Bitcoin Network Demand Under Pressure

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 22

You’ll notice on the ByteTree Terminal that the 5-week transaction value $ and 5-week fees $ are declining.

Flip to “Featured Charts” and you can see them change block by block. I suggest you set the time to a quarter. They move up and down, as you’d expect, but the bottom line is that for Bitcoin to become more valuable, the network needs to grow, and these lines need to be rising.

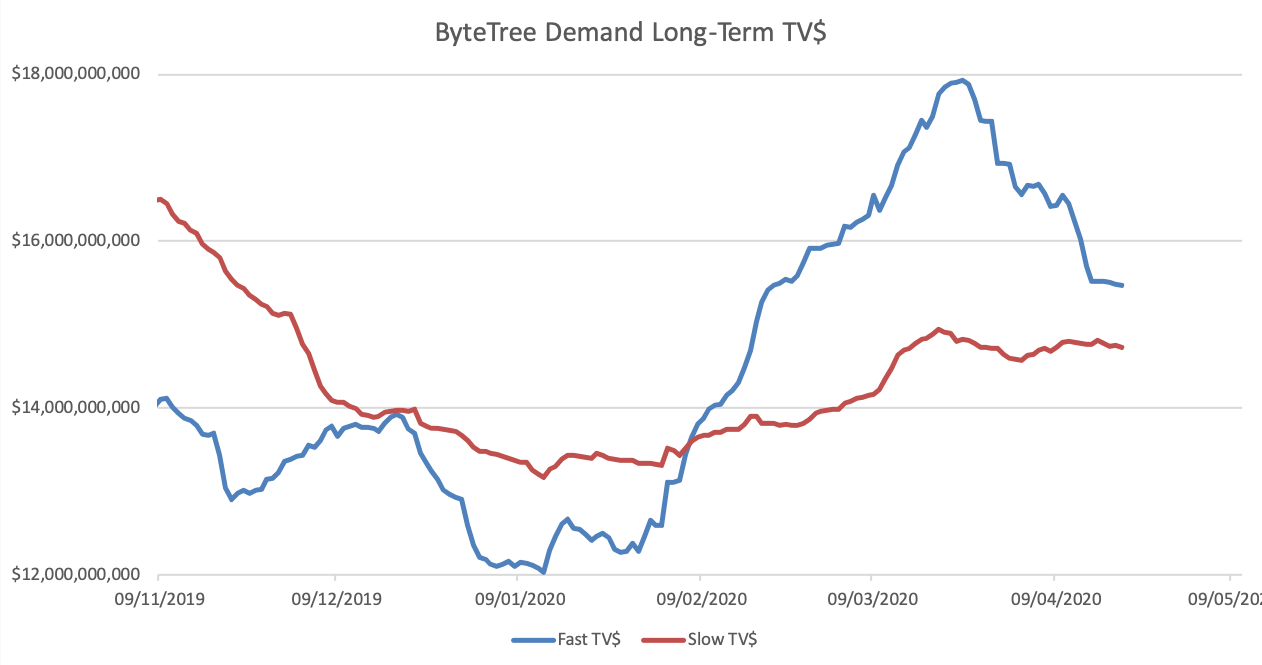

The Network Demand Strategy uses four different measures and this week, I want to focus on TV$ and Fees $ because they are both under pressure. Among other inputs, our investment strategy uses moving average crossovers to identify a change in trend. In identifying the best time frames to use we have tested thousands of different combinations, all of which are available in Tableau, and have selected both short-term and long-term signals for both TV$ and Fees $.

In the chart above, when the blue line is above the red line the score is 1, and 0 when it is below. This simple model remained cautious in late 2019, only to turn bullish in February, just as most people in the space had started to give up. It remains bullish for the time being and will flick back to 0 soon if TV$ doesn’t pick up.

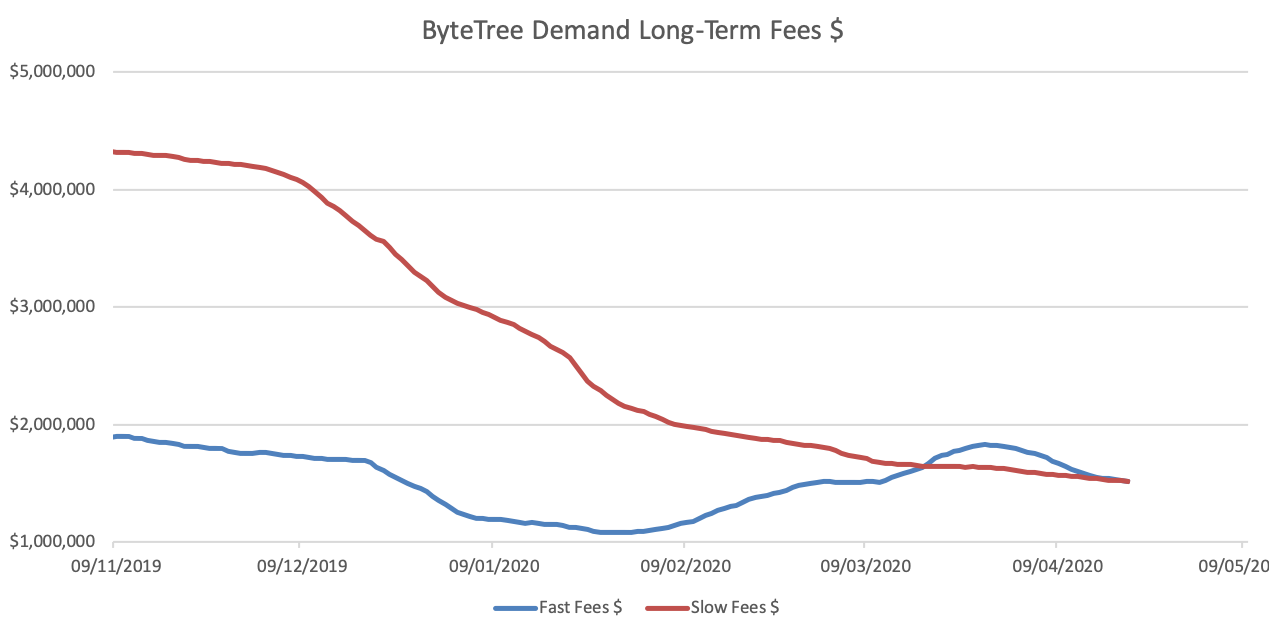

Next, I’ll move onto Long-Term Fees $.

This one also turned bullish after the COVID price collapse, and remains positive, but only just. The faster signal generated from the blue line is just $3,000 above the slower red line and converging fast. It is likely that this signal moves to a zero in the coming days (possibly today!).

Looking at the overall picture, the current Network Demand is 4 out of 6. Two of our indicators, Velocity and Miners’ Rolling Inventory (MRI) are positive. The models above are also positive but close to turning down. The other two shorter-term TV$ and Fee$ models turned down some time ago.

A score of 4, 5 and 6 means own bitcoin. A score of 0, 1 or 2 means don’t. We see a 3 as mixed and go 50/50 Bitcoin / cash. We are currently showing a 4. A 3 is imminent, and a 2 will only be averted if the network picks up.

If halving created value, I’d be excited. I fear the opposite. Too many people believe it will double their money. When it doesn’t, they’ll throw in the towel. In my opinion, the next bull market will begin once the halving tourists have left the space and found new ways to lose money. Oil wouldn’t be a bad place for them to start.