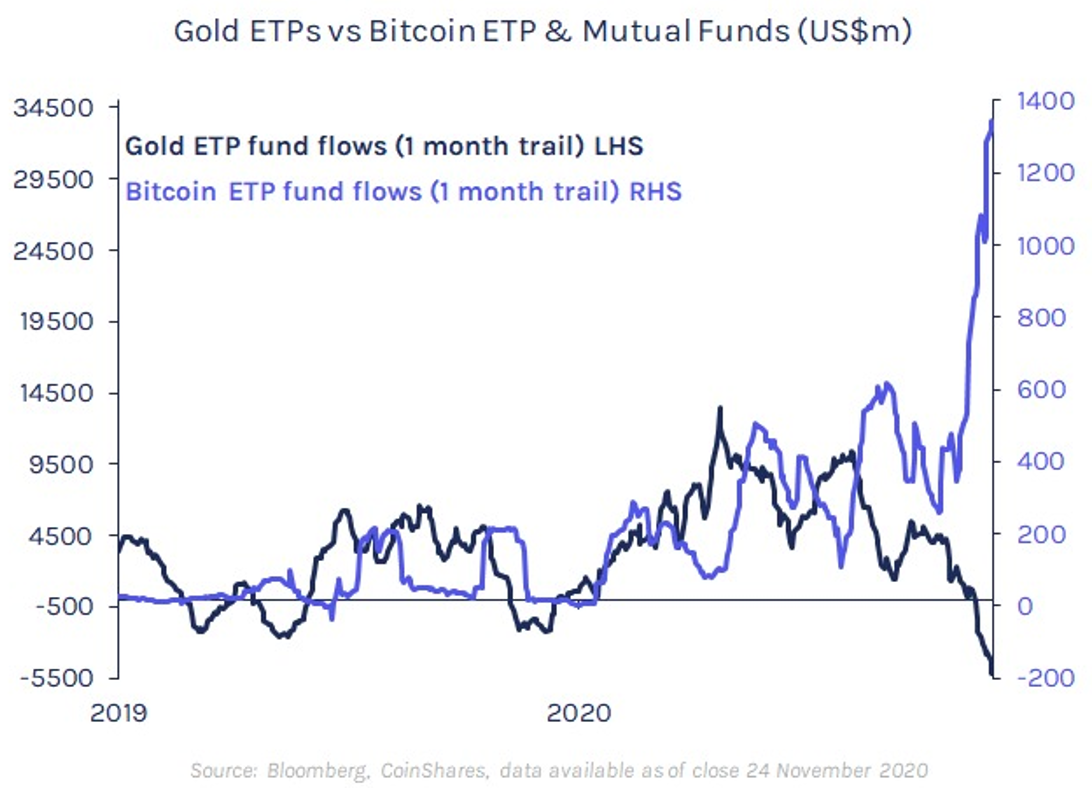

The price of Bitcoin is rising for all the reasons we have been highlighting in recent months. Investors have tended to agree, which is evident in the flows. In this excellent chart from James Butterfill over at CoinShares, he has aggregated the global fund flows for gold and Bitcoin exchange-traded products and other funds. They were somewhat correlated until the late summer, then boom. Money leaves gold as investors flock to Bitcoin. We cannot be sure that gold funds necessarily went into Bitcoin funds, but there must surely have been an element of that.

It is funny how 90% of the investment world seemingly ignore both gold and Bitcoin. They appeal to like-minded people, who seek protection from debasement. Most people believe in the system, for if they didn’t, it would already have failed. But gold and Bitcoin folk have become tribal, just like you see in sport or religion. Rather than respect one another’s views, and collaborate in winning over the 90%, they throw sticks at each other. Unlike in late 2018, Bitcoin is the current flavour of the month while gold is seen as irrelevant. No doubt that will reverse at some point.

There was a strong pushback from the Austrian economist and author, Emil Sandstedt. (Hat tip to Adam Cleary for highlighting). He wrote how the gold and Bitcoin proponents are both wearing blinders to each other’s arguments. In favour of gold, he said it was immune from “double spend”, and it does not leave traces. When multiple actors want to move Bitcoin, the network can become congested, and fees can spike, whereas gold can be transported independently without impacting other market participants. Finally, there is only one gold, whereas Bitcoin can be forked. In the future, forks might not necessarily be opportunistic, such as BCH, but to correct bugs or attacks. Read the thread for yourself.

I like counter arguments, especially when the consensus becomes so strong. With Bitcoin back in the spotlight, it is a time to reflect. Having banged the drum on these pages since April that Bitcoin was poised to rocket, it is now happening. You can punch the air and think you’re clever, or you can prepare for the next battle. That is the eternal humbling force in financial markets. As soon as you are proved right, your views soon become irrelevant. You have to keep on being right.

To remind you, I have studied gold since 1999, and Bitcoin since 2013 (having dismissed it in 2011, which was the most expensive mistake in my life). I like both assets, for different reasons, and believe they will both perform very well in a debasement or inflation scenario. It goes without saying, as I have argued in recent weeks, that Bitcoin has the potential to do much better, but not without risk. But despite the recent performance, gold will still do very well indeed, but with less risk.

Michael Saylor, Bitcoin’s man of the moment, compares gold to a horse, buggy and stagecoach; the implication being that humanity moves forward and embraces new and better solutions. That is a Silicon Valley view of the world, that everything must be automated and connected. It has been a very bad idea to bet against the computer since its creation. It has led to a giant leap forward and improved our lives. But do you really believe that the computer will dominate everything? I do not. It will achieve everything it possibly can, which is not everything. What’s left of the old economy will happily coexist.

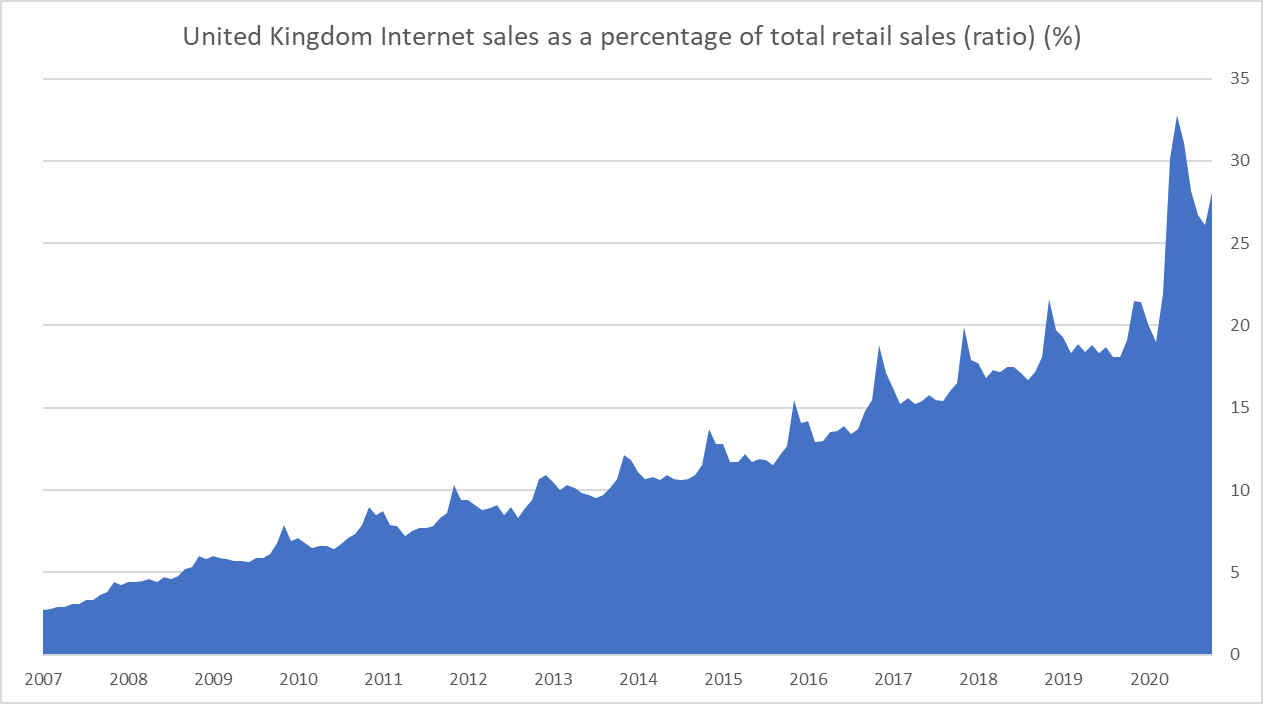

For example, UK internet retail sales (e-commerce) make up 28% of all UK retail sales, when back in 2007, it was less than 3%. As it has grown, it has destroyed the traditional retailers who failed to adapt. 2020 is an unusual year. Before the lockdown, e-commerce had a 20% market share, which boomed during the first lockdown to 32%. To put things into perspective, the last 10% gain in share took months in contrast to the previous 10% gain, which took a decade. No doubt a similar experience has been witnessed in other countries.

E-commerce has been a megatrend and will continue to gain share, but hopefully lockdowns become a distant memory, and we’ll flock back to the shops. With many shops closed for good, 2021 will likely see relief for whatever is left. Within a few years, e-commerce will make another new high, even in the absence of lockdowns. But at some point, e-commerce will plateau. It will never kill off traditional retail as the old world will find a balance with the new.

For the future of gold and Bitcoin, I see a similar development that we have seen in retail. With the likes of Paypal betting big on Bitcoin, digital assets will soon become more relevant to the everyday consumer. What’s more, Paypal CEO Dan Schulman recently commented that integrating digital assets into their payment system will increase their overall utility and decrease volatility over time. We believe he is right.

With money being printed on a gargantuan scale, there is room for two debasement hedges in the world. Gold will continue to grow as a store of value, even while Bitcoin gains share. The journey will be bumpy, and whenever the markets come under pressure, as they periodically do, money will flow back to gold. Like we see in retail, gold and Bitcoin will find a balance.

Gold and Bitcoin are ideally placed to work together, almost like bonds and equities (used to) do in a 60/40 balanced portfolio. Some of the old gold bugs think Bitcoin is ridiculous, just as the Bitcoin maximalists see gold as a barbarous relic. As with extremist views in general, they are blind. In the meantime, it is Bitcoin’s time. Let the bull run commence, and never write off gold.

ByteTree Network Demand Model

The network demand strategy is a regime model and takes no account of valuation and was not designed to forecast tops. It is built around risk and identifies bull and bear markets. When the Bitcoin network is stable or bullish, the model remains long. When the network is contracting, or at risk, it exits Bitcoin. It is simple yet effective and the basis for one of our flagship strategies at ByteTree Asset Management.

This sits at 6 out of 6, which is bullish. It is normal to be overbought and extended in bull markets. Be long.

Comments ()