Emerging Market Internet

In last week’s flash note, I highlighted the opportunity in Emerging Market Internet Stocks and the ETF that tracks them, EMQQ. Just to confuse you all, EMQQ is the USD ticker, and the company’s brand name. The GBP ticker is EMQP. I shall refer to the index as EMQQ and the ETF as EMQP.

EMQQ is an index of internet stocks that operate in the emerging markets. The creator, Kevin Carter, is highly experienced in technology and financial markets and has been close to the ETF industry since it began in the 1990s.

Emerging markets are supposed to offer higher returns because they have most of the world’s people (especially youth), land mass, and resources, and grow at a faster rate as they play catch up with the developed world. On the flip side, they can be less stable, and their capital markets may not be as “well” regulated.

Kevin’s epiphany was that if you wanted to capture the growth in the emerging markets in the 21st century, you should avoid the old state-owned enterprises and just hold consumer stocks. Then, as the computer, smartphone, and internet took over, it was even simpler; investors should buy the internet stocks, and EMQQ was born.

The best ideas are often simple, and Kevin realised that the emerging market internet stocks were a mixed bag. They were listed on different exchanges with inconsistent sector and industry classifications, making it difficult to bring them together. Their job was to do the work, identify the companies, and unite them in an index, EMQQ, which could then be tracked by an ETF. It was a very good idea, and I was bought in, which explains why we have owned this before in 2020.

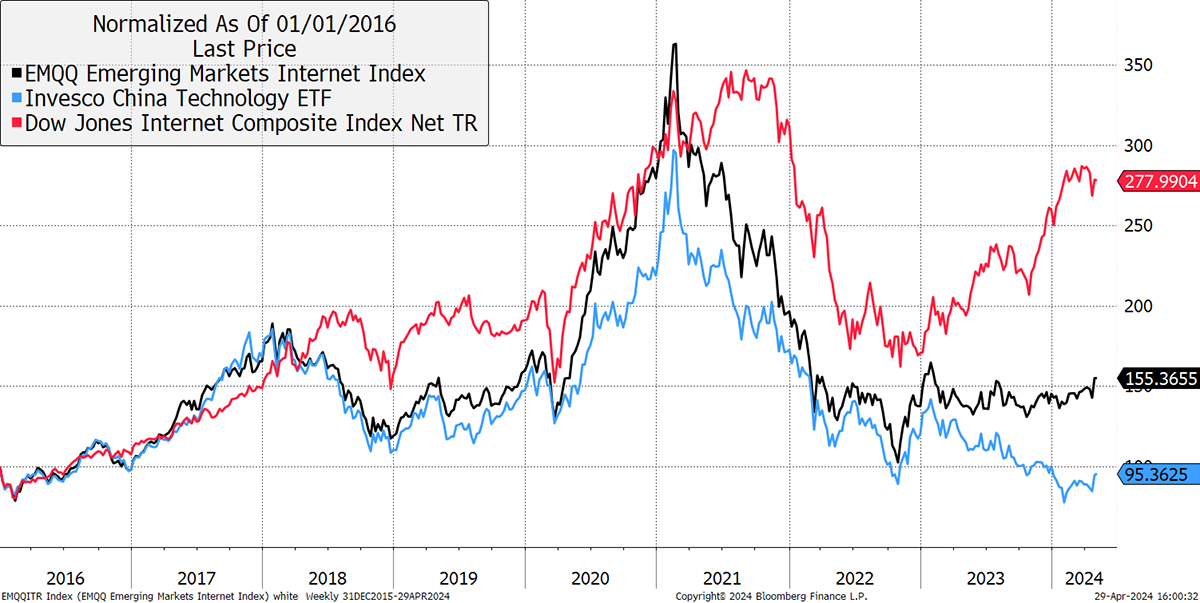

Yet the performance divergence between EMQQ and US (and global) tech stocks has been extraordinary. Despite faster growth in the emerging markets, US internet stocks fell less in 2022 and have rallied further since. It is an anomaly, and with the worst of the geopolitical news already digested, my simple thesis is that it’s catch-up time.

