Sell Tech, Buy Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 35

Looking back to last year, it is easy to see why some doubt the link between tech stocks and Bitcoin. Correlations can come and go, but Bitcoin always seems to drift back to mother tech.

Clearly, Bitcoin has significantly outperformed, but that has lessened since the 2017 peak. The match is becoming increasingly visible. As I keep saying, it shouldn’t come as a surprise that internet money behaves like internet stocks.

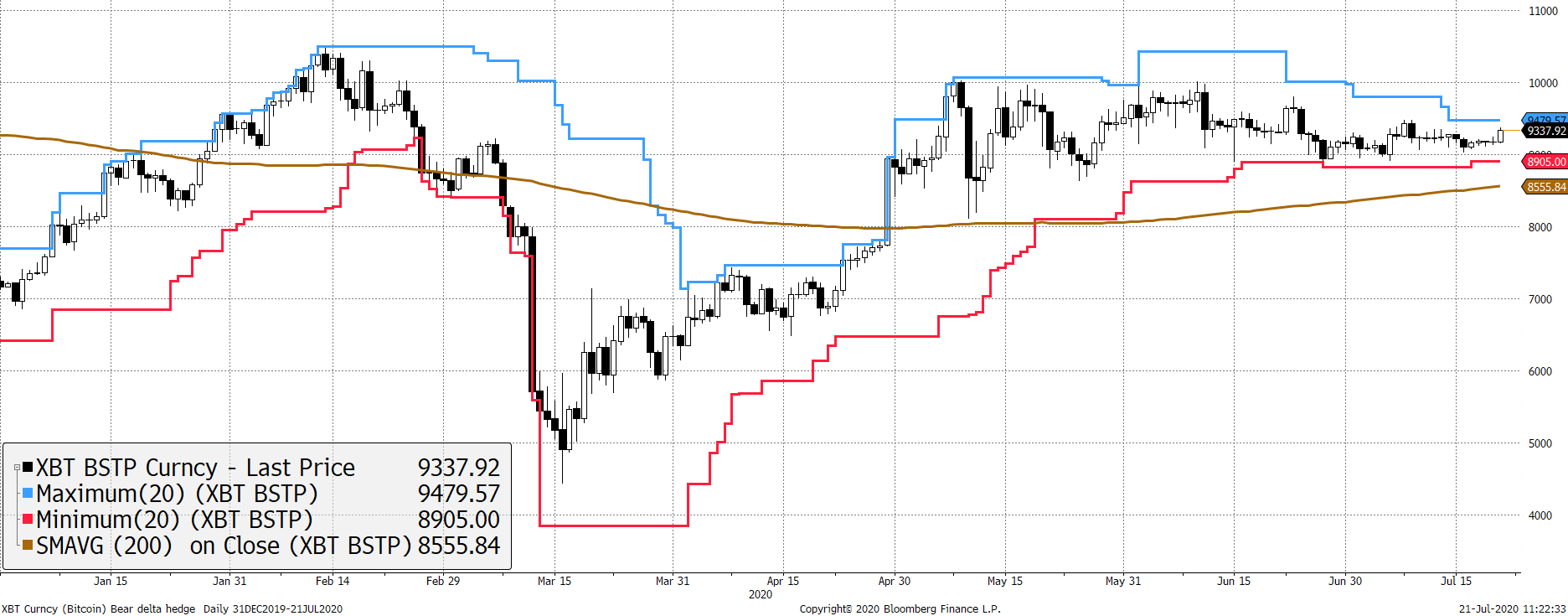

In a week where everything from silver to Brazil has broken higher, this morning’s Bitcoin $200 move, on ultra-low volatility, is somewhat disappointing. Fear not, as all is well. The hope is that Bitcoin picks up just as tech becomes exhausted. The 20-day range is now less than $500. This is extremely low by past standards.

