Internet Money Behaves Like Internet Stocks

As a result of the virus, financial markets have crashed, and it should come as no surprise that Bitcoin has been caught in the storm. The scale of the crash is on par with 1987 and the 2008 credit crisis. The crash has been swift and brutal, and there has been nowhere to hide.

Being a virtual asset, many believe bitcoin should be detached from the real world, and perhaps they are right to think so. But you can’t escape that Bitcoin’s owners come from the real world, and there lies the link. If they start to panic about asset prices, they sell everything – the good, the bad and the ugly. We should not make excuses why the likes of Bitcoin, and indeed gold, have fallen in recent days. We should simply accept that they are assets, and asset prices have fallen across the board.

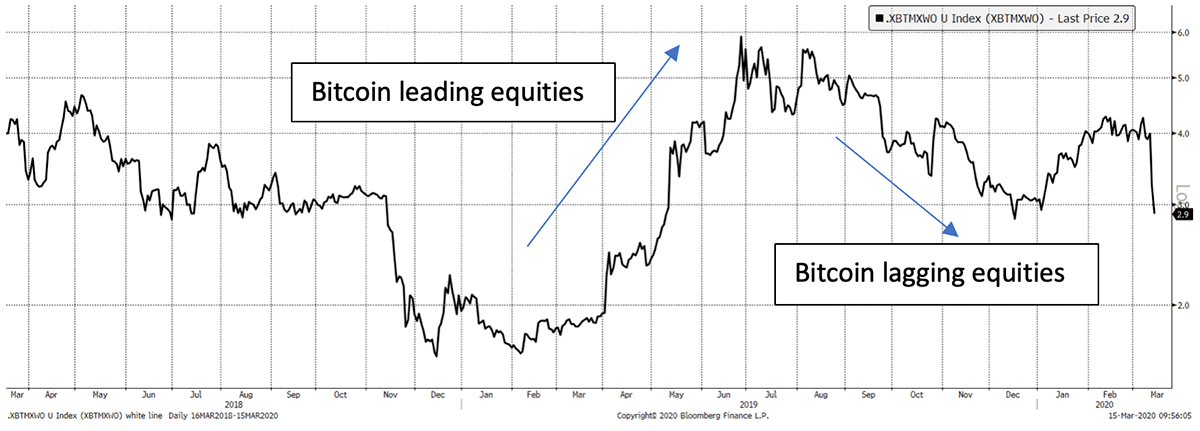

As I write, Bitcoin is down 26% this year, which is about the same as Asian equities, 10% better than European equities, and 10% worse than US equities. The puzzling thing is that Chinese equities are still in positive territory this year - strange but true. Looking at Bitcoin relative to global equities, it has under performed over the past week, having outperformed before that. It is back to the December low, and trading close to the average level over the past two years.

Bitcoin Is Behaving Rationally Versus Global Equities

The point is that Bitcoin is no worse than equities, which is a very good thing. Had it been down more than oil, European banks or cruise ships, then there would be a real problem. Take some comfort that Bitcoin has been relatively resilient during a period of extreme stress. Moreover, unlike cruise ships, it could recover quickly.

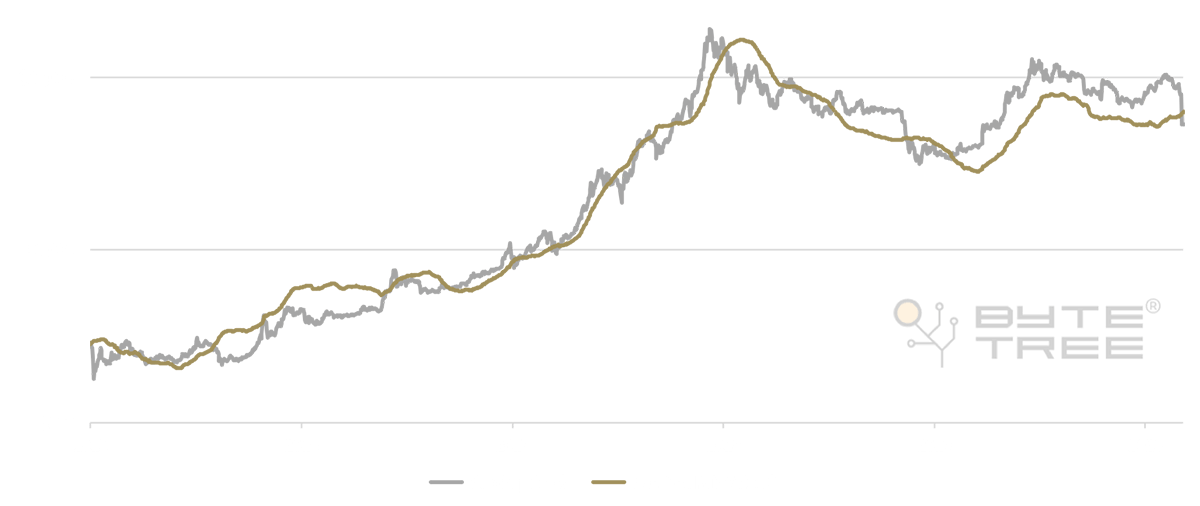

ByteTree was built to analyse the Bitcoin Network. Back in 2014, I linked total blockchain spend (transaction value $) to the price of bitcoin; an indicator we used to call network to spend ratio, or NSR. As the industry has grown, that has become known as NVT or Network Value Transaction (which doesn’t exactly roll off the tongue, but there it is). ByteTree’s NVT is recommended over 12 weeks, and currently gives a bitcoin fair value of $6,600 when the price is $5,500. In my opinion, Bitcoin has been overvalued in recent months and has fallen to a point that is slightly below fair value. In fact, as you can see on the chart, bitcoin has always reverted back to fair value. It is somewhat surprising that it has remained at a premium for over a year.

Bitcoin Price Vs. Fair Value ($)

There is no stronger link for modelling the price of Bitcoin than the network effect. Forget the number of users or the noise on social media, what matters is that bitcoin is doing what it was designed to do – transfer value. This year, around $15 billion has changed hands each week, and a staggering $24 billion last week. That is what creates value, and for what it’s worth, the fair value trend is rising. I suspect the premium is down to “halving hype”; something I do not believe will materially influence price, but many people do.

I have always said that Bitcoin has more in common with tech stocks, or more specifically internet or social media stocks, and so it has proved to be. After all, why should it surprise anyone that internet money correlates with internet stocks? The consensus a few weeks ago was that tech was a bubble and the real world was a bargain. But the world has just changed. COVID-19 makes us realise that we need the Internet like never before. The Internet is no longer just a disruptive technology that finds a better way to get things done, it is essential.

Just as the Internet will come out of this much stronger, so will Bitcoin. More people will question the financial system and look for alternatives. The Bitcoin ecosystem will continue to grow, and new applications will thrive. An asset that can withstand a shock of this magnitude will emerge with more respect.

Bitcoin used to have 90% corrections: much worse that general asset prices. In those days, it was regarded as a rarely used asset, that was highly speculative but with potential. Whenever the music stopped, liquidity dried up and the price collapsed. Things have changed. As we have just seen, the corrections are much smaller than they were, the market remains liquid and its value is underpinned by a vibrant network.

2020 is going be a tough year. Some people will die, and many more will lose their livelihoods. We mustn’t underestimate the scale of the problems that the world faces. But we should remember that humankind has faced many threats over the years and has always come out stronger. In my humble opinion, we’ll overcome this virus, and Bitcoin will thrive.

Stay safe.