Tracking Bitcoin’s Fair Value

Disclaimer: Your capital is at risk. This is not investment advice.

At ByteTree we have derived a fair value for bitcoin based on its utility as a payment network. We compute the market value using on-chain data directly from the Bitcoin Network.

Once we have a fair value, we can identify whether bitcoin is trading at a premium or discount versus its exchange traded price.

The fair value is based off the Network Value to Transaction Ratio (NVT). Whether or not you are familiar with the NVT, we suggest checking out our prior article to understand what we do differently at ByteTree to improve the accuracy of our NVT calculation.

NVT has proven its relevance over prior cycles

The NVT has proven its capability for signalling periods of overvaluation during the 2013/14 and 2017/18 cycles. For bitcoin, the upper limit for the NVT’s reasonable range has historically been a network value 12x the transaction volume. As such, a network transacting $15Bn per week would have a value of $160Bn ($15Bn * 12weeks). If the network value was over $160Bn (while transacting the same $15Bn per week), the NVT ratio would exceed 12 and this would signal we are in a bubble phase. Note that we calculate the $15Bn per week by taking the weekly average of transaction volume over the past quarter.

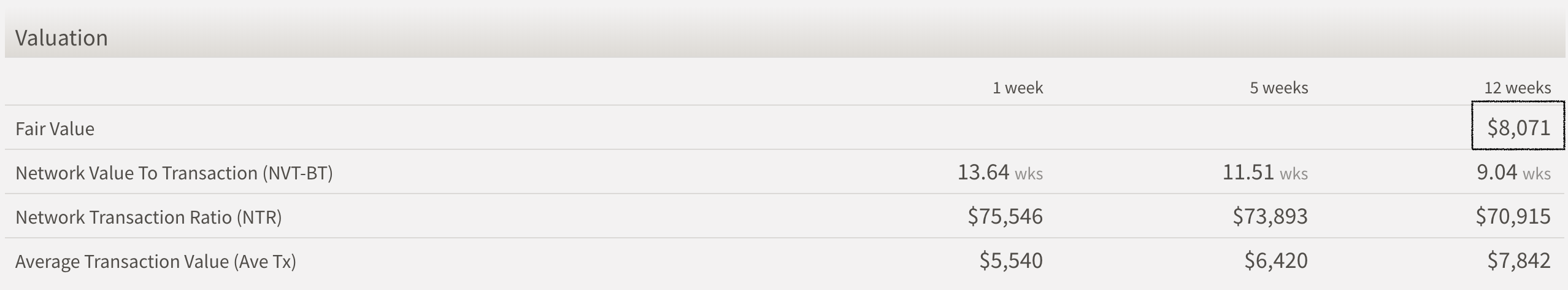

Deriving a fair value with median NVT

As discussed in the prior article, the quarterly transaction volume provides the most representative NVT as it smooths the impact of individual transactions from significant holders (such as Custodians and Whales). We therefore use the 13 weeks NVT to calculate fair value. To find the fair value we take the 5-year median of NVT, which provides a fair representation of a normal range, somewhere between a bull market and a bear market.

Using this methodology, we get a median of 7.1 weeks. This means that the network is at or close to fair value when the network value (bitcoin price*adjusted coin supply) is 7x the volume transacted over it.

Calculating the fair value

With the 7.1 weeks constant we can derive the fair value of bitcoin through the following formula:

` "Fair Value" = (NVT_("hist avg") xx "Transaction value"_"12 weeks") / "Supply"_(adjusted) `

