Bitcoin Needs to Beat the Stock Market

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 28

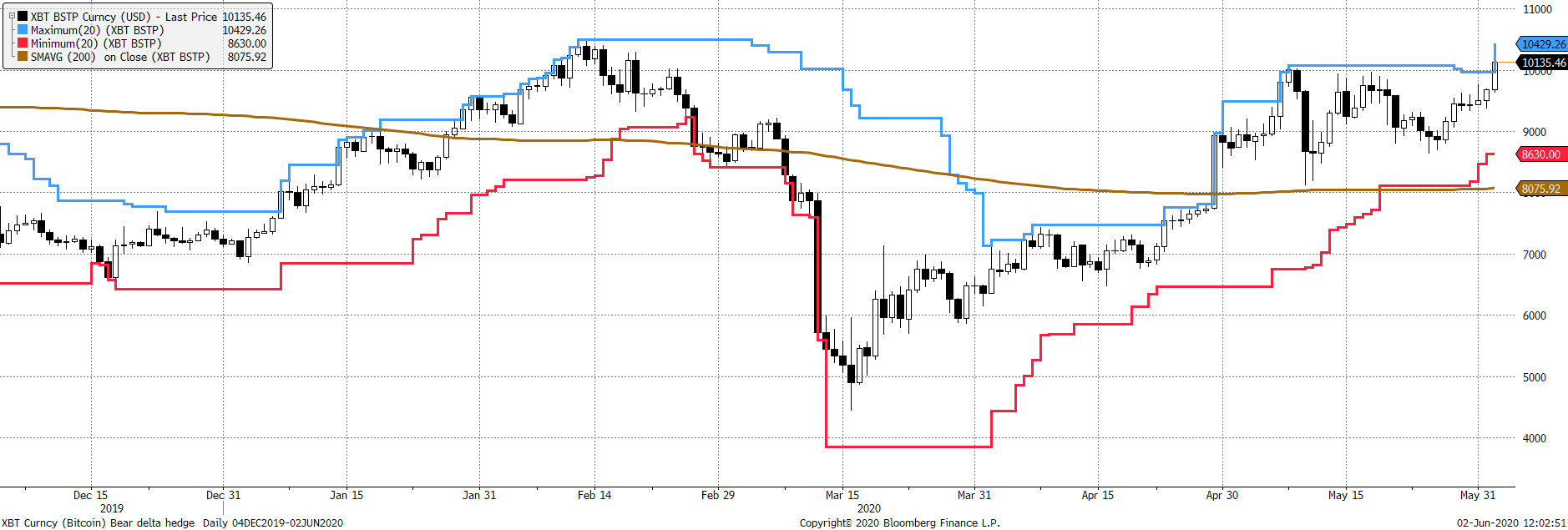

I love to hate stock to flow models, but when they cause a breakout, I’m not complaining. The trouble with $10,000 is that it has history, and the recent surge might need another push. But it’s best to be bullish when you see a new high, especially when the 200-day moving average turns positive.

Bitcoin Breakout

Looking at the bigger picture, there is still resistance at the downtrend that dates back to the 2017 bull market peak. There was a bold attempt to break above this red line before the COVID crisis, and it is having another attempt now. The recent break is positive, but $10k seems to attract sellers.

