What is the Bitcoin Hashrate and How Does it Affect Halving?

Disclaimer: Your capital is at risk. This is not investment advice.

Bitcoin Halving Series

The Bitcoin Halving is scheduled to happen just seven days from now, on 12th May around 11:30am. However, the exact time and date of the halving is not fixed. The time of the halving will move based on the balance between network hashrate and difficulty. Let’s kick off by defining what those terms mean.

Hashrate: The hashrate is the total amount of computing power that is dedicated to solving Bitcoin’s proof-of-work problem at any given time. Higher hashrate = more compute power; lower hashrate = less compute power. When the network has reached a hashrate of 10 Th/s, it means it could make 10 trillion calculations per second.

Difficulty: This is a parameter that adjusts to keep the average time between blocks constant as the Network’s hashrate changes. More computation leads to higher difficulty. More on this shortly.

In a prior article we provided a brief summary of what the Bitcoin Halving is and assessed how different scenarios could affect the date that the Bitcoin Halving 2020 will occur. This involved a brief overview of the mechanism behind the way new coins are created. This article will dive deeper into that mechanism, looking at what is the hashrate and how does the difficulty adjustment work.

Hashrate leads difficulty

Hashrate is applied to the Bitcoin Network by miners who are trying to solve mathematical puzzles in return for bitcoin. Miners can be thought of as rational economic actors. They invest in mining hardware (fixed cost) and electricity (variable cost) to generate revenues.

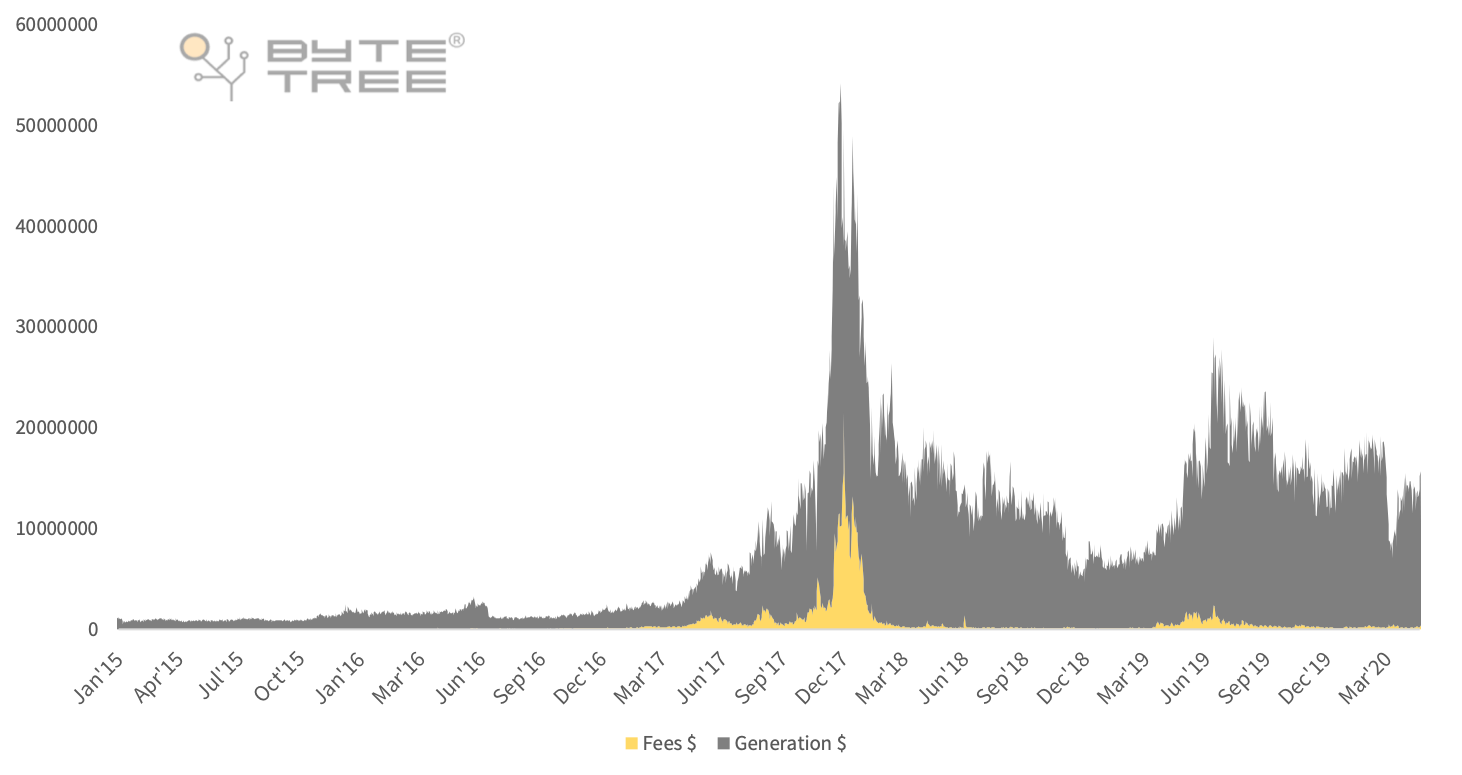

As rational economic actors, miners only operate if they are profitable or expect to be profitable in the future. Profit for miners is calculated as the difference between their total revenues and their total costs. Revenues, or at least a large percentage of them, are made up of the bitcoin earned by miners – known as the block reward or generation. If miners increase their hashrate, by investing in more equipment and/or electricity, they are able to increase the amount of bitcoin they earn in the short run.

