BTC, BCH, or BSV: Which Is Better as a Peer to Peer Electronic Cash System?

Disclaimer: Your capital is at risk. This is not investment advice.

This is the final part of a trilogy about visualising bitcoin’s economic output.

I would suggest reading Part I and Part II to set the context. In this piece we compare the transaction value heat maps of BTC, BCH and BSV to bring more clarity to the question of which network is currently the closest to a peer to peer electronic cash system.

Often, the simplest way to settle an argument is with raw data. In this post we analyse network traffic from three of the most popular bitcoin forks. We evaluate the payment utility of the respective networks by looking at network traffic alone. No bias, just data.

A little background

The Bitcoin Network was launched in 2009 as a peer to peer electronic cash system. The goal? To decentralise an internet-based system of monetary exchange. As network usage increased, the limited capacity of the block-based system was challenged. With new blocks created just 6 times per hour, and a capacity of around 3k transactions per block, the throughput of the network was limited to 18k transactions per hour or 5 TPS. Rival factions, claiming a superior grasp of Nakamoto’s concept, altered components of Bitcoin’s protocol in order to increase transaction throughput, claiming the title as the one true electronic cash system. Notable challengers included Litecoin, Bitcoin Cash and Bitcoin Cash SV, which approached the problem through a combination of faster block times (Litecoin blocks are created 24 times per hour) and the introduction of larger blocks (Bitcoin SV blocks can be up to 20mb versus bitcoin’s 2MB). Each time a challenger reared its head there was significant disturbance among the crypto communities – once true believers of Bitcoin began to question the ground on which their beliefs were built.

Bitcoin’s challengers took increasingly more public positions as they staked their claim to the electronic cash throne. Their claims to being cheaper, faster paymentnetworks were heard far and wide across the subreddit channels. To their credit, they have delivered on the technologic updates they set out to do. Litecoin blocks are added to their native chain 4x faster than bitcoin, bitcoin cash can pack more than twice as many transactions per block and the cost of sending a transaction on bitcoin SV is on average 0.06% of the price of sending via bitcoin.

So what’s the cash?

As we identified in a previous blog, on convenience of payments alone (i.e. cost, speed and price volatility), bitcoin is not top of the list. However, a payment network and the currency that runs on it requires more than just convenience. Security, reliability and decentralization are key tenets of a sustainable electronic cash solution. Tenets that bitcoin dwarfs its competitors on. As one goes further down the rabbit hole it becomes apparent that bitcoin blocks are intentionally slower and smaller by design. They come as part of a necessary trade-off with security and decentralization (see the scalability trilemma). Regardless of which “brand” of bitcoin you like best, security and decentralization are intrinsic to the long-term integrity of any solution.

So, Bitcoin is not the fastest or cheapest network for peer-to-peer payments, but it does have the highest security and decentralisation.

But what do the USERS prioritise for a peer to peer electronic cash system? The speed and cost of transacting or the security and decentralization of the network? To answer this question, we turned to the raw data.

Which network is being used the most to transfer cash-like payments?

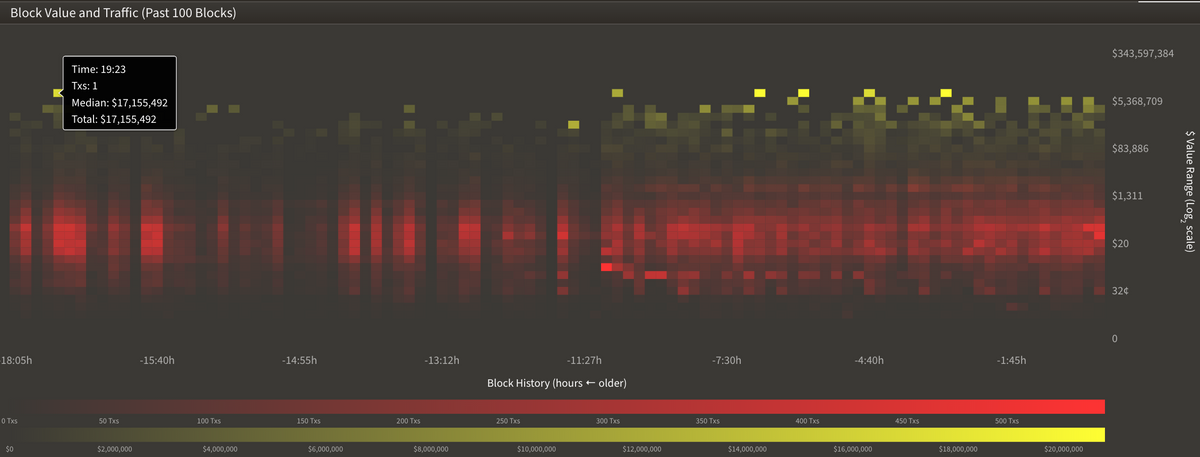

Bitcoin

As detailed in part II of this series, the heatmap for bitcoin shows a high level of activity within the retail payments space. That is transactions valued between $10 to $100. On average we see around 1k transactions within this range in each bitcoin block. Bitcoin has the most active network across the value spectrum, as can be seen by the dispersion of red and yellow blocks below.

