Bitcoin Stalls, Breadth Improves

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 101;

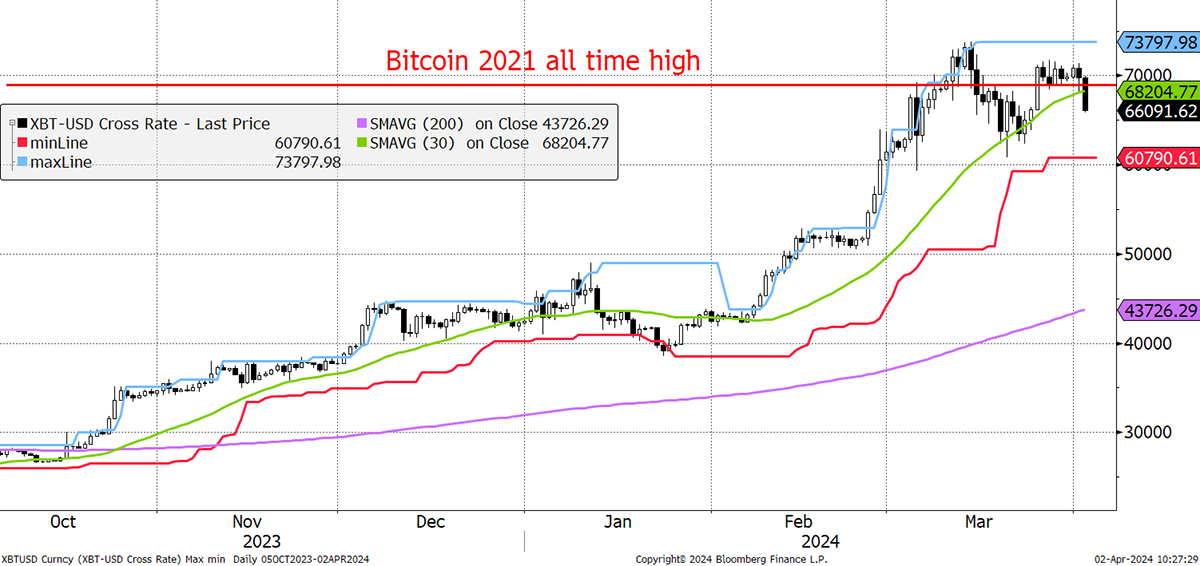

Bitcoin has just slumped from a lower high two weeks ago. It has broken below the 30-day moving average, so the 5-star trend becomes a 4-star trend. It’s been one hell of a ride, but it appears to have stalled. The surprise, if there is one, is how the price has stalled at the 2021-high. In the past, the new ATH has always led to a surge.

Bitcoin Stalls at the 2021 High

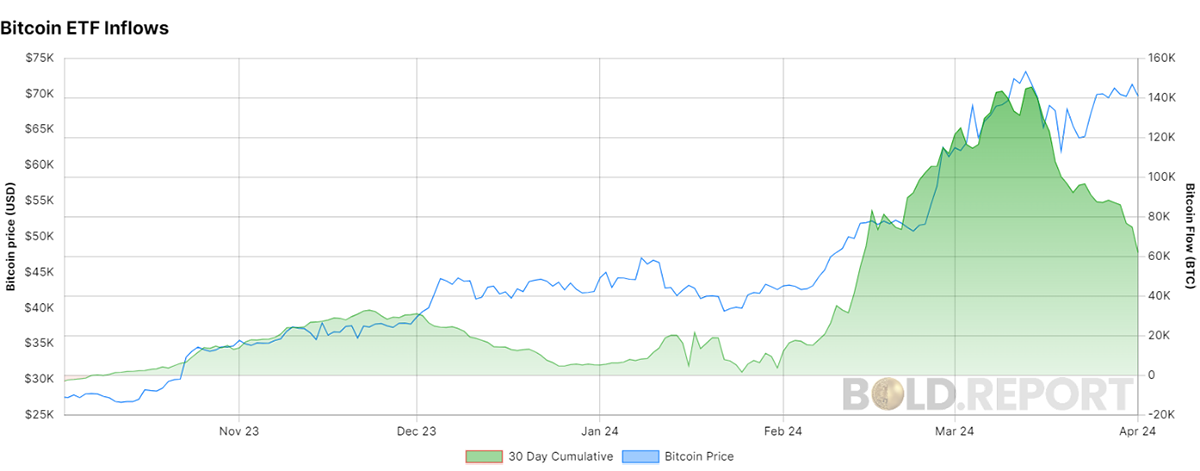

The rally came in two parts. The strength in Q4 2023 anticipated the ETF launches on Wall Street. Then, in Q1 2024, the inflows exceeded our best expectations. The BOLD.REPORT is telling us that the best is behind us, but be clear: the funds are still buying Bitcoin, just at a slower pace.