Block rewards make up the majority of miner revenues

So, you might ask, can miners accelerate their revenues by increasing the amount of hashrate (the output of hardware and electricity) that they are committing to the network?

Simple answer: no, not in the long run.

The standard amount of time between new bitcoin being earned (generation) is 10 minutes. This is programmed into the core bitcoin code and cannot be altered.

If miners want to increase their revenues in the short run, they simply increase their hashrate, which increases their chance of earning the new bitcoin. We can observe this either through tracking the hashrate or even better, tracking the rate at which new bitcoin are created. If blocks (which deliver new bitcoin) arrive in less than 10-minute intervals, the hashrate is increasing. If they arrive in more than 10-minute intervals, the hashrate is falling.

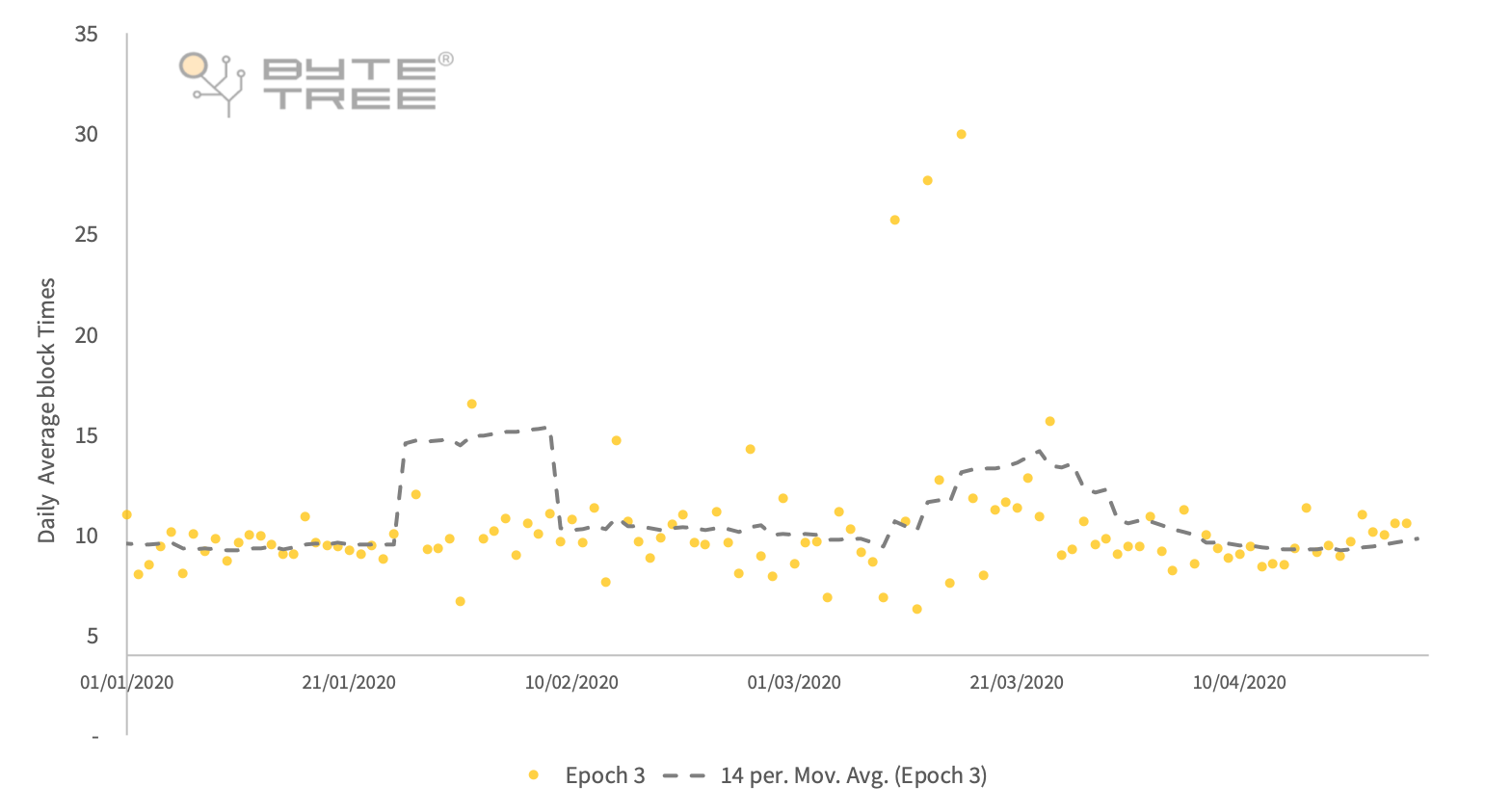

Block times in 2020 have ranged

The chart above shows that block times in 2020 have varied between 80 and 5 minutes, but trend towards 10 minutes. The next question is, how does the network continually readjust to keep block rewards evenly spaced out, i.e. trending towards 10 minutes?

