Bubble Trouble; Dollar Surge Causes Global Mayhem

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 42

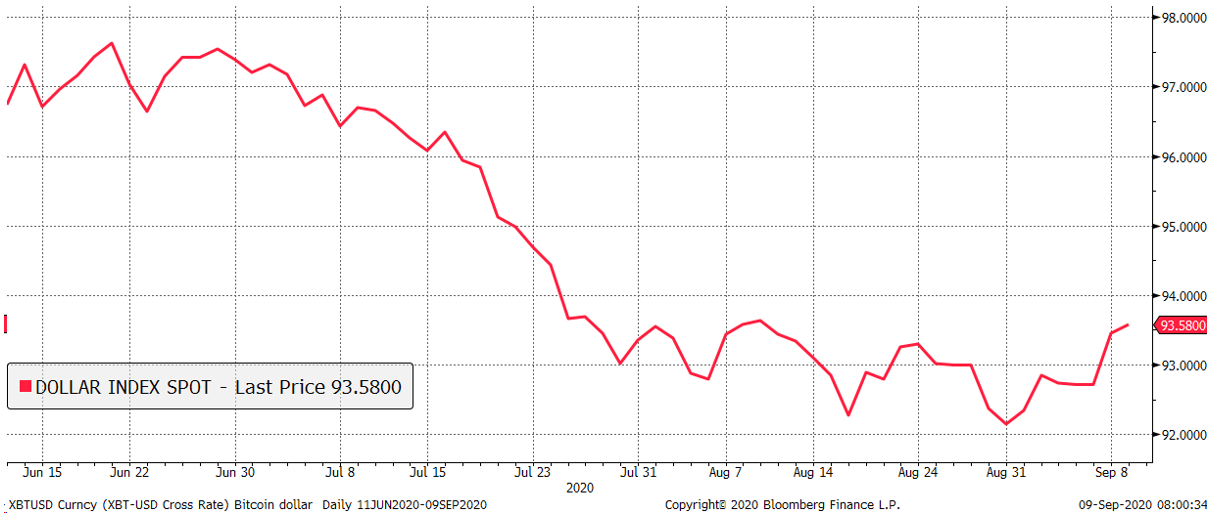

The dollar index has gone back to July levels, and guess what? So have asset prices. August is always a period of lower liquidity as people take their holidays. That means asset prices move around on low volume and aren’t always what they seem. It’s a notorious month because when the masters of the universe return to work in September, prices will move sharply, one way or the other.

Ove the past few trading days, the US dollar has rallied by 1.5%, which really isn’t much, but markets disagree. It means tightening, and to the markets, that’s Kryptonite. It kills them.

The 1.5% dollar surge causes global mayhem

If we invert the DXY so rising is falling, it correlates with most risk assets. Here I show it with Bitcoin. Not a perfect fit, but seems fairly close to post-March.