Bitcoin ETF Inflows

Up next is halving, but my recent ATOMIC describes this as an anti-anticlimax. It’s bullish of course, but not nearly as bullish as the recent price action calls for. In a normal cycle, we’d expect to approach halving above the average price for the current cycle, which is $32,562, but well below the old high of $67,734. Several months ago, when the price was below $20,000, I called for $40,000 by halving. The ETFs skewed that and brought forward demand, but it’s not implausible that it could still happen. That is not a prediction, just an observation. The latest forecast for halving is on 20 April 2024 at 4:39:52 UTC.

We can’t be sure who has been buying the Bitcoin ETFs, but I don’t think it’s the wealth management and institutional crowd we wish it were. I fear it has been largely hedge funds, which are notoriously flighty. They saw an opportunity and jumped aboard. The trouble is that when the trends turn, it may not be very sticky capital.

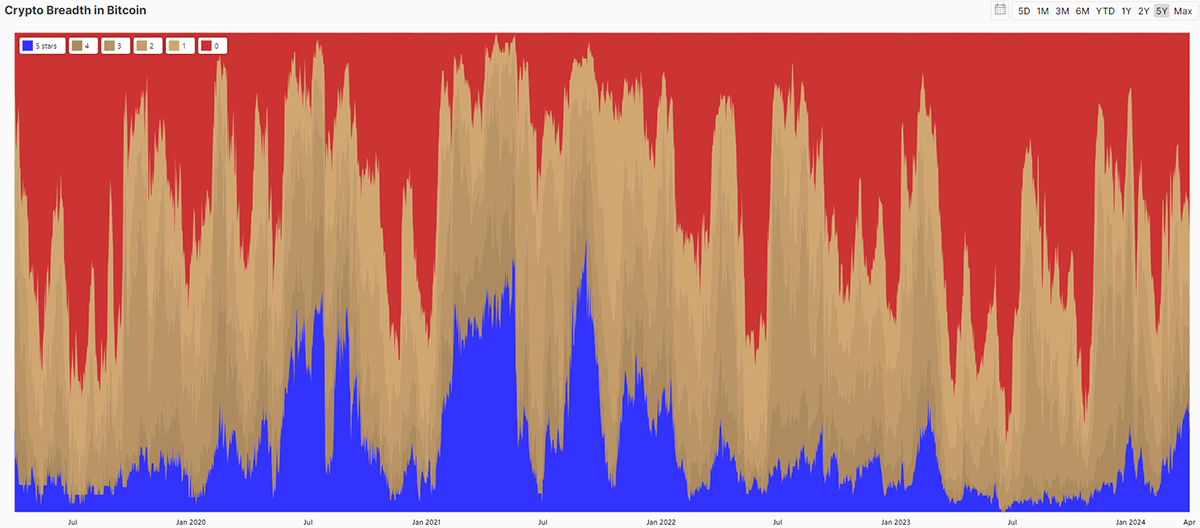

For ByteFolio, this could be good news. It has been hard to beat Bitcoin by investing in tokens because breadth has been weak. That has been picking up, which means performance in BTC terms should improve. The blue seas are rising which means more tokens are now outperforming Bitcoin.

