Generation and First Spend

Disclaimer: Your capital is at risk. This is not investment advice.

How New Coins Enter the Economy

In this article we look at how new bitcoins become available in the Bitcoin Network and how we monitor miner inventories. To begin with let’s look at what we mean by Generation and First Spend.

Generation - The number of new coins awarded to miners during that period.

First Spend - The number of coins that move out from miners’ wallets during that period.

Where do new bitcoins come from?

The Bitcoin Network was created as a decentralised system, meaning that no single entity is in charge. Unlike a centralised system that leverages authoritative power to maintain order, a decentralised system must find another way to prevent anarchy. In the case of Bitcoin, order is maintained through economic incentives. Ultimately, the benefit of acting in the best interest of the network must be greater than acting against it.

Bitcoin, the currency, is the medium used within the Bitcoin Network to incentivise good behaviour. Bitcoins are “rewarded” to the network guardians, known as nodes, for their positive contribution to the network. The rate at which bitcoins are rewarded to these nodes is programmed into the core code of the network. There are a total of 21 million bitcoins that can be rewarded to the nodes, and the number of bitcoins awarded to the nodes is cut in half every four years.

What do we mean by the inflation rate?

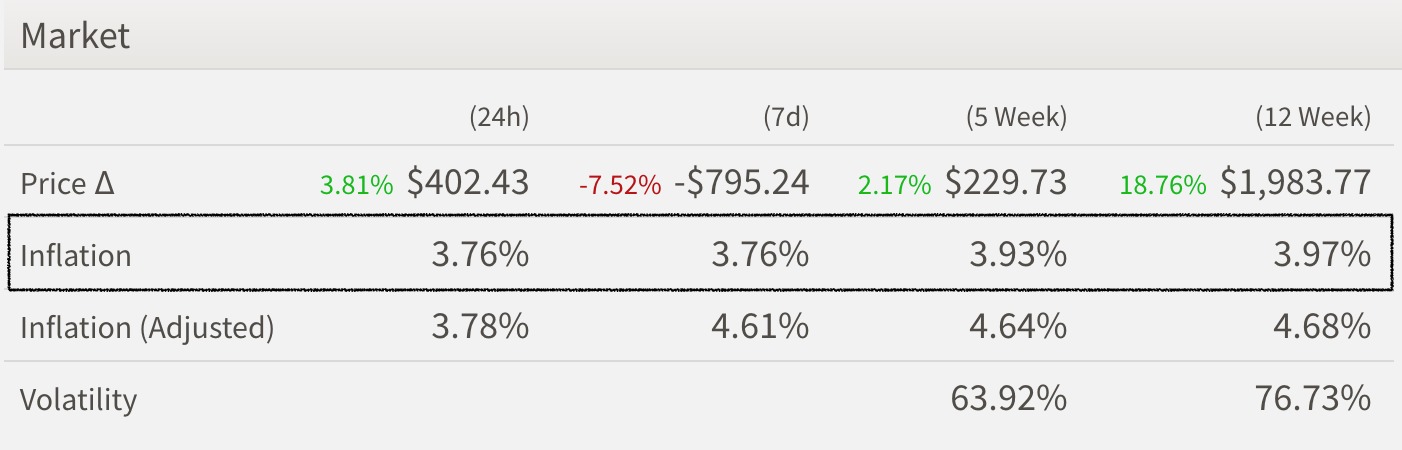

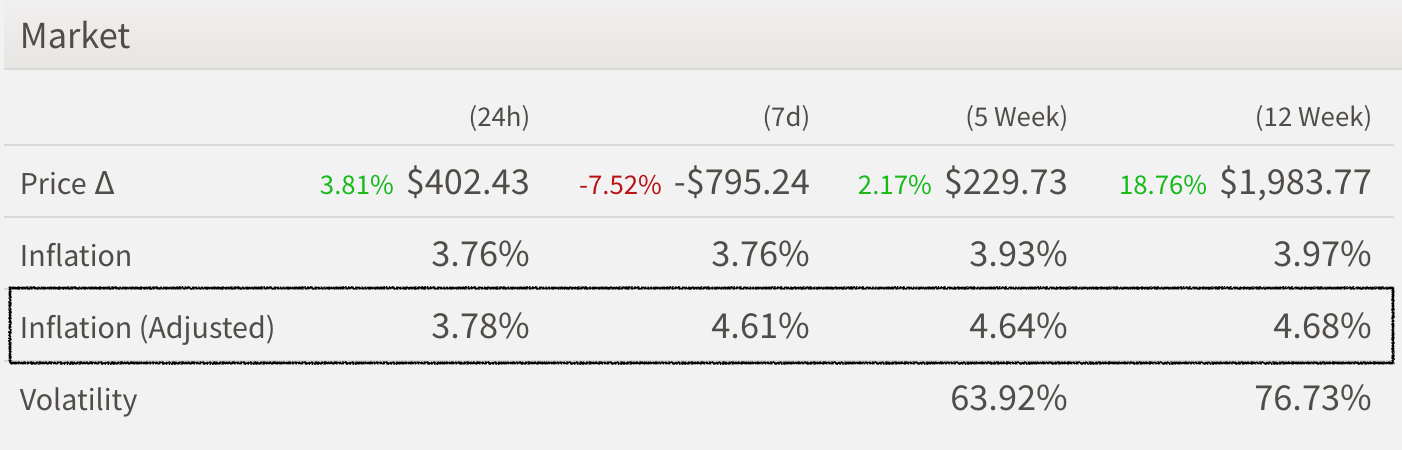

We now know that new bitcoin can only be introduced into the network through rewards to the miners. With that in mind, we can calculate the inflation rate of the network using the following formula:

Network inflation = number of bitcoin generated per year / existing number of bitcoin in circulation

At ByteTree we monitor the number of bitcoin generated in each block, around every 10 minutes, and annualise it to show the current inflation rate of the network. The inflation rate currently trends towards an average of 4% per year, but can vary in short periods depending on the hash rate applied to the network.

The inflation (adjusted) below looks at the rate of newly minted coins as a percentage of those coins in circulation. With around 1.6 million BTC, or $60Bn, of coins having never moved from the wallet in which they were generated, the adjusted inflation is typically higher than the normal inflation rate.

The inflation rate tells us how often bitcoins are awarded to miners. However, it does not tell us what the miners do with these bitcoins. While a miner may receive a bitcoin as an award, it is not available for circulation until they release it into the network. At ByteTree we measure the number of newly minted coins that move out from miners’ wallets during that period, termed the first spend.

At ByteTree we utilise on-chain data to develop investment strategies for institutional crypto investors. Look out for a post in the coming weeks on leveraging miner inventory behaviour to generate alpha versus bitcoin’s performance.