Bitcoin in 2019

Disclaimer: Your capital is at risk. This is not investment advice.

A Year in Ten Charts

Bitcoin began the year with a decisive recovery from the 2018 bear market cycle. An investor that bought the bottom of the market in Jan’19 would have returned in excess of 200% by July.

This short and sharp recovery brought us to a peak price just shy of $13k before subsequently tracing back to the $7k mark. Total ROI for the year was +94%, with 30-day annualised volatility ranging between 17% to 107%.

The bitcoin price equation is a complex beast, one that this report won’t tackle in its entirety. We do however focus on the biggest piece of the pricing puzzle – Network Demand. We highlight the relationships between key demand-side metrics and bitcoin’s 2019 performance.

2019 in 10 charts

1. $100 Invested in Jan’19 was worth $194 by Dec’19, +94% over the year

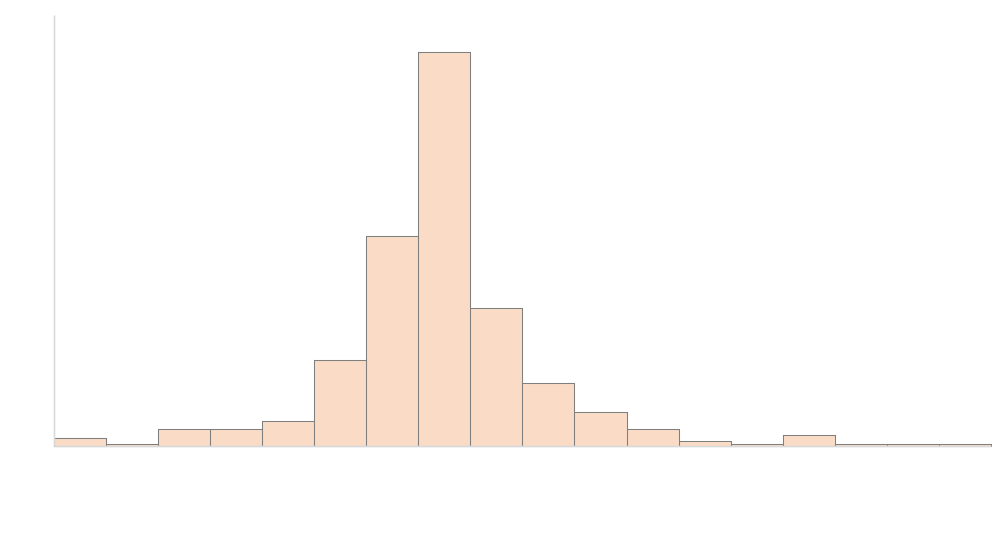

2. An investment in bitcoin generated >1% in daily returns over 29% of days in 2019

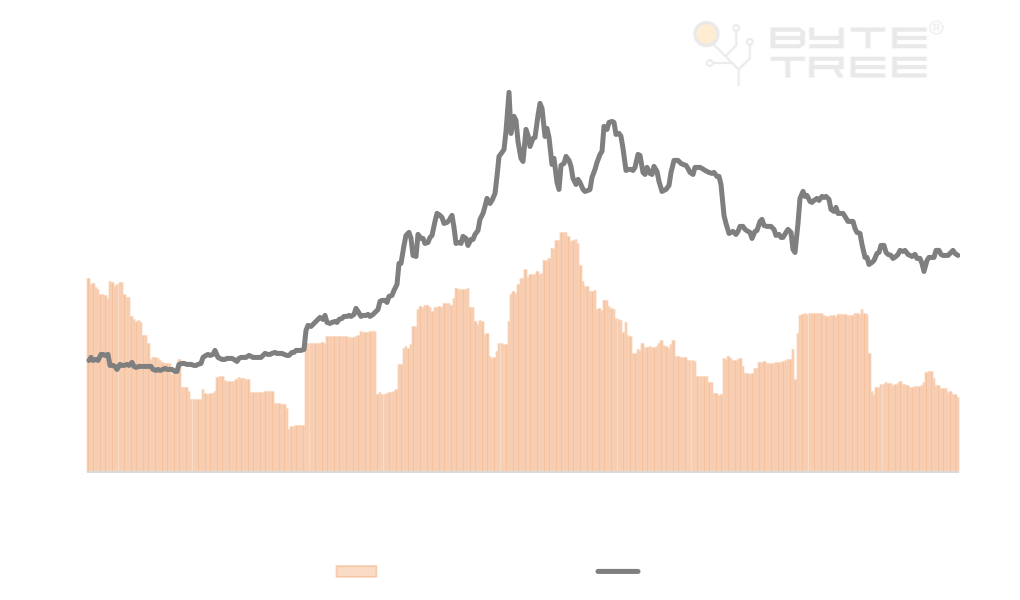

3. Bitcoin’s economic output hit a yearly high in July, while the number of transactions fell steadily

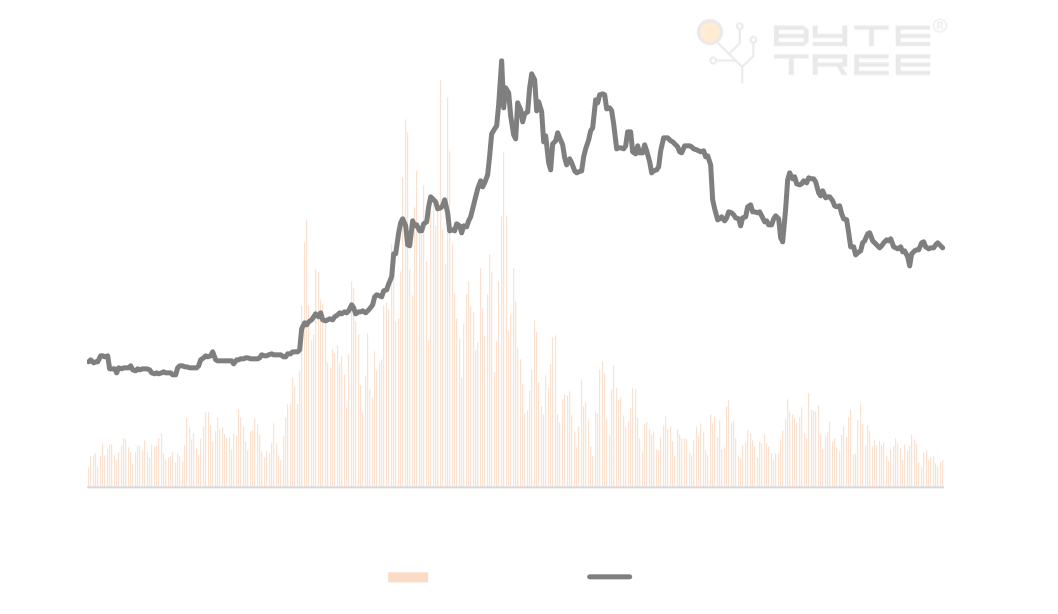

4. The volume of bitcoin being spent dropped in July, driving network velocity to a low of 460%