A tight range

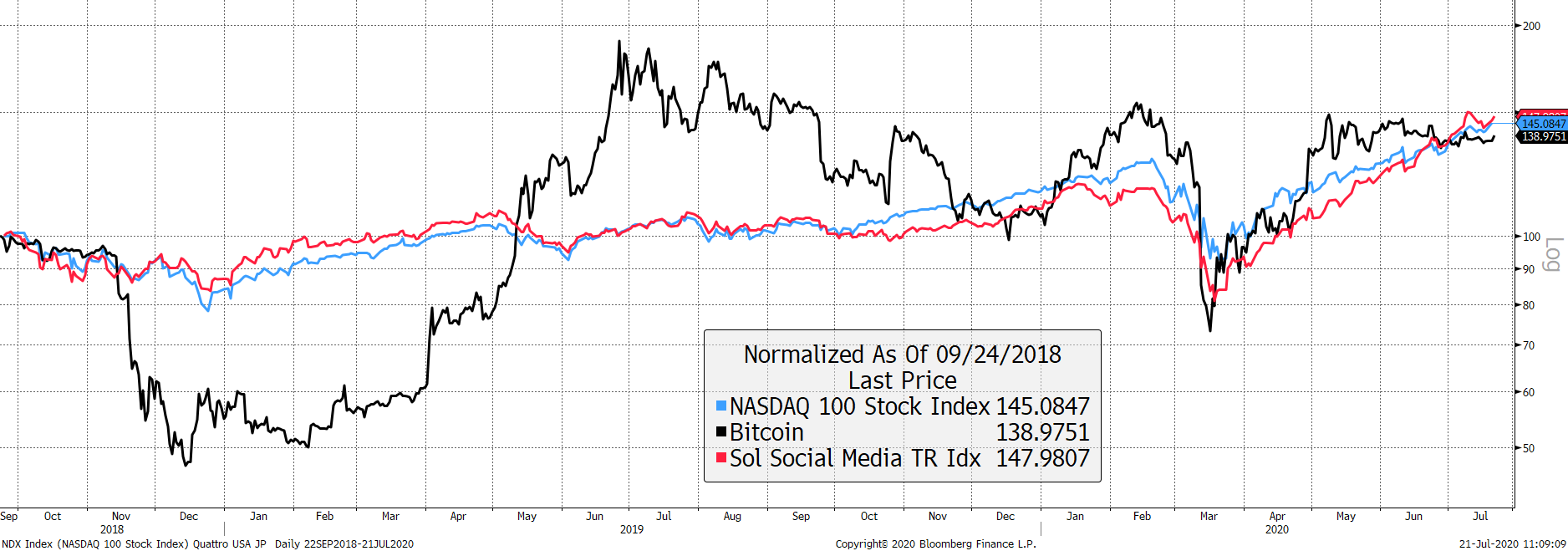

In the next chart, I compare Bitcoin to tech. When you look at this since September 2018, Bitcoin collapsed, recovered and then cooled, while seeing volatility cool over the period. Bitcoin and tech, whether it be the Nasdaq or social media, have returned approximately the same amount. The difference is that Bitcoin delivered too much too soon. With strong performance in late April and early May this year, tech has merely caught up.