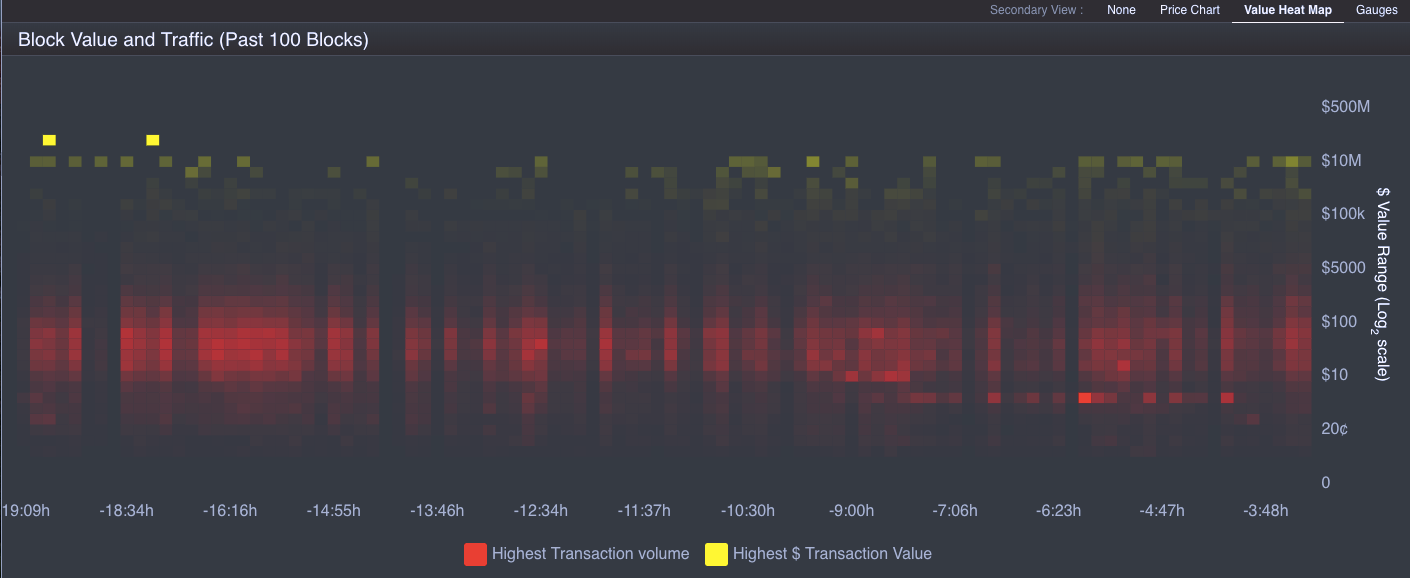

Bitcoin Cash

The value heat map for transaction on the Bitcoin Cash network shows a high density of payments within a very specific value range, as indicated by the red line seen below. Where bitcoin has a relatively equal spread of transactions in the $10 - $100 range, bitcoin cash is clearly favoured for $40 transactions. There continue to be some, although less frequent, higher value transactions (above $100k), as well as waves of activity in the lower value ranges.