Bitcoin breaks the post-2017 downtrend line

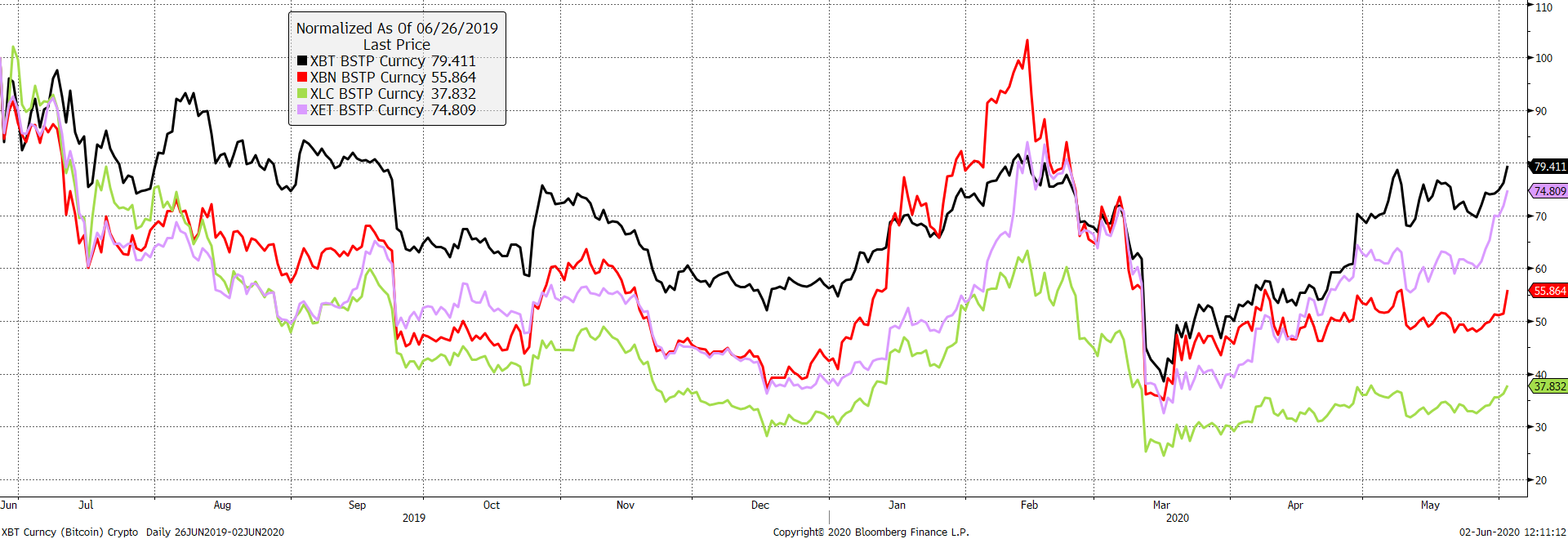

As the saying goes, when the wind picks up, even the turkeys fly. I wouldn’t say all altcoins are turkeys, but many are. This next chart starts at the price peak last summer. Bitcoin is 20% lower, but Ethereum is close behind. Bitcoin Cash isn’t doing badly, but Litecoin seems to be behaving like a turkey. Such a shame, as I’ve always been a fan.

Alt Rally

Crypto, or digital assets, are a highly correlated space, as you can clearly see. The best coins will always have the softest bear markets, and it is becoming clear that Ethereum wasn’t much worse on the COVID correction and is punching above its weight in the rally. With a network value around 15% of Bitcoin, there is the potential for a catch-up, but its network is smaller on the most important measures.

Based on the evidence, crypto valuation is all about the network. While Ethereum processes a large number of transactions, they tend to be small. It won’t catch up unless its network sees a surge in transaction value, which means either many more transactions or to attract a greater share of the larger ones. But this is a youthful space, and anything is possible in crypto.