Bitcoin and the dollar

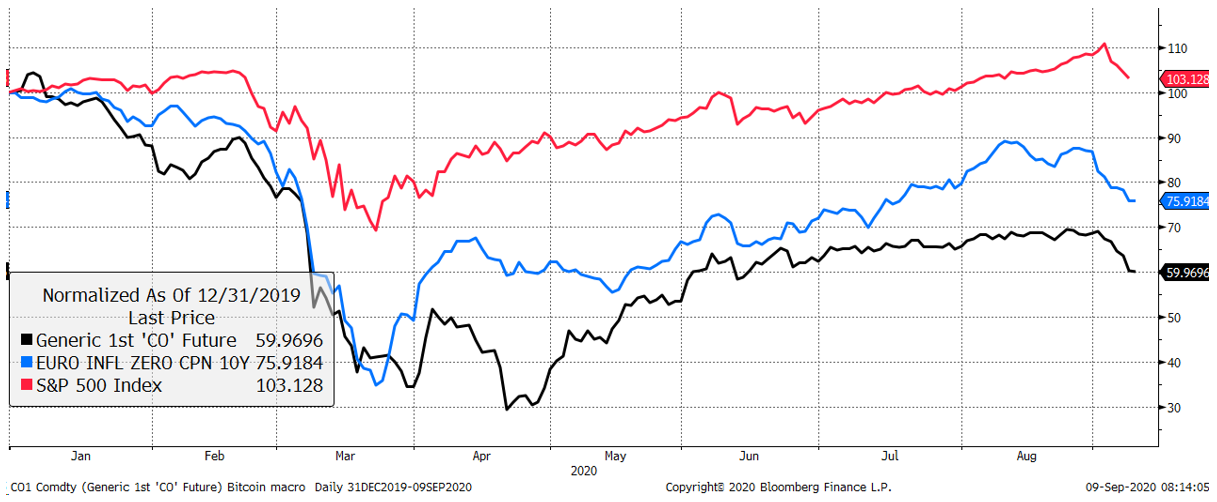

Just a small rally in the dollar has knocked Bitcoin for six. The good news is that Bitcoin still trades above the levels achieved in April and May. The key point is that Bitcoin is not alone. The oil price has taken a knock as lockdown measures tighten. Eurozone inflation expectations turned down sharply (the nearer term two year crashed), and the S&P 500 has defied gravity for the first time in a while.

