The Week Before Halving

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 24

Last week, the network demand score was a healthy 4 out of 6. That blasted to 6 out of 6 over the weekend before settling down to 5/6 today.

It is hardly surprising that the network is heating up ahead of the Blockchain Olympics, which only comes around once every four years. Many people believe that having doubles the price of bitcoin, so there is maximum interest ahead of such an exciting prospect. ByteTree data picks up on the network. If that comes courtesy of halving, then so be it. The one model that has turned against us is the Miners Rolling Inventory (MRI).

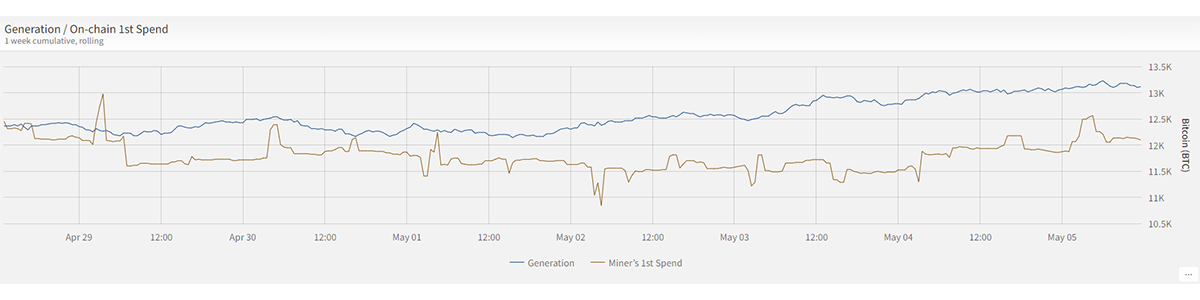

The miners have hoarded 1,067 Bitcoins over the past week, as they have sold (or distributed) less than what they have mined. We normally see this as bearish because it implies a soft bid in the market. With a recent price surge, clearly this hasn’t been the case, and so we can only assume that the miners also think higher prices are coming post-halving. I hope they are right.

Hoarding ahead of halving

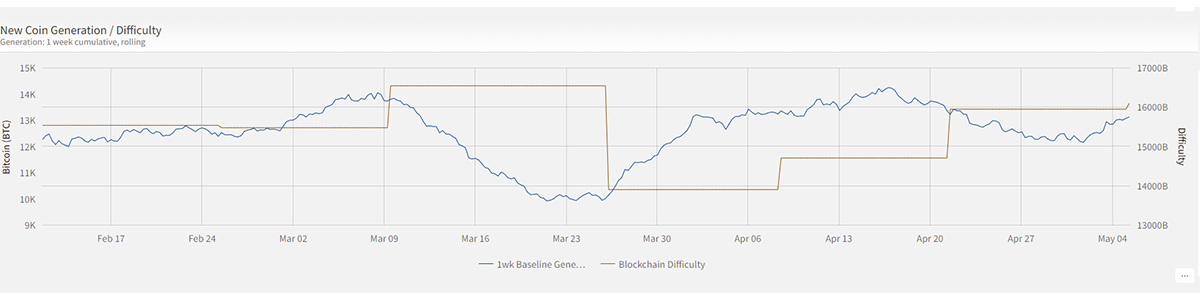

Many things have been somewhat crazy over the past week on the blockchain. It was looking like difficulty would drop as generation cooled, but then it turned up at the last minute. As a result, difficulty has managed a minor uptick yesterday. Flushing out the weaker miners perhaps?

The network speeds up again

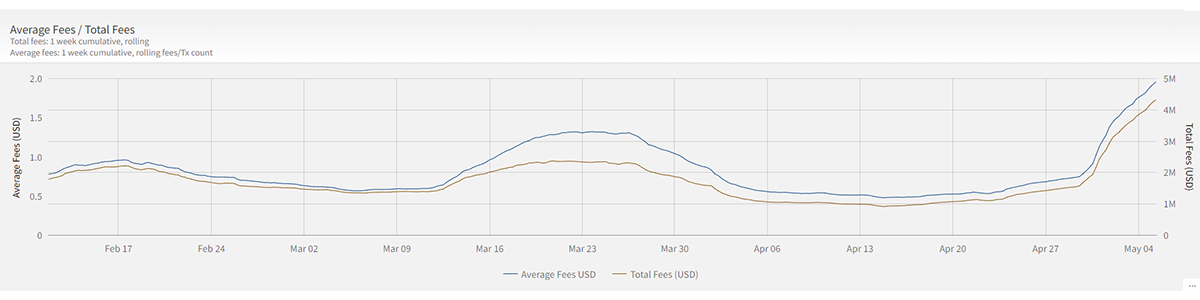

But nothing compares to the surge in network fees. Only a couple of weeks ago, I was complaining that they had dropped below $1 million per week. That has subsequently surged above $4 million.

Boom time

It’s a reminder that when the number of transactions rises too far, the cost of transacting rises with it. The positive is that high fees reflect network interest, and that is good for the Bitcoin price. The negative is that small transactions will dry up. Halving means the Bitcoin network rewards the miners with 6,300 BTC per week plus fees, in contrast to 12,600 BTC per week today. With their income slashed, it may well be the case that fee income needs to remain high, and not just in the short-term. This will mean only higher value transactions will survive, which is no bad thing as small transactions don’t need to live on the Bitcoin network. Bitcoin sits at the top of the crypto food chain, and everything comes back to that. The small stuff can find a home elsewhere.

Halving happens on the 630,000th block, which is expected to arrive at around 06:00 UST on Tuesday 12th May. Please join us for our halving show on Monday evening UST - you watch the full stream on our Youtube channel.