Crypto Breadth in BTC

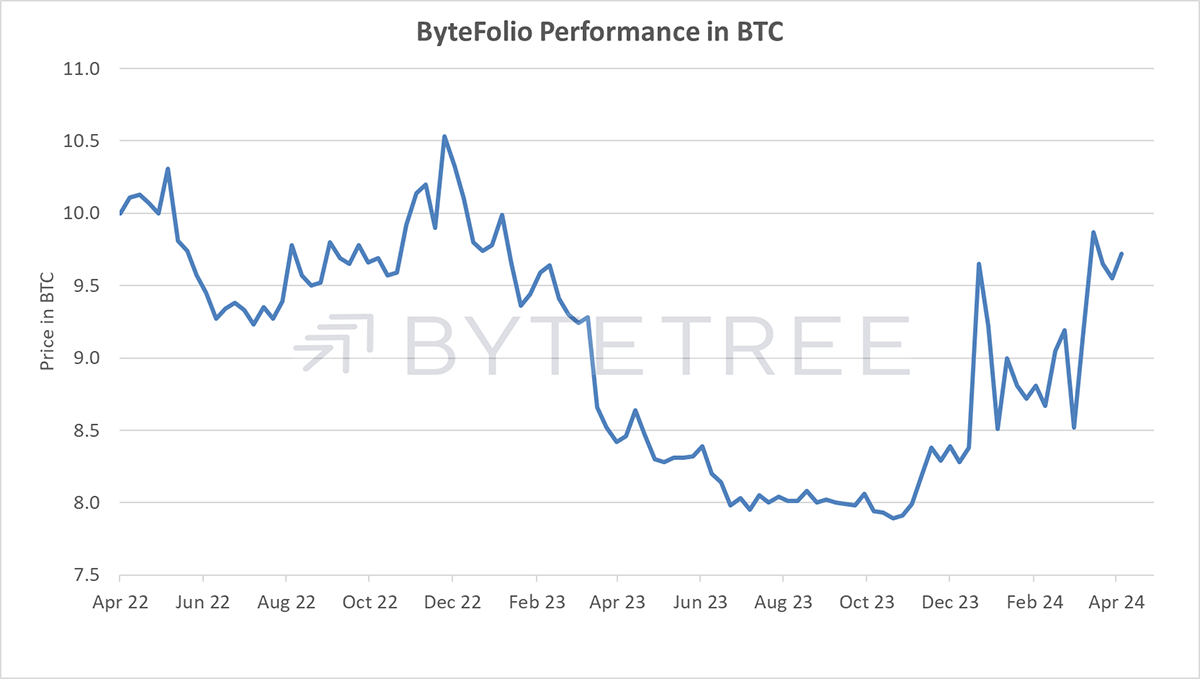

So far, that has proved helpful, and I very much hope we can surge ahead of the 10 BTC notional starting capital this year.

ByteFolio in BTC

The portfolio has done a great job recently in identifying the leading tokens, and the analysts have done a superb job.

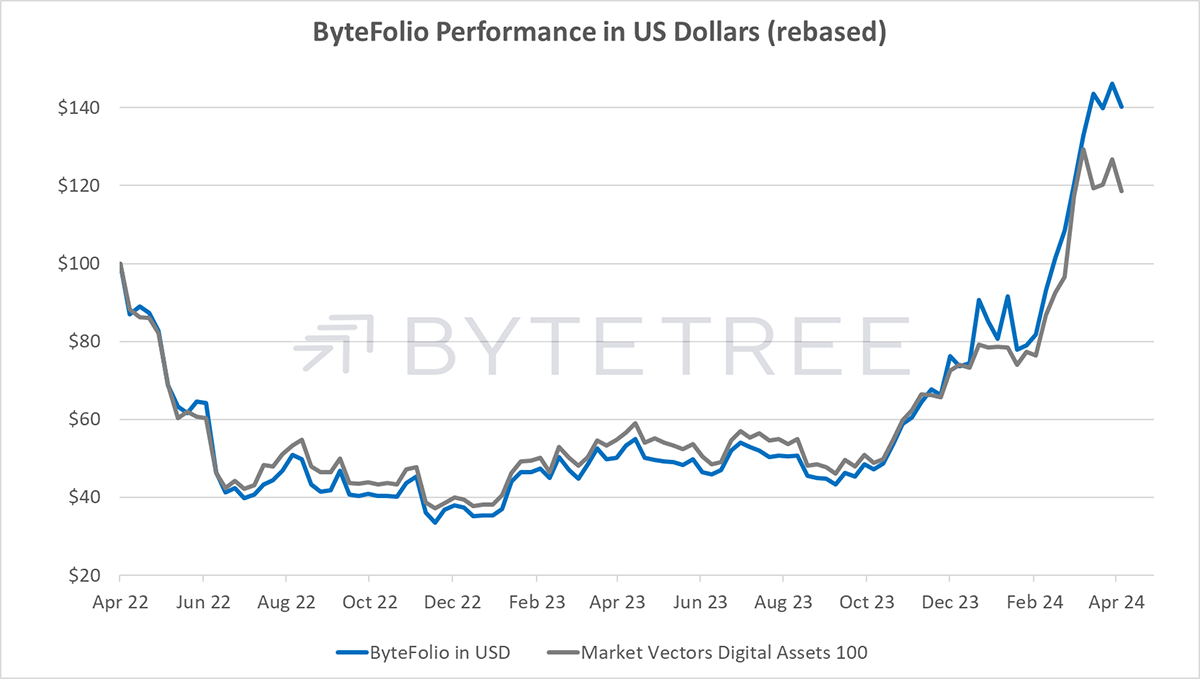

ByteFolio in USD

ByteFolio is a never-ending process of finding winners and cutting losers. Another cut takes place this week.