Bitcoin; A New Buy Signal

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 32

Before I delve into why the Bitcoin network demand strategy has turned positive again, I wanted to address the market technicals.

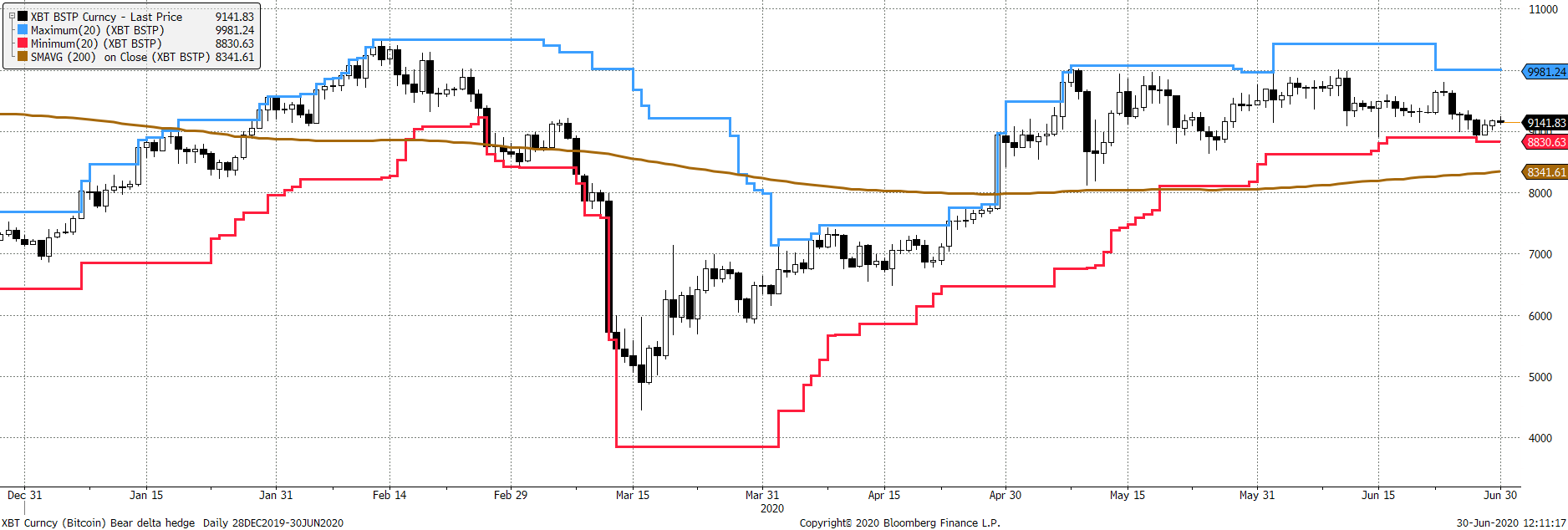

Having tried to break higher, the price has met resistance at $10,000 and has been consolidating since April. The market seems to be supported around $9,000, as can be seen by the red line. That line has been rising since March but managed its first 20 day low last Saturday. One day doesn’t make a trend, and so I am looking for longer term evidence. The 200-day moving average is positively sloping and the price is comfortably above it.

Bitcoin uptrend in tact.

If I were a teacher and had to grade the trend, I would give it a C+. An A grade would demand a new high above $10,500. A B grade would want to see a recent (and convincing) touch of the blue line, which hasn’t happened since early May. But anything with a rising 200-day moving average is a pass, so it must be at least a C. I have decided to award the recent Bitcoin trend a C+ because, on balance, it seems more likely to move up to a B than down to a D.

ByteTree isn’t about the technicals, it’s about the fundamentals, because technical are changeable, especially with volatile assets. Yet when they are both working together, the odds of success improve markedly. The trend is the most powerful marketing tool for an asset as it feeds on itself. What would cause a Bitcoin demand surge? An all-time high, and all the hype that would go with it.

Upgrade to buy

The last sell signal was generated on the 10th June 2020. Two of the models turned to sell, and the demand strategy dropped to a 2 out of 6 a week later. Yesterday, the model returned to a 4, which is bullish. Consolidations are often tricky periods because models are prone to noise. Strong markets are easy to identify, as are weak markets. It is the middle ground that is more complex.

The process that ByteTree has developed is essentially a risk management exercise. We are not interested in clipping short-term moves. Our objective is to identify risky periods whereby a significant price fall is possible. We are not looking for short-selling opportunities, merely to get out of the way and preserve capital until the network has time to re-establish itself. This recent buy signal suggests the risk has fallen over the past few weeks, but we are mindful that things can change. Take comfort that the network has been growing this year.

What we need to see is $20bn of weekly transaction value becoming the new floor. Short-term velocity is rising again, which is helpful. Hopefully, it will last.

Summary

A brief note this week, but a bullish one. Let’s hope a C+ is enough to win the next battle.