Bitcoin's Weekday Bias

Disclaimer: Your capital is at risk. This is not investment advice.

Network Activity Drops at Weekends

All the analysis we do at ByteTree is either in daily or weekly periods. You won’t see us using a 5 day, 30 day or even 90 day moving average because of the weekly bias evident in bitcoin’s on-chain activity.

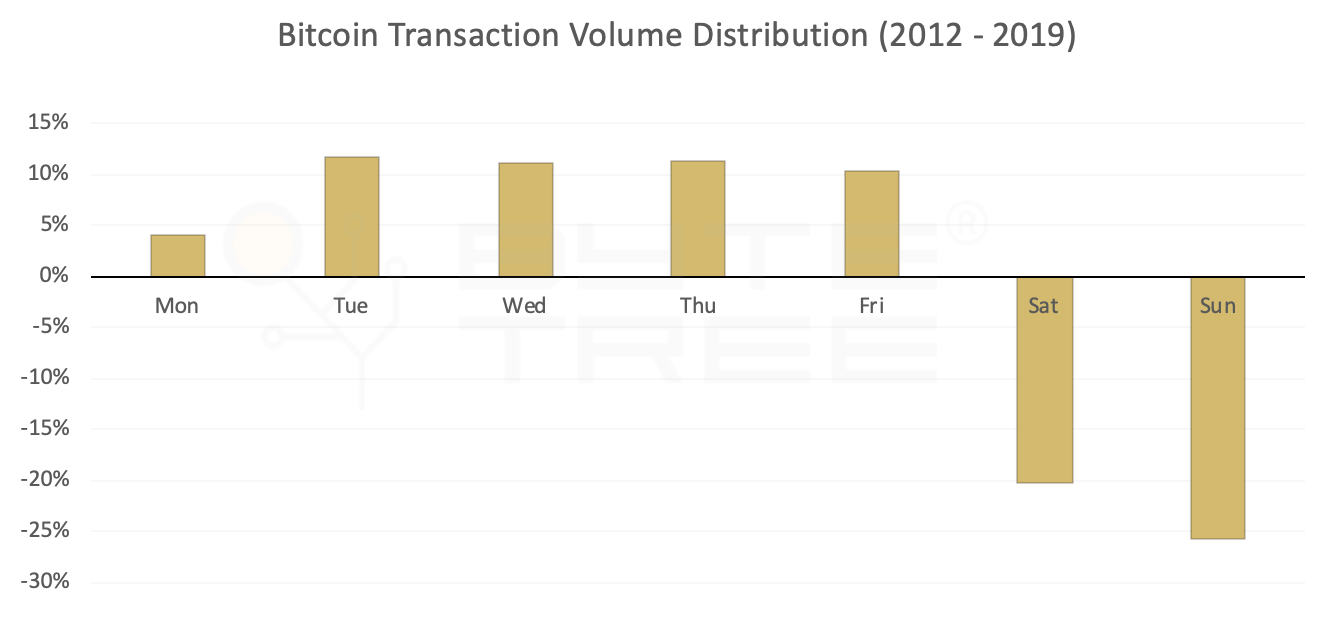

Bitcoin activity never sleeps, but it does slow down at weekends. While analysing on-chain transaction volume we noticed a clear pattern in the distribution of weekly on-chain activity.

The average daily transaction volume consistently drops below the 7-days moving average at weekends. The chart below looks at the weekday variance to the moving average since 2012.

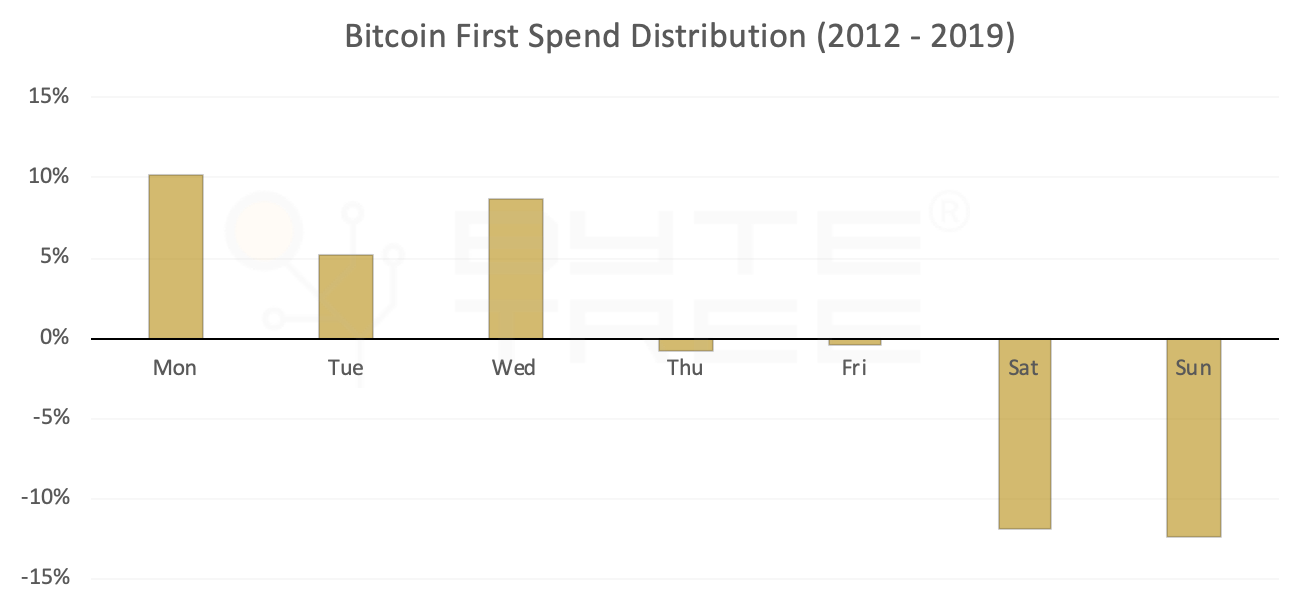

It isn’t just the transaction value that drops at weekends. While new bitcoins are distributed to miners at a steady state, miners decide when to move them. The first time a newly minted bitcoin is moved from a wallet is called the first spend.

The chart above demonstrates the same weekday bias for first spend activity, with significantly lower-than-average activity at the weekend. It is also interesting to note that Monday and Wednesday consistently see a higher volume of newly minted coins spent for the first time.

What does this mean for our analysis?

The weekday bias highlights the need for a default measurement period of one week when analysing trends or identifying trading signals. At ByteTree we take one week as the minimum economic cycle in crypto networks and therefore adjust for biases from inactive weekend days.

By computing our indicators across the rolling week you will get the most accurate and relevant signals from ByteTree.