Global Internet Stocks

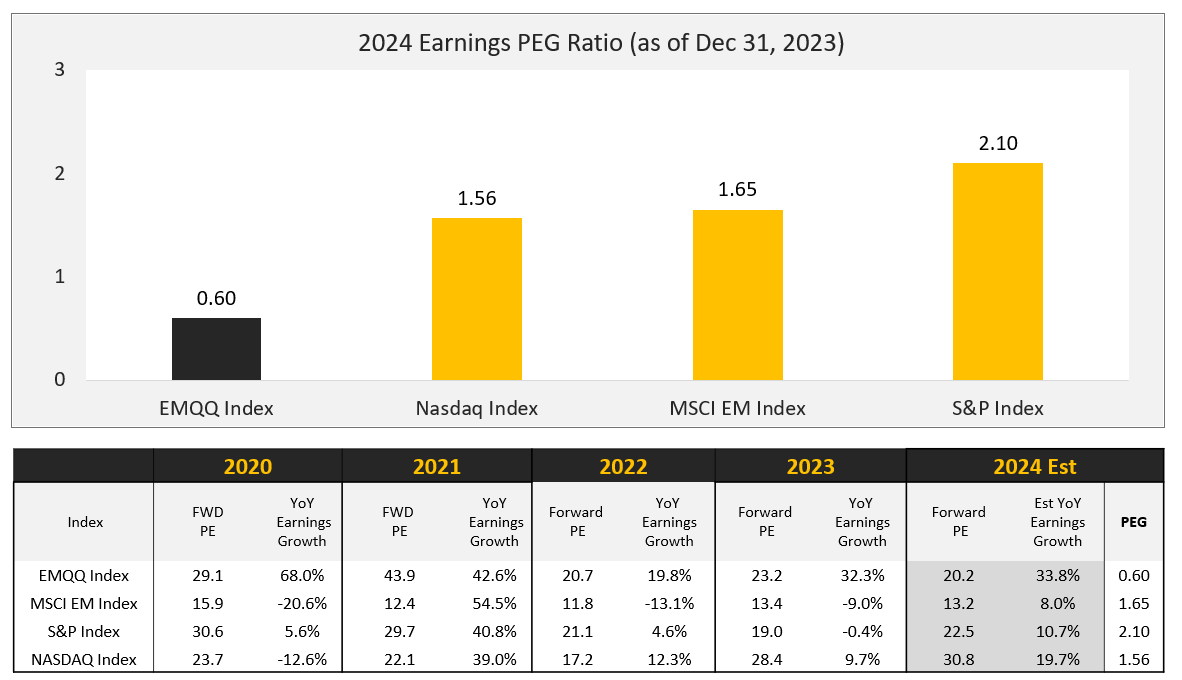

The valuation gap is extraordinary. The PEs and growth rates show consistent higher growth, with lower valuations. On the right, the PEG ratio, the PE divided by the growth rate, is 0.6x, which is a bargain. Compare that to the S&P 500 with a PEG of 2.1x, which is extortionate.

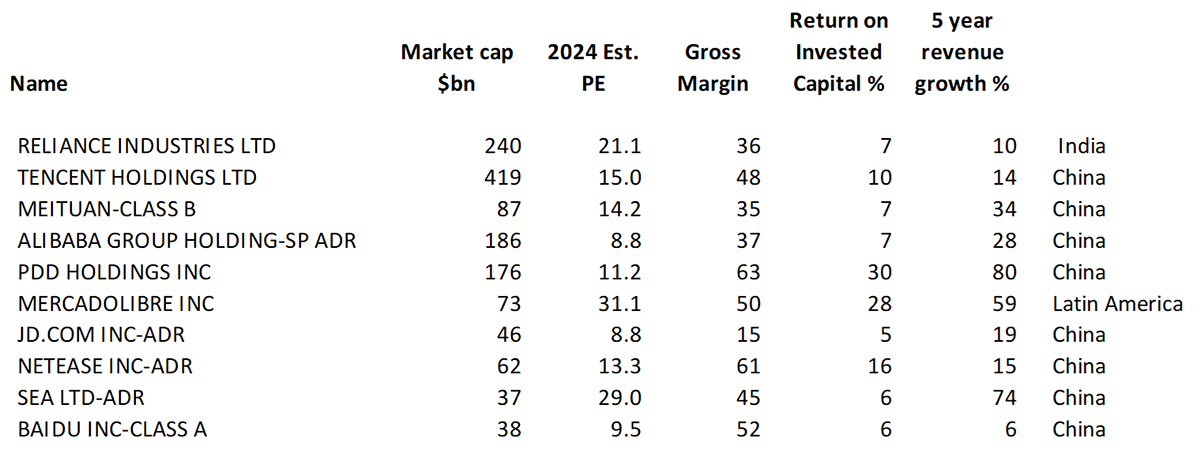

In the UK, EMQQ is managed by HAN ETF. The top holdings are shown in the table with PEs, profitability, returns and growth rates. It’s pretty eyewatering stuff.

EMQQ is dominated by Chinese stocks (51%), but things are happening all over the world where the allocation seems to be growing faster. It has 18.4% exposure to India, 13% to Brazil and others. Kevin is most excited about India because it has the world’s largest population and a well-governed democracy. It is just getting started, which is a huge growth opportunity ahead.

Nandan Nilekani, co-founder of Infosys, was asked by the government to lead a national identity card scheme in a country with poor record keeping. He agreed on the basis it would be driven by technology. He took fingerprints and eye scans from the people, with a photo and a 12-digit ID number in a system called Aadhaar. Best of all, it was voluntary, yet 95% of the country signed up.

The result? You can open a bank account in two minutes. Over a billion people have signed up, and now the country has a full-blown instant payment system. Tax collection has improved, and the country is truly digital, with the best and cheapest 5G and 6G mobile networks in the world. Reliance, EMQQ’s largest holding is at the heart of this.

(Please can I have an ID card; it might make things work in the UK.)

I had the opportunity to talk to Kevin yesterday (Monday 29 April), where he shared his thoughts on EMQQ and the current situation. We discussed some of the problems the index has faced such as the pulled IPO of Jack Ma’s Alipay in 2021, and the war, which saw Russian stocks marked to zero. These have proven to be minor setbacks, and EMQQ is a fascinating investment theme that seems to have been overlooked by the market.

I believe that investors will come to realise that the world has changed. China and India are great powers, and, like it or loathe it, their progress is inevitable and unstoppable.

Watch the recording here.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd