The King of Crypto

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 44

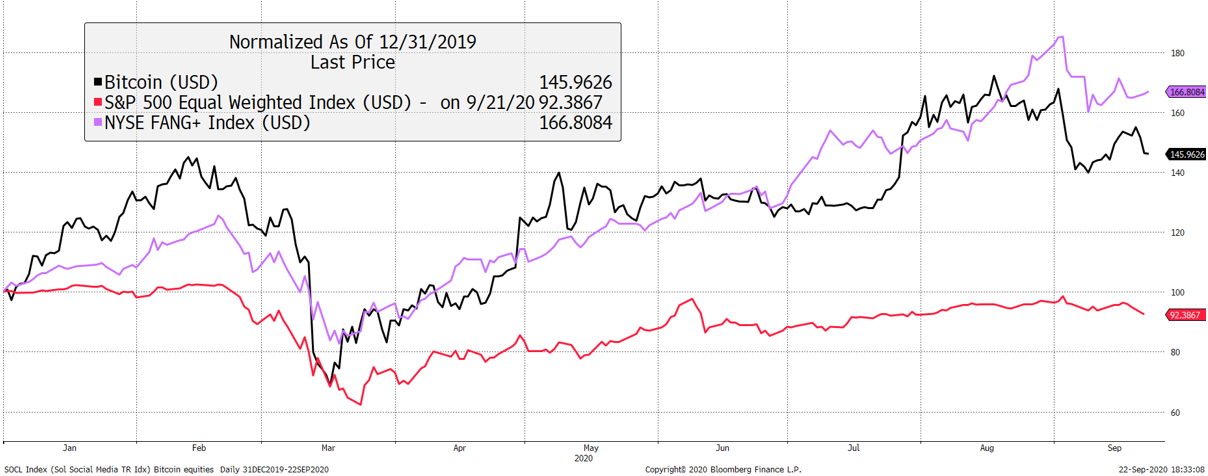

Financial markets dived on Monday in a continuation of the tech smash that began in early September. Back then, it was the new economy that took the pain as the tech stocks struggled. Then on Monday, it was the old economy’s turn as the European lockdown 2.0 took hold. The upshot is that this market shakeup gives us yet another opportunity to ponder whether Bitcoin sits within the old world or the new.

Bitcoin still quacks like tech

There can be little doubt that Bitcoin remains closer to tech stocks than anything else. That makes sense because; it comes from the internet, is immune to Covid-19, and embraces the future. But regardless of how great the story is, it will get pushed around by macro factors as it matures, and this will be most noticeable when the network is consolidating, and the macro is interesting.

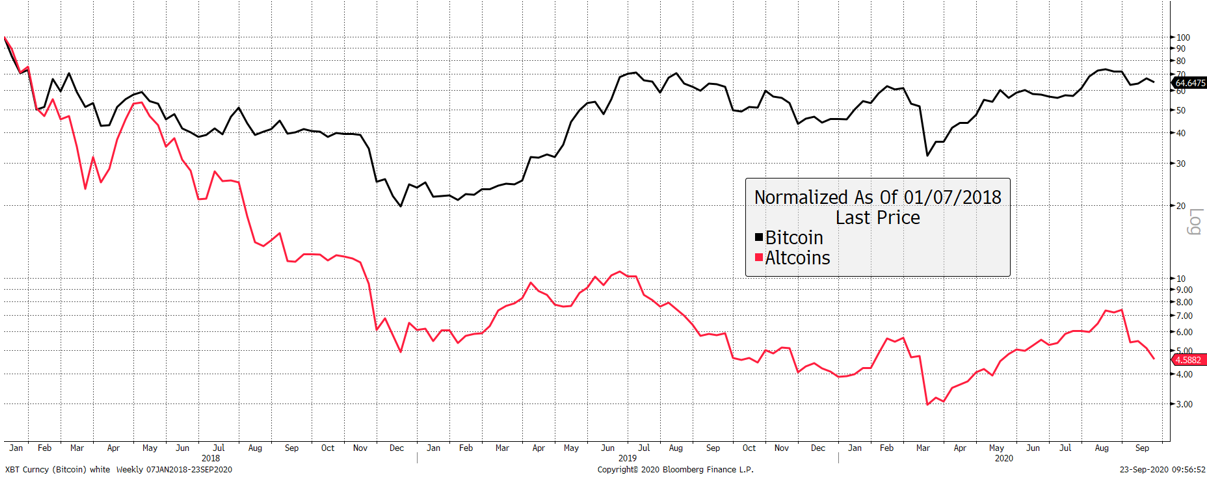

While not exactly growing, Bitcoin isn’t contracting either, merely going through a flat patch. In 2020, the most fun has come from the altcoins, egged on by the DeFi boom. That tide is now going out, and many leaders, such as Ethereum, Ripple, and Link, have fallen considerably in recent weeks. The Altcoin Index is down 40% since 1st September, which incidentally is the same day the Nasdaq and the FANGS peaked. In the next chart, altcoins can be seen alongside Bitcoin since 2015.