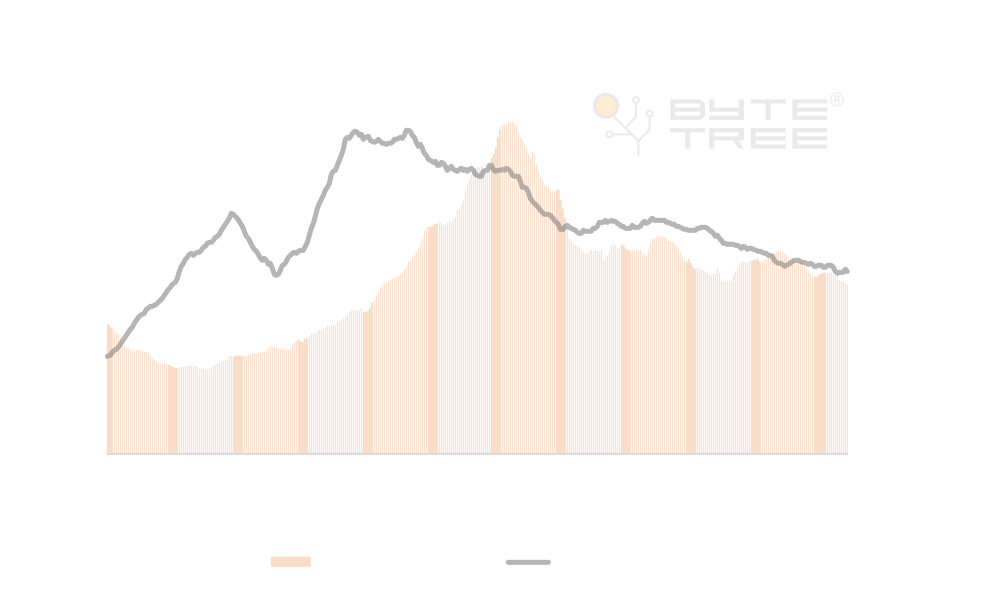

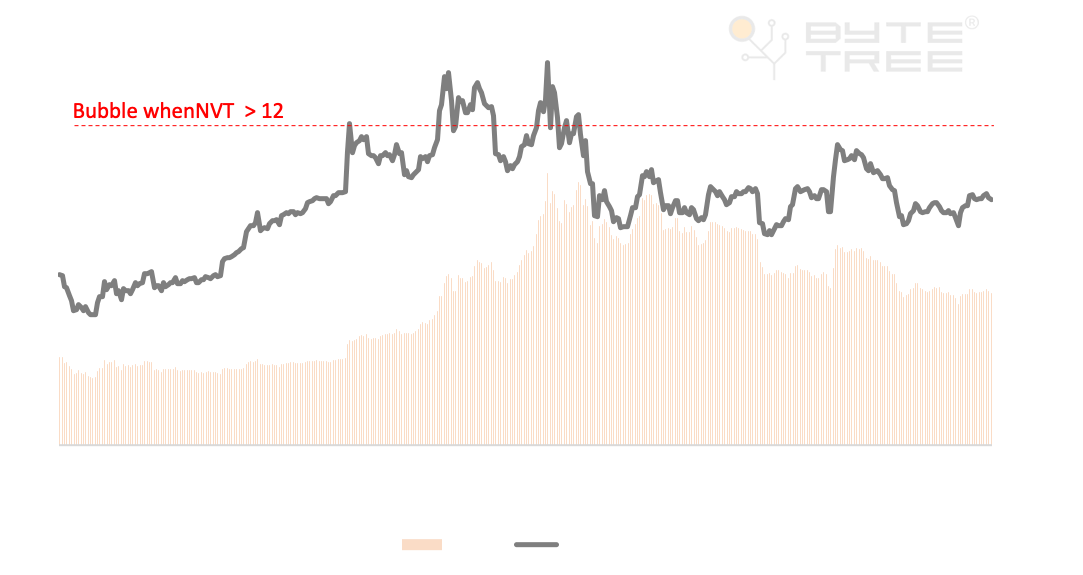

5. Bitcoin entered into a “bubble” in late May as the network value to transaction ratio exceeded 12

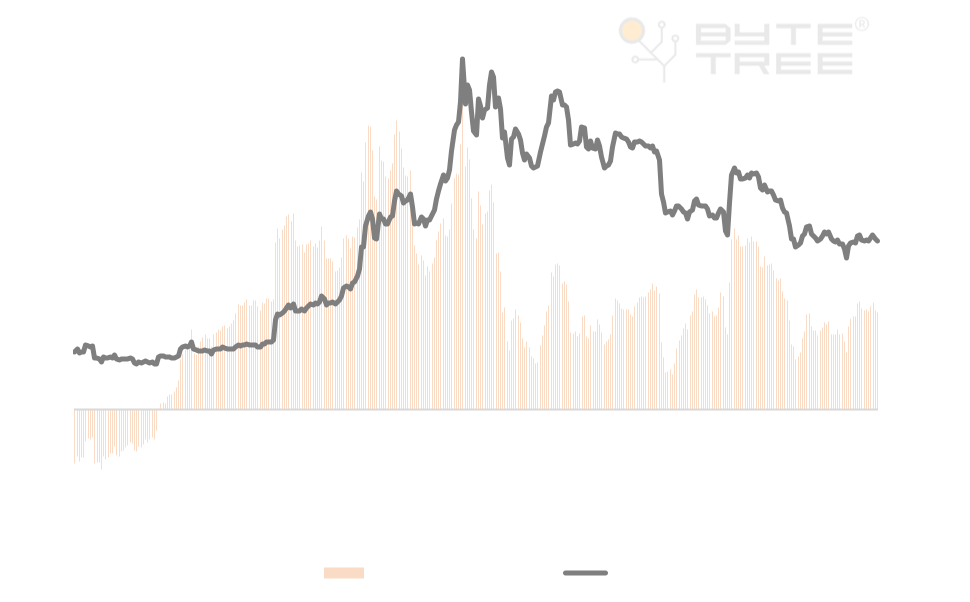

6. Bitcoin traded at a premium to its fair value from march, peaking at +100% premium in July

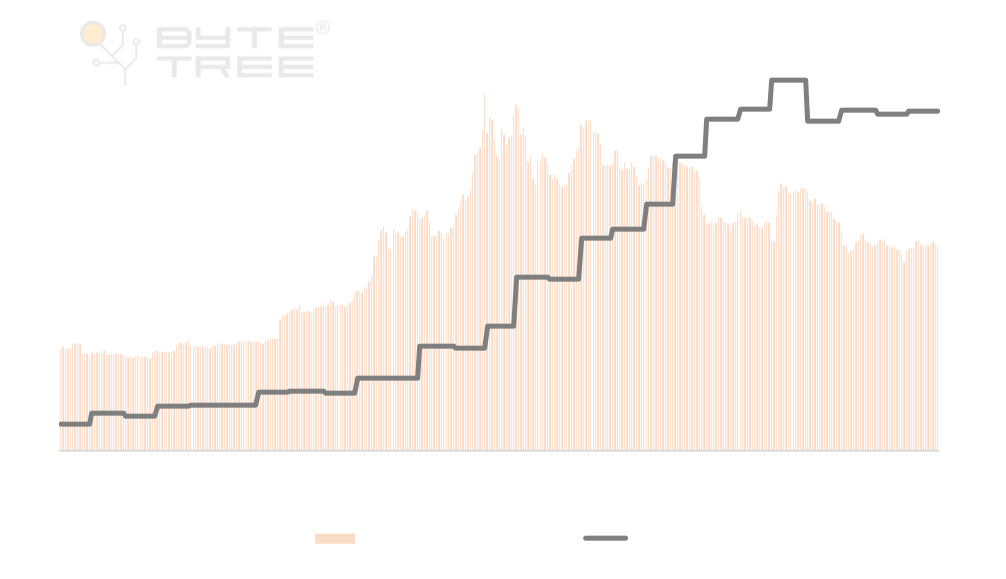

7. Miners increased their efforts to mint bitcoin until Nov, pushing difficulty to all-time-highs

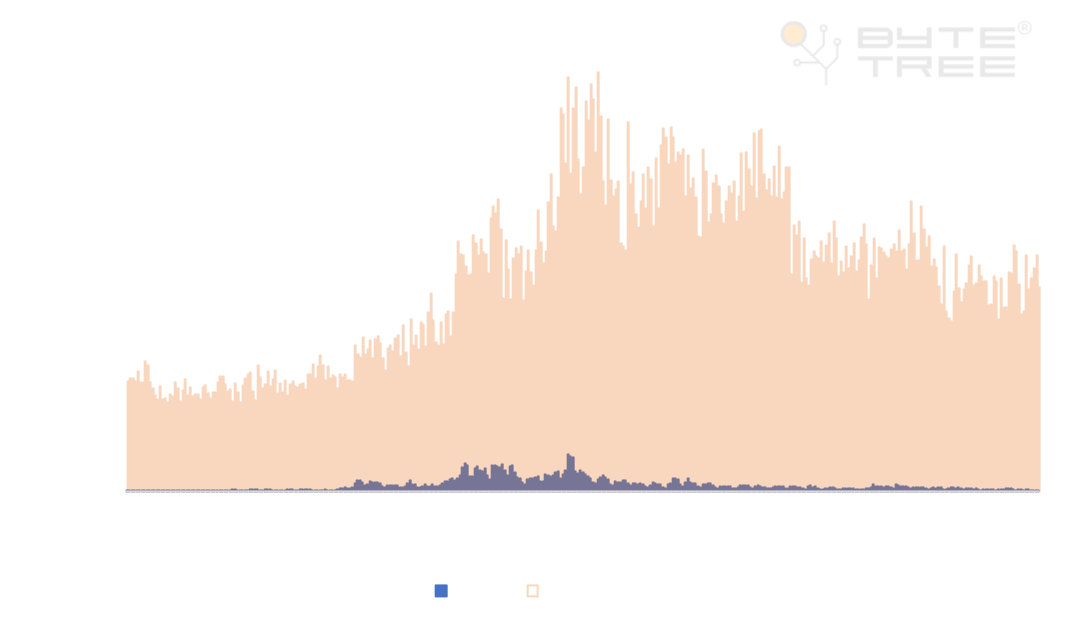

8. Miner revenues were dominated by block rewards ($ Generation rather than fees) through 2019