That is where the network difficulty level comes in. Difficulty responds to hashrate in order to ensure that revenues are distributed at a steady rate over time.

The difficulty level is continually reset by the network every 2,016 blocks. It is the dynamic control that keeps new bitcoin being released to the miners as earnings every 10 minutes. If bitcoins are being earned in less than 10 minutes, the problem miners solve becomes more difficult. If it takes more than 10 minutes, the problem miners solve becomes easier.

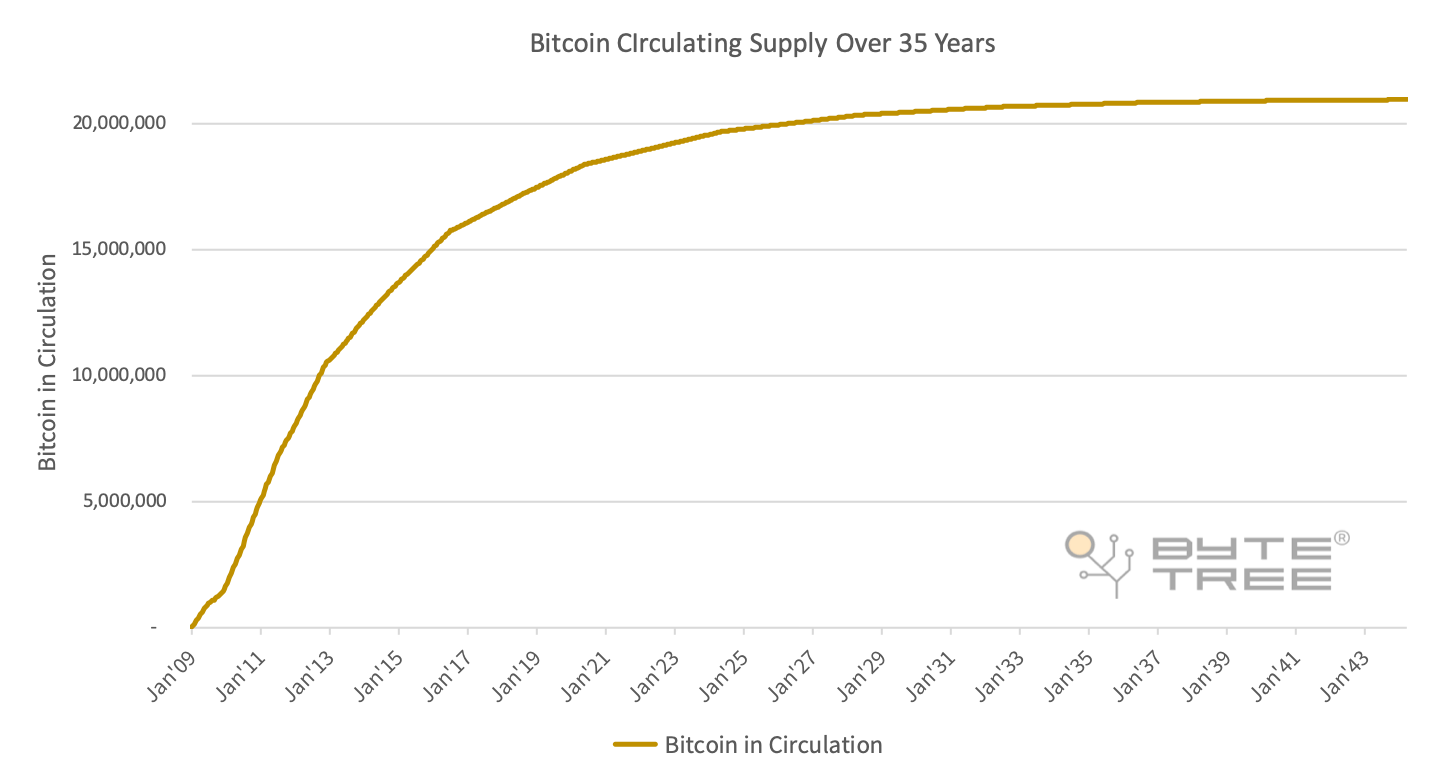

This dynamic control inhibits miners’ ability to increase their revenue much past the pre-designed constraints coded into the network and ensures that the remaining 2.4 million bitcoin will continue to be awarded to miners every 10 minutes over the next 2130 years!

How does hashrate and difficulty affect halving?

Now that we understand the relationship between Miners, the Hashrate and the Difficulty, it’s time to look at how this affects the Bitcoin Halving.

In a previous article, we showed how the time and date of the halving can be estimated based on the rate that miners are being rewarded new coins. However, recall that this rate can change depending on how hard they are working. Put another way, the halving occurs every 210,000 blocks and the rate of work defines how quickly or slowly that miners can get through those 210,000 blocks.

If miners are pushing to increase their revenues, new blocks arrive faster and this means we reach the halving sooner. The best way to know when the halving is? Track it live on the ByteTree terminal!

Comments ()