Bitcoin and the small caps

The altcoins did well in 2017, even managing to peak after Bitcoin in January 2018. But since that peak, Bitcoin is down 35% while the altcoins are still down by 95%. This tells you that Bitcoin is a proper asset and the altcoins are not.

Altcoins are not a store of value

We very much hope that there are changes in the future, and more credible assets come to be. But when looking to invest in this space, it is important to remember there is Bitcoin and there is the other stuff. There can be only one king of crypto. That said, there’s lots of fun to be had in altcoins, and one that is bucking the trend is Monero; a privacy coin. This theme keeps on coming.

Monero bucks the trend

ByteBox

“Thanks for getting the data back up and running - very interesting now that it has been [re-]scrubbed. If the other set of data was too bullish, do you think these values are too bearish or ‘just right’?”

Ironically, it doesn’t matter very much whether the absolute level of “spend” is right or wrong, provided the changes are consistent with economic activity. If we record $100, when it is actually $1,000, that’s fine as long as our $200 meets the blockchain’s $2,000. It is the consistency that is most important. That said, the new numbers are around 15% lower than the pre-August readings as we have stripped out more change than previously. No one knows what ‘just right’ looks like because you have to make assumptions. But we are confident that our new spend data is much closer than ever before.

Complex and batched traffic will be interesting to follow, as well. Above all, I want to learn more about their economic sensitivity, relevance to the fair valuation of Bitcoin, and their influence on future price moves. Watch this space.

Why not go short in a bear market?

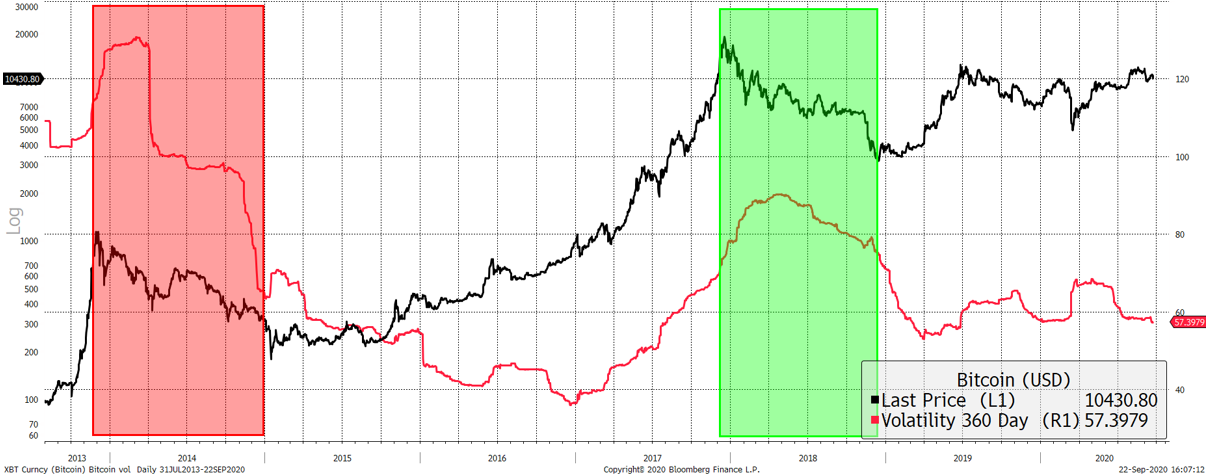

The aim of the network demand strategy is to identify, and therefore avoid, financially devastating bear markets. The strategy, therefore, reduces risk, while also boosting returns by preventing losses. The Bitcoin long side is so profitable over time that I’m not sure you need to milk out the short side as well. Clearly, you could go short if you wanted to, but that is an entirely different proposition which increases risk when our aim is to reduce risk in this strategy.

During bear markets (shown highlighted), the price volatility has surged. Bitcoin’s volatility has tended to be sub 60% during bull markets and higher during the bears. A short contract has the potential for limited profit and unlimited loss, and you would have to accept this when the market was at its most erratic. That’s fine for a trader, but for an investor, it would only bring sleepless nights.