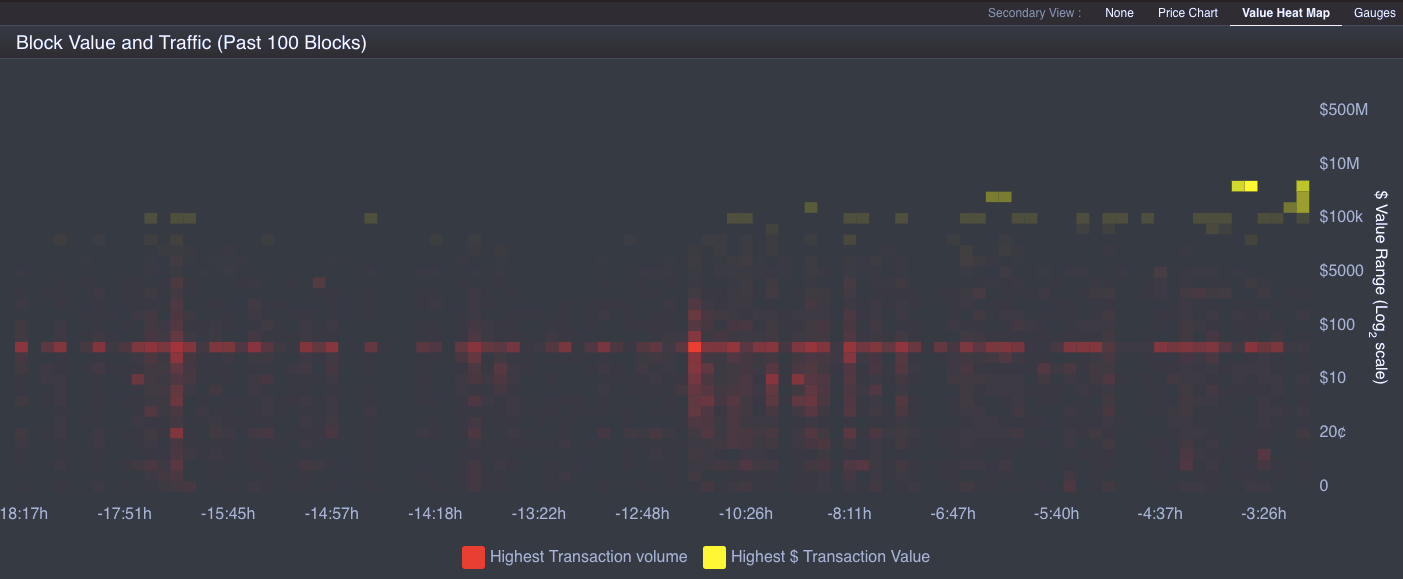

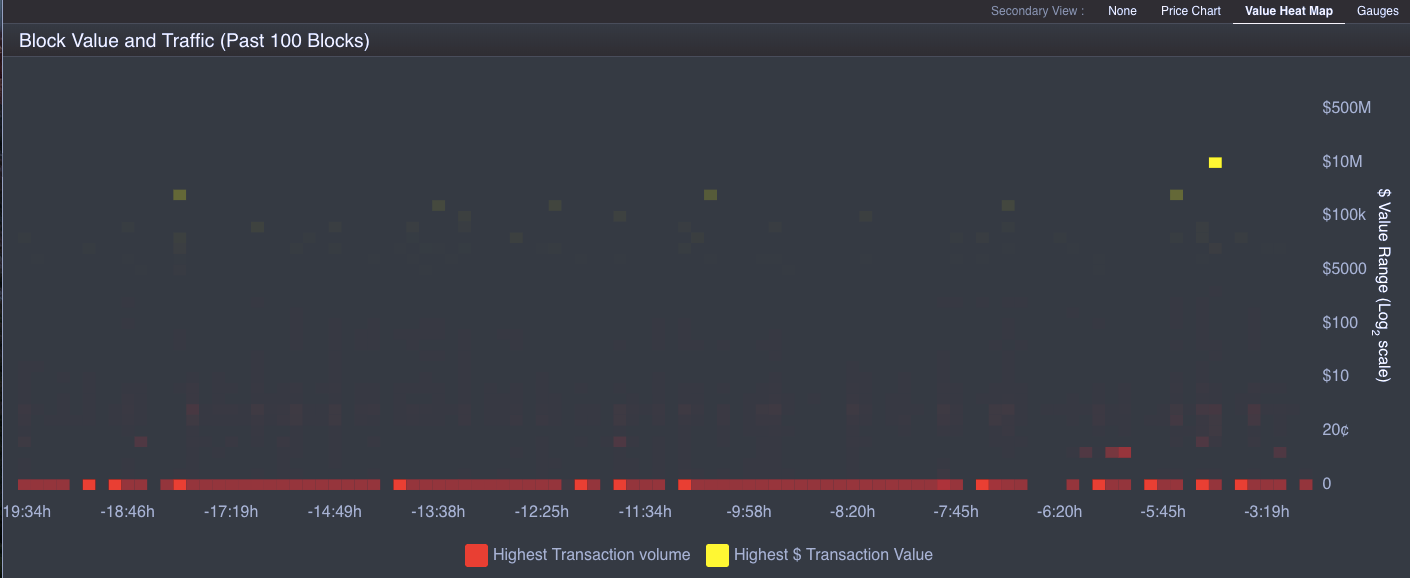

Bitcoin SV

Bitcoin SV has the most distinctive traffic patterns of the three dominant bitcoin forks. Observing the heat map below, it becomes immediately evident that BSV supports fewer economically relevant transactions. The red strip along the bottom of the heat map indicates that each block contains between 750 to 1,500 transactions with an average value of $0.00087. Considering an average fee per transaction over the last month was $0.0006, this means on average around $0.00027 of value is transferred per transaction. Bitcoin SV claims to serve the underbanked with micro payments. As it happens I’m in Kenya right now and thought I would see what $0.00027 can get me. Out here it is the equivalent of 0.03 KSH which is around 0.33% the price of an abundant fruit such as a banana.

Summary

Bitcoin’s potential as a means of exchange was recognised early on. Finding utility as a currency for the privacy seeking communities of the internet. There have been numerous bitcoin forks attempting to improve on the speed and cost of the Bitcoin Network. However, using the Byte Tree Heat Maps to visualise the distribution of transactions, it is clear that bitcoin remains the dominant network for sending peer to peer electronic cash.

Explore the transaction value heatmaps for each blockchain that we track LIVE on the ByteTree Terminal. To view them, simply click on the blockchain you want to explore and select “value heat map” from the secondary view. If you’d like access to the raw data, please contact us at info@bytetree.com.

Comments ()