Bitcoin matches tech

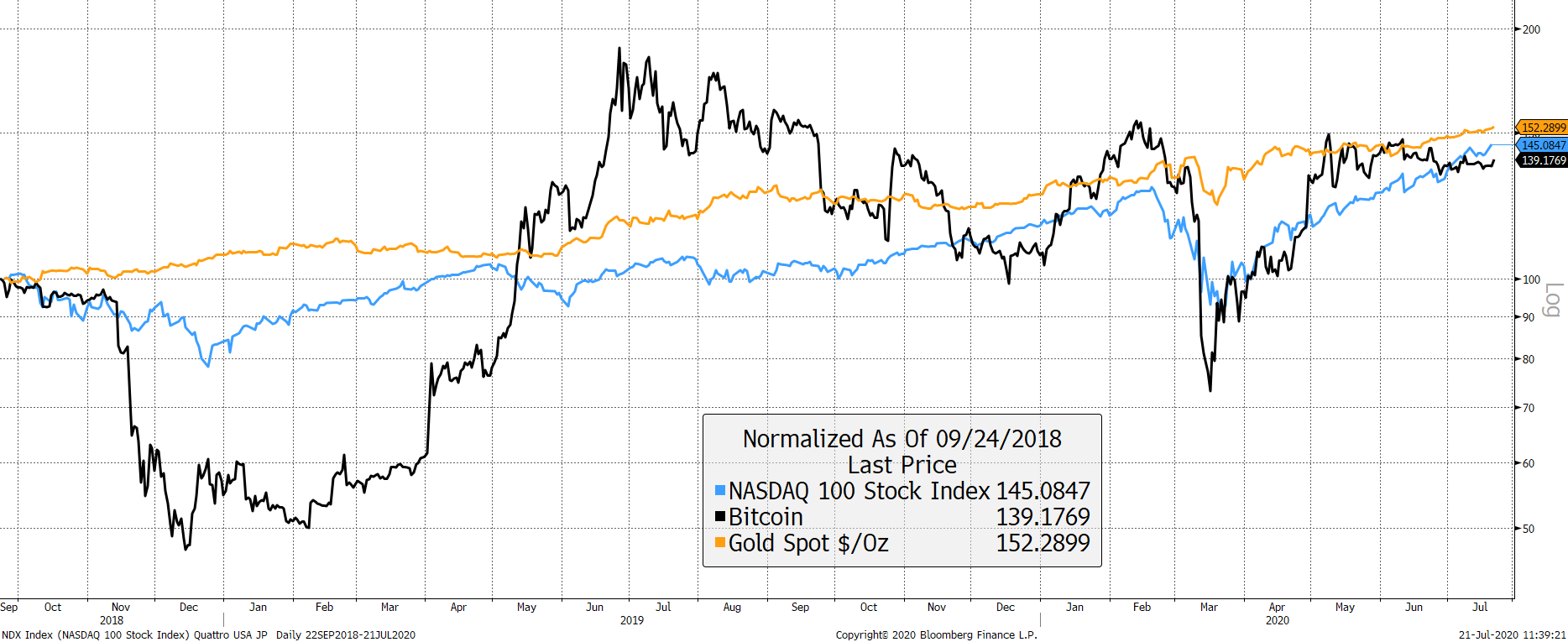

I chose my start date carefully, not to demonstrate a performance match with tech, but from the last period of calm when Bitcoin volatility was unusually low. It just so happens that there was a performance match. The Bitcoin collapse of November 2018 also coincided with peak US real interest rates (10-year yield less the expected rate of inflation). Tech also wobbled at the time, but to a lesser degree as falling real rates are supposed to be bad news for growth assets, yet good news for gold as seen in the next chart. Notice how gold and tech (Nasdaq) normally converge and then diverge. Again, similar returns are seen over the period.

Gold and growth deliver a balanced outcome

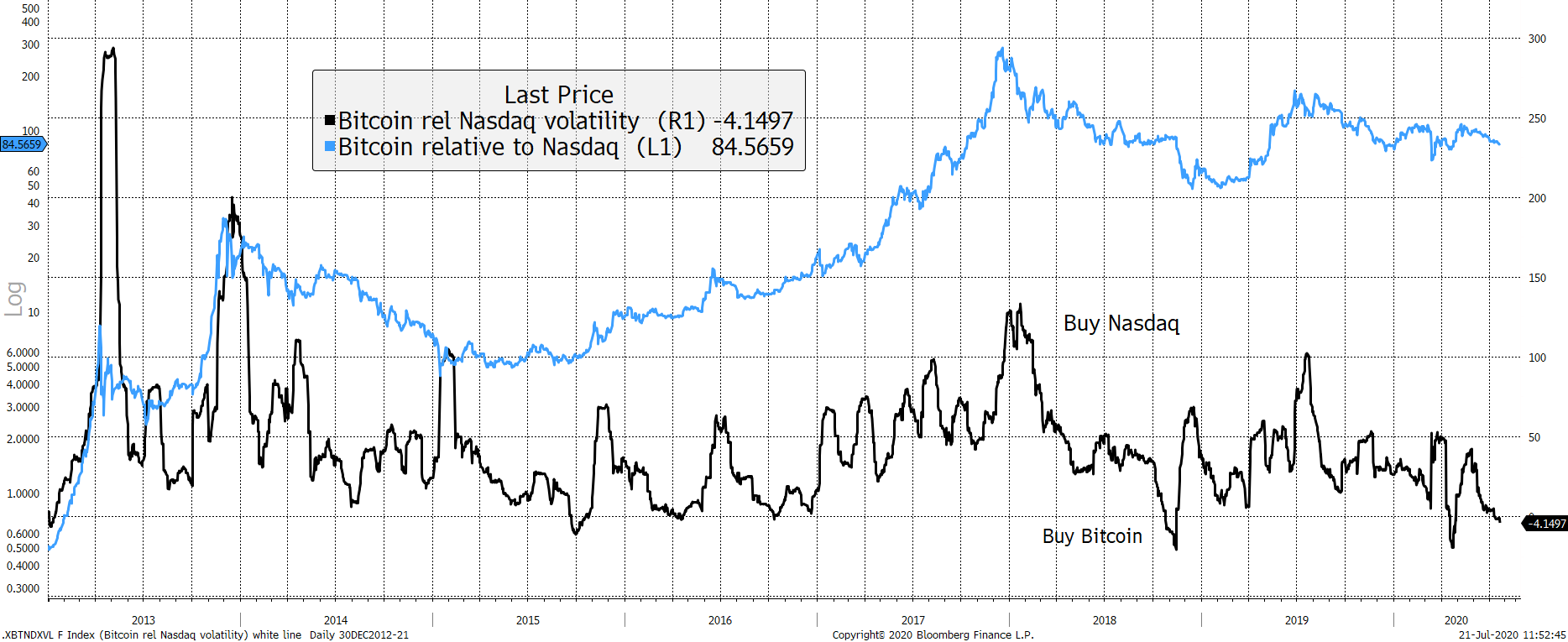

This comes across quite clearly, but the doubters will point to Bitcoin being something different. Yet the returns are a match and Bitcoin had its own dynamics to consider in late 2018, with a bust followed by a strong bear rally. Since then, Bitcoin’s volatility has cooled and is now below that of the Nasdaq. Loosely speaking, volatility is a measure of risk. Most of the time, but strictly speaking not all of the time, an asset is less risky when its volatility is low and vice versa.