Bitcoin is most volatile when you want to short it

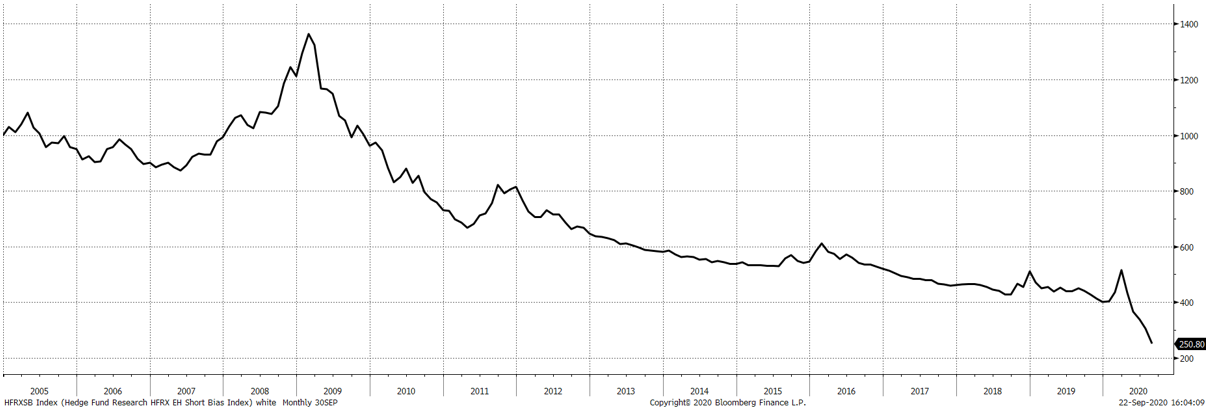

Furthermore, short selling is a mug’s game as I can illustrate using the HFR Short-Bias Index. This index shows you the collective returns from hedge funds that play the short side since 2005; $1,000 has been turned into $250. They made a bit in 2008, but the aggregate results are truly terrible. And make no mistake; these people are smart investors.

Professional short sellers struggle

Consistent and profitable short selling is much harder than it looks. Market conditions are against you, as is the risk versus reward. An unlimited downside can add up to quite a lot.

“[ByteTree is] underrated and is an enormously helpful resource – thank you for freely sharing”

Thank you for saying so. It probably won’t always be free, but certainly parts of it will be. The data is designed around economic demand as opposed to intellectual curiosity, and the smarter investors recognise that.

There is so much more to build, and we have barely scratched the surface. ByteTree has a history of development stagnation followed by bursts of genius. I can feel another burst coming soon.

When will crypto become part of the formal financial system?

Central banks will embrace stable coins relatively soon. Although the current insurers aren’t angels, the mechanism is far superior to the current system (SWIFT etc.). I believe this technological step forward will develop relatively quickly, with the established commercial or central banks becoming the issuers.

As for crypto, I don’t see a formal role anytime soon for several reasons. Crypto is far too small and needs to be 100 times more prominent, and much more widely distributed and entrenched before it could be considered worthy of reserve status, and so on. The investment banks would need to be active, and the multi-trillion-dollar global asset management would need to treat it like a credible, standard, and regulated asset class. There is so much to be done here that it cannot possibly happen quickly. This stage would need a decade or so at least.

Moreover, there is no need for the formal system to adopt crypto. Fiat money is a fintech that came to be in the 1970s. Most talk about fiat coming at the end of the gold standard, but what about the tech side of the story that enabled fiat to supersede gold? It wasn’t until the 1970s that modern communications were good enough for a vibrant foreign exchange system with real-time exchange rates. Gold has had its day, and fiat was ready; something that wouldn’t have been possible much earlier.

Above all, crypto doesn’t need a formal role. It just needs to keep on proving itself as a technology, and an alternative asset class; the rest will take care of itself. The constant innovation in the space will lead to great things; many valuable assets are being created, and more people are getting involved.

The future is bright, and ByteTree aims to be at the heart of it.

Network Demand Model

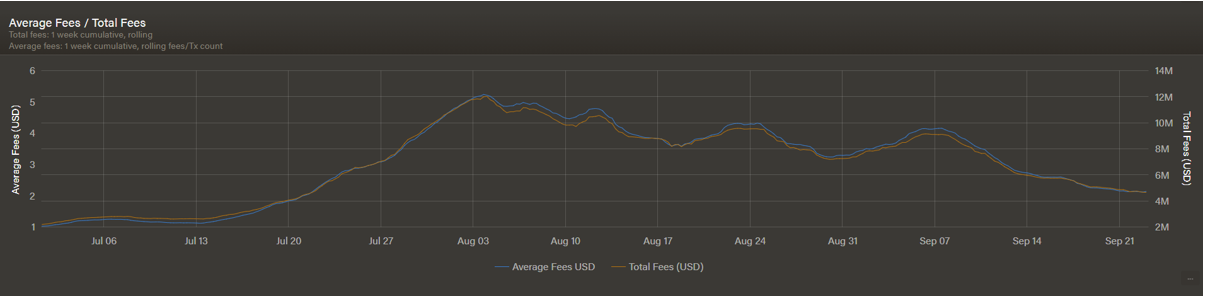

The score remains 4 out of 6, with velocity and short-term spend giving bearish signals. A material weakening of traffic seems unlikely, but the tide is going out slowly, and the next shoe to drop will be short-term fees. Fees have already fallen from $10m per week to $5m, but that is still technically “healthy” and appears to have stabilised. If fees drop another 20% or so, then that will reflect longer-term network contraction and ByteTree models will turn bearish.

Fees stabilising

It is a crucial part of this model’s design that it seeks to avoid bear markets, and nothing else. It does not look for short-term trading signals or aims to predict highs. The whole point of owning Bitcoin over the long-term is taking comfort in that the worst drawdowns will be avoided while capturing the upside from a unique, and spectacular asset.

There is no strategy that is more profitable than this.

Comments ()