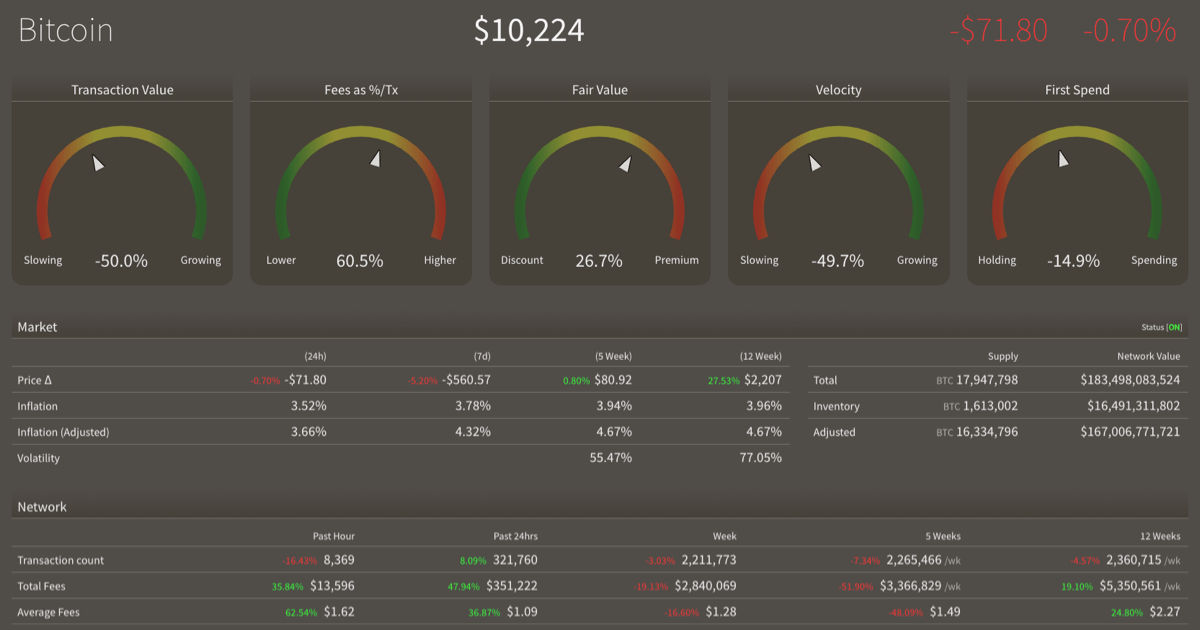

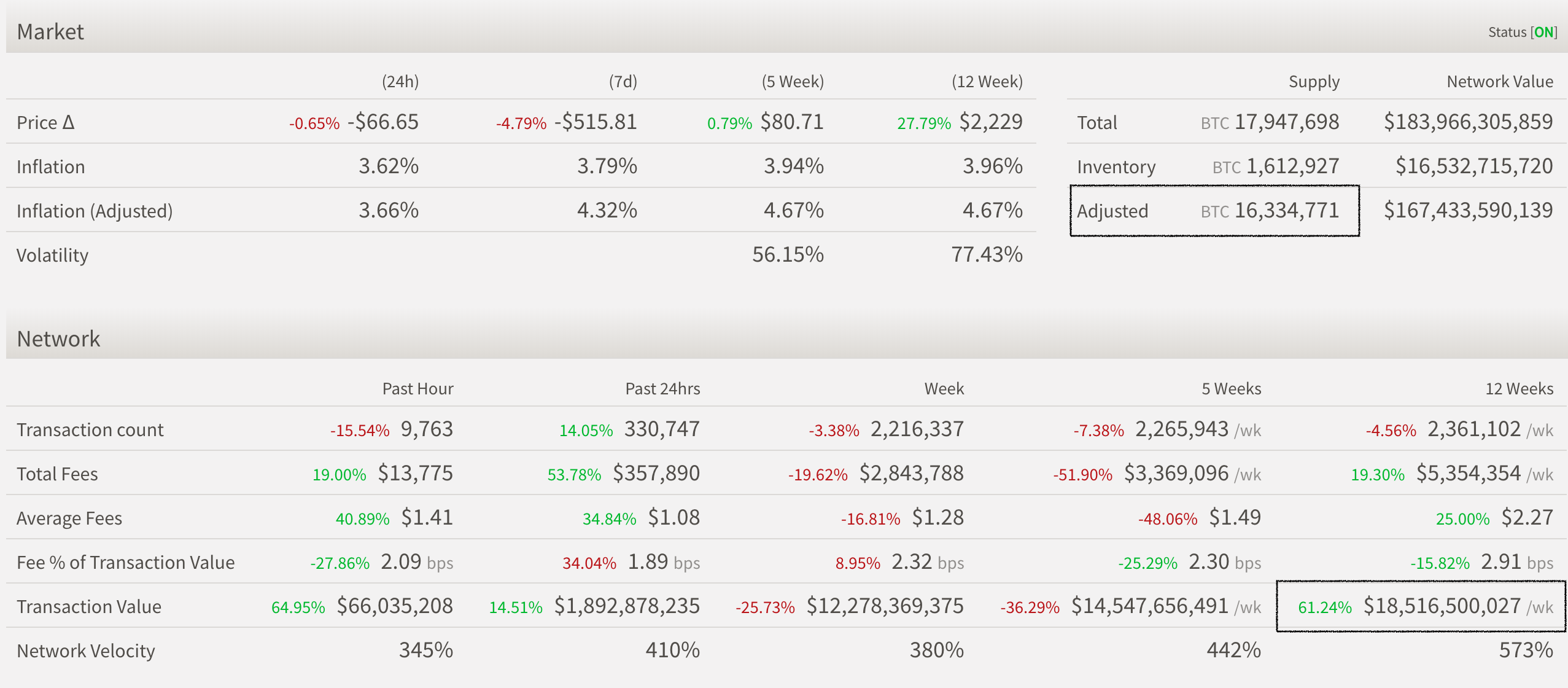

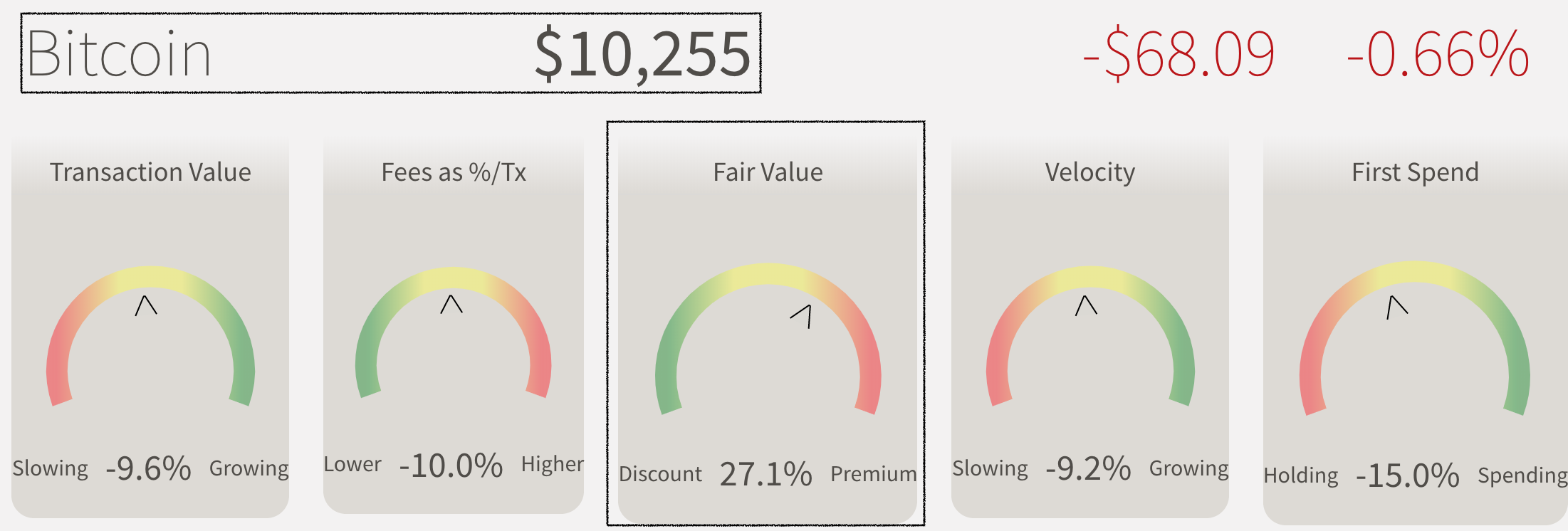

Taking a snapshot of the network at time of writing, the network metrics are as follows:

It follows that the fair value of bitcoin at this current level of transaction activity is $8,071 which represents a premium of 27.1% to its current market value of $10,255.

Summary

The fair market value describes a network value multiple with respect to on-chain transaction volume (the economic value of transactions in USD terms). While it is not an exact science, our window into the blockchain now enables crypto-asset investors to make informed, data-driven decisions. Investors with a keen eye should look out for transaction value increasing at a higher rate than the network price, which in turn will present a more favourable fair value.

Comments ()