The world takes a dip

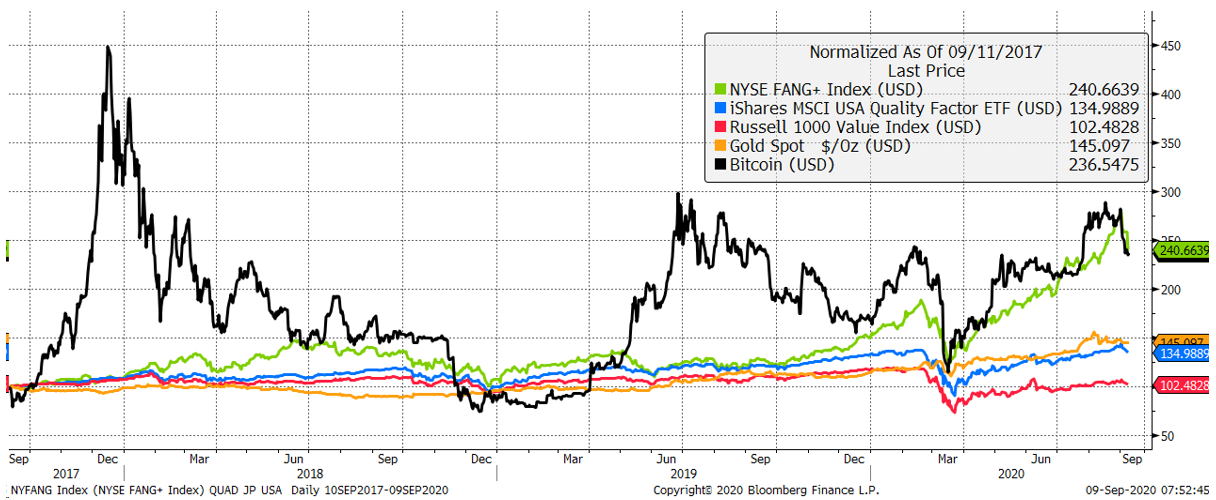

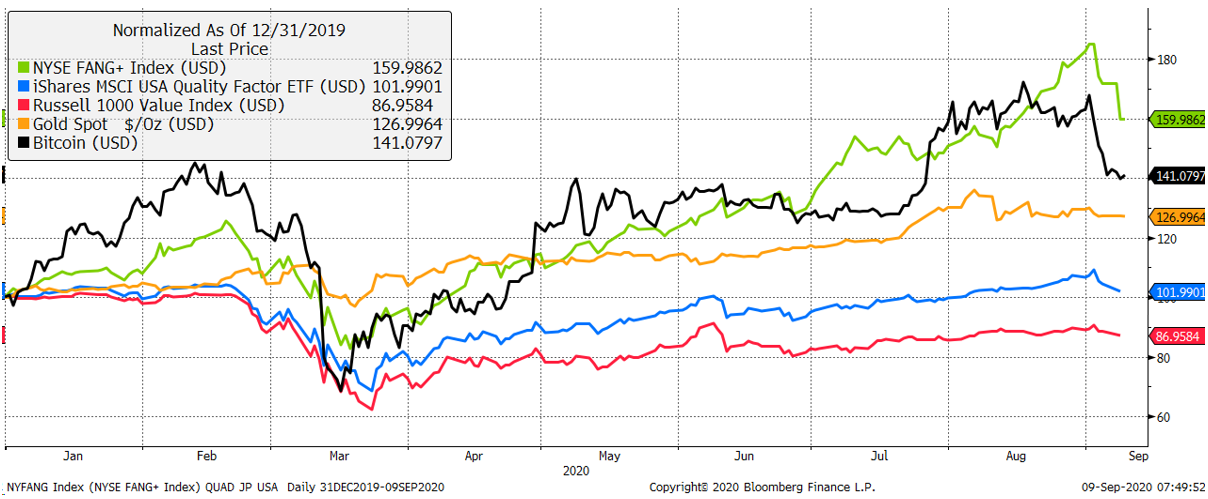

Bringing it back to the impact on asset prices, I will split the world of financial markets into just five items, which is basically all you need. There’s gold and Bitcoin, which are wonderful and fascinating. There’s the old economy represented by Russell Value Index (red), which you shouldn’t write off because the world economy is real and alive; it is not dying, but merely out of favour with market trends. Then there are quality stocks in blue. These make everyday essentials such as toothpaste and vodka. And finally, the fashionable FANGs; the stocks that can do no wrong.

The five FANGs are worth as much as Western Europe. They trade at valuations that will ensure investors lose money over the long-term, in contrast to the old economy which trades at prices where it is nearly impossible to lose money over the long-term. These are the five key assets that represent the world of finance and we’ll look at them over the past 3 years in steps.

Over three years, Bitcoin has seen its bubble burst, collapse and then settle down. The recent behaviour has seen it move more closely with mainstream asset prices. The bigger picture: it has done well over three years, despite a price collapse in 2018.

Over 3 years, Bitcoin has normalised

Three years is plenty of time for a price to settle down in a post-bubble environment. Over the past two years, Bitcoin trades in line with the old economy, quality, and gold. Those aren’t bubbles, or at least modest ones if they are. It is the FANGs that have surged to the moon. If it’s not clear, the FANGs are a bubble, and I would expect them to trade 70% below their recent high before this is over.

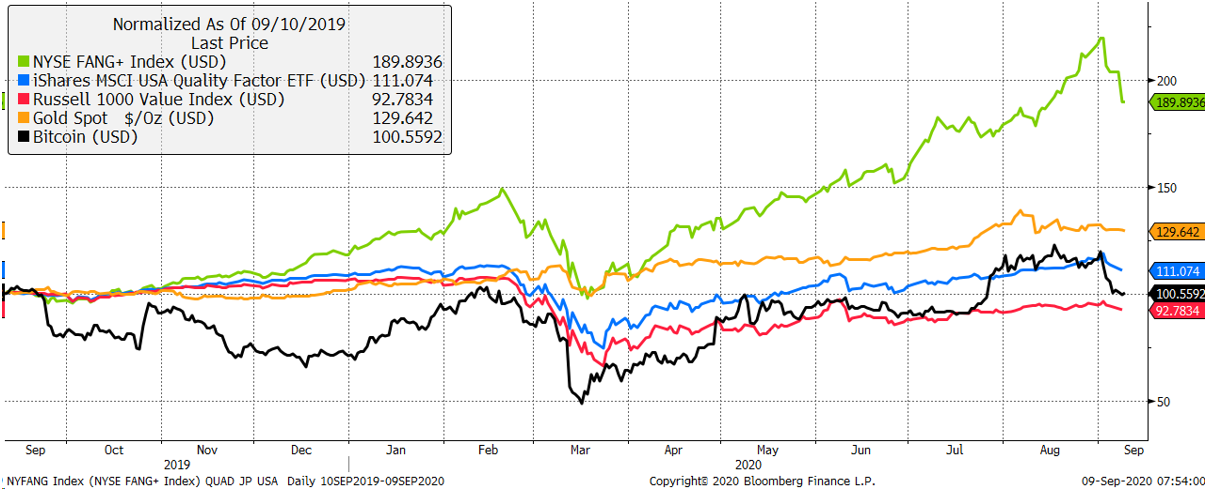

Over 2 years, it is the FANGs that are inflated

And finally, there’s this year. Bitcoin has taken the lead at times, and then passed it back to the FANGs. But after a modest correction, it is back in the pack, while the FANGs remain at lofty levels. The key point here is that Bitcoins trades close to fair value, while the FANGs are significantly overvalued.

This year, Bitcoin remains in a good place

In 2020, it is important to think macro, because external factors have been so influential. But recall that over the long term, it’s up to the asset to shine. At least 95% of Bitcoin’s appreciation has come from network growth. When you think of it like that, just get comfortable and let the storm pass.

Comments ()