Bitcoin beats tech when volatility has been low

To have sold Bitcoin when it had 100 volatility points more than the Nasdaq would have been a great trade, as would selling tech and buying Bitcoin whenever this relationship has fallen below zero. Even in November 2018, which would have a terrible trade in the short-term, Bitcoin soon marched ahead within 8 months. This thesis currently favours Bitcoin over tech.

My last point on this topic is that the bands are narrowing between tech and Bitcoin. I’ll re-show the blue line from above as it forms a wedge. In six months, the apex will be complete, and we will know once and for all whether Bitcoin is the great switch from tech, and decisively so.

Bitcoin consolidates with Nasdaq

Network Demand Health Model

With the latest score being 4 out of 6, there is no change since last week. The network is healthy. The one difference is that a short-term network indicator turned negative, while MRI turned positive. I am unconcerned by the short-term network decline as it merely tells us what we already know. The network is quiet and exchange volumes are low. That could turn on a dime.

Expect things to get interesting before too long.

ByteTree fundraise

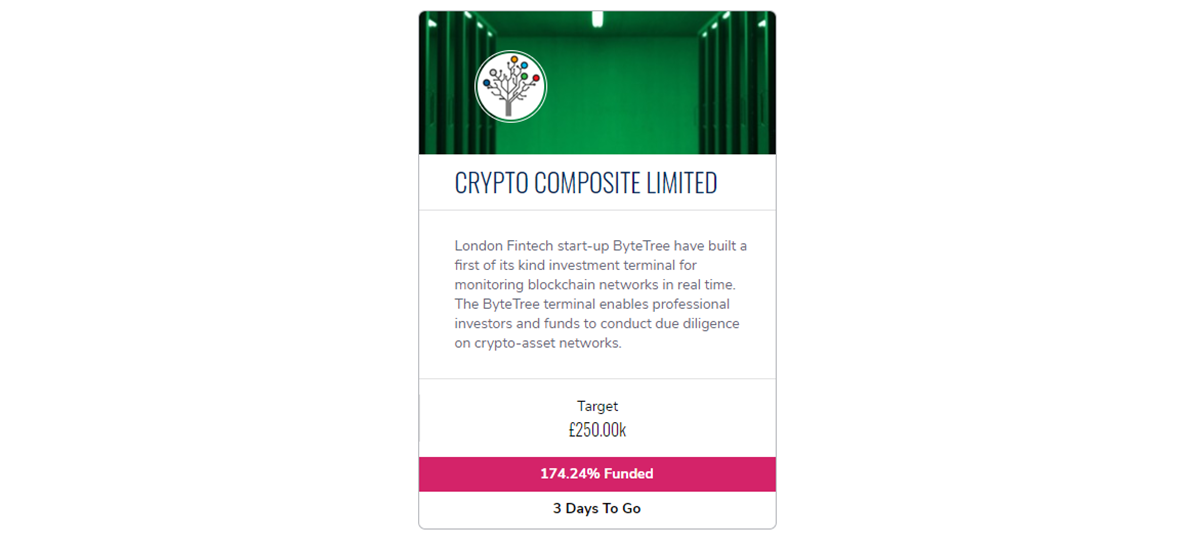

It’s an exciting week for ByteTree as the fundraise that will propel us to the forefront of the crypto industry is now 74% oversubscribed.

That will take the raise to £500k which will be spent on new coders to beef up the team, and funding for our soon to launch asset management operations. We have decided that a hard cap of 100% oversubscription is our limit, which means just £67k of allocation remains, with the round closing on Friday 24th July. Our accountants have confirmed that this round will be EIS eligible. Should you be interested in becoming a ByteTree (Crypto Composite Ltd) shareholder, please get in touch for further information. If you would like further details please email investors[at]bytetree.com.

Summary

The calm before the storm is a time to prepare yourself. The broader crypto market is in good shape, and the innovations keep on coming. Standard Chartered are building a custody platform, which will see them compete with Fidelity. The big boys are coming.