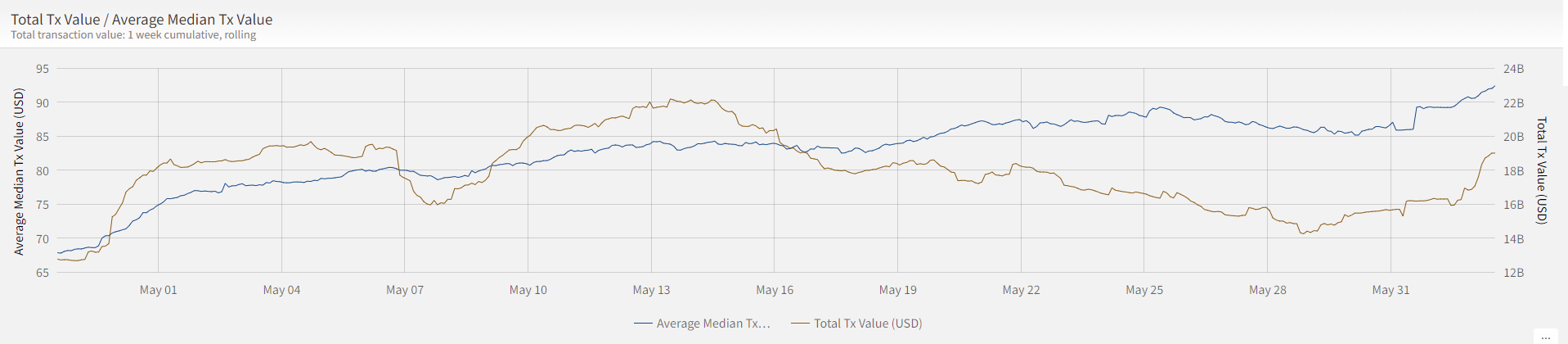

In the meantime, Bitcoin is heading back to $20 billion of network transfer each week. So long as this goes up, so will the price of Bitcoin.

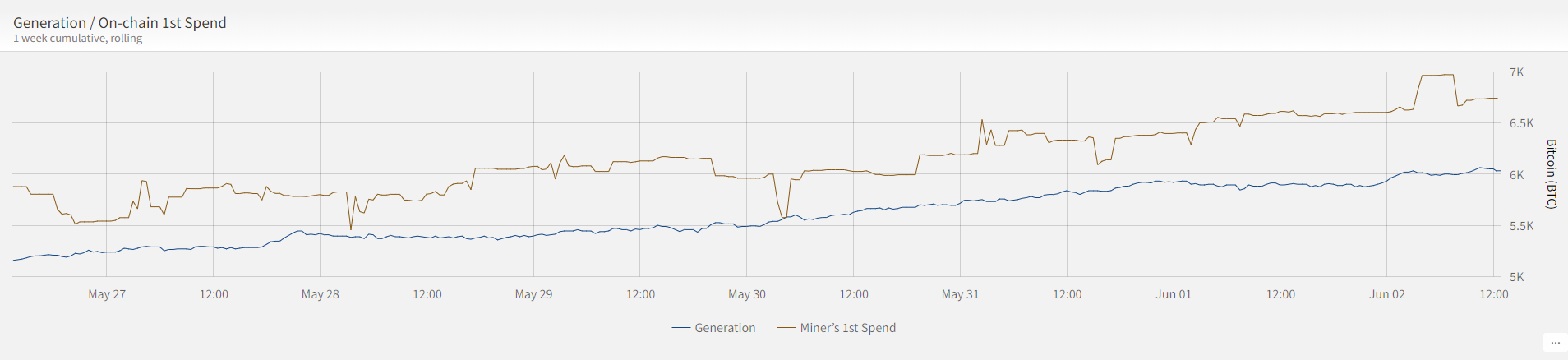

One piece of good news is that the miners are hard at work again, producing 6,000 new coins each week. Previously there were too few blocks, causing fees to surge, but this seems to be easing. $10 transaction fees are a turn-off and won’t go far in challenging the financial system, so anything that eases it should be seen as a positive. The miners continue to run down inventory, which is good because it implies the market bid is firm.

All in all, our network demand health score sits at 5 out of 6 which is bullish. If this strength continues, that will jump straight back to a 6 within days. The things to watch out for are weak velocity, which is uncomfortably close to 600%. Our fair value also sits at $7,000. Perhaps the breakout needs a call to action. And for that, Bitcoin needs to break higher against the exciting parts of the stock market.

Bitcoin needs to beat the stock market

Put into this context, Bitcoin desperately needs to break $10,000 just to keep up with the fun being had in the stock market. Everyone loves a rising price and that is the tried and tested way to catch Wall Street’s attention.

Breakout, please, Mr. Market.