9. Fee income as a % of total revenues increased periodically through later stages of the bull run

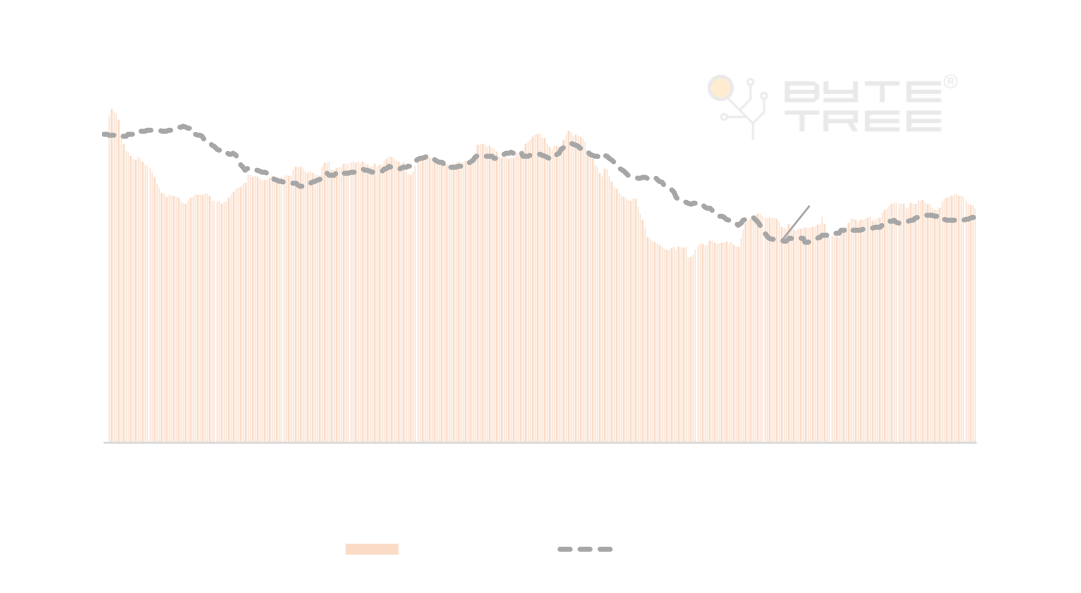

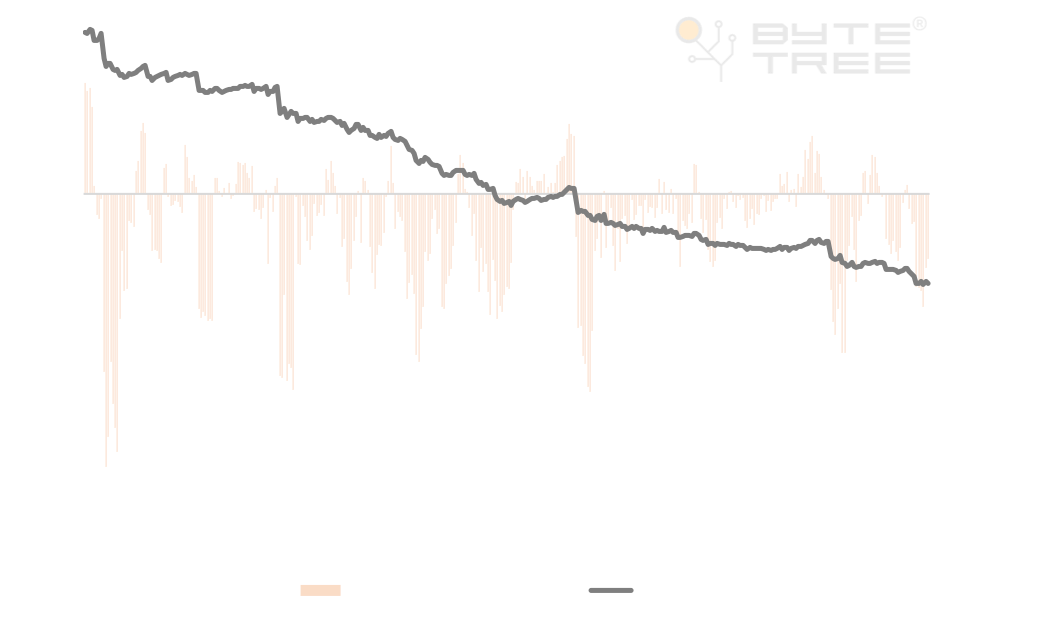

10. Miners continued to offload their inventory throughout the year as profit margins squeezed

Summary

Bitcoin showed signs of real recovery in 2019 following the year long bear market of 2018. Investors that opened new positions at the start of the year would have generated close to 100% ROI, outperforming every other asset class. Speculative investors looking for shorter term gains and willing to take the risks had ample opportunities through 2019, with one day gains reaching up to +16% and 30-day annualised volatility breaking through 100% in the second quarter.

Overall network fundamentals increase marginally versus 2018 but remain down versus the bull market of 2017. Network usage made little gains versus last year, despite a surge of activity during the mid-year bull run. Miners spent the year offloading their inventories, one suspects this is related to squeezed profit margins. Total mining power dedicated to the network broke multiple new highs up until Q4’19. Miners are capitalising on the 12.5BTC block reward prior to the halving, scheduled for 12th May 